In brief

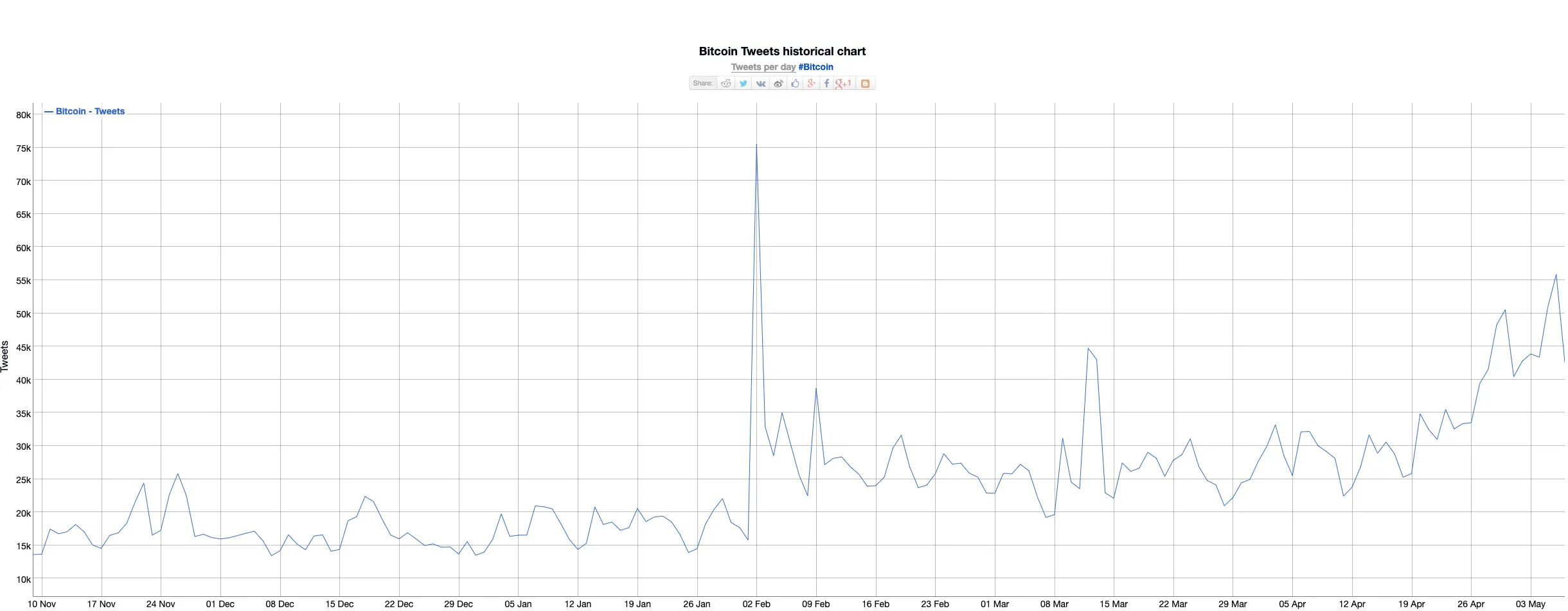

- Bitcoin’s Twitter presence more than quadrupled in 2020.

- Google Trends data also demonstrates heightened interest in Bitcoin.

- The upcoming Bitcoin Halving and rising prices are likely responsible.

Bitcoin’s Twitter presence has more than quadrupled since the start of the year, reaching levels not seen consistently since 2018.

That’s according to social media metrics from Bitinfocharts which show a 313% increase in “Bitcoin” references since January 1, 2020. Twitter mentions for Bitcoin rose from 13,500 on January 1—up to 55,866 today.

Barring a single outlier spike in February, that returns Bitcoin’s Twitter presence to the same as it was on May 11, 2018, almost two years ago exactly. On that day, Bitcoin opened the trading day priced at $9,125. Today, on May 7, Bitcoin struck the same price at around 02:00 (UTC), and is now nearing $10,000 per coin.

Google Trends data suggests more symmetry, with Google searches for Bitcoin just 2% away from their 2018 level.

The rise in the price of Bitcoin appears to be driving interest. And some of that new interest could also be attributed to the upcoming Bitcoin halving—a once-in-four-years event that cuts mining rewards in half thereby reducing supply and controlling Bitcoin’s inflation. Analysts are split as to what this will mean for Bitcoin’s future, but some are predicting an increase in price as a result of the supply cut.

Bitcoin’s revived popularity hasn’t gone unnoticed on the blockchain level either. Average transaction fees recently shot up to $2.94, while the blockchain mempool was clogged with over 80MB worth of unconfirmed transactions. Today, the mempool contains just under 20MB of unprocessed data, while average fees remain perched at just under $2.