In brief

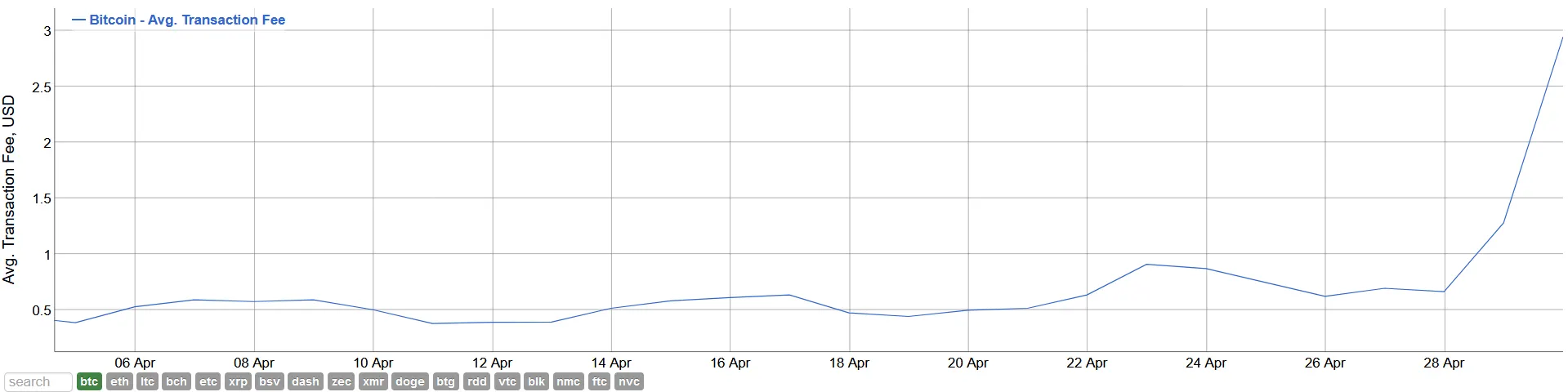

- The average fee for transacting on the Bitcoin network hit $2.94 on April 30th - the highest in ten months.

- Bitcoin’s mempool shows a data backlog that will take hours to clear.

- As the network becomes congested, users must pay higher fees to make it into the next block - thus driving up fees.

The average transaction fee on the Bitcoin blockchain has hit its highest level in 10 months. Data from Bitinfocharts shows that Bitcoin fees spiked to a high of $2.94 on April 30—a level not observed since July 2019.

Twenty-four hours earlier, average fees were perched around the $1.28 range. One day earlier still, the average fee was as low as $0.66. But on Thursday night, fees increased by 129% to the ten month-high.

Despite the sudden spike in the past few days, average fees on the Bitcoin network were on the rise all throughout April. From April 1st to April 30th, average fees increased by 673%.

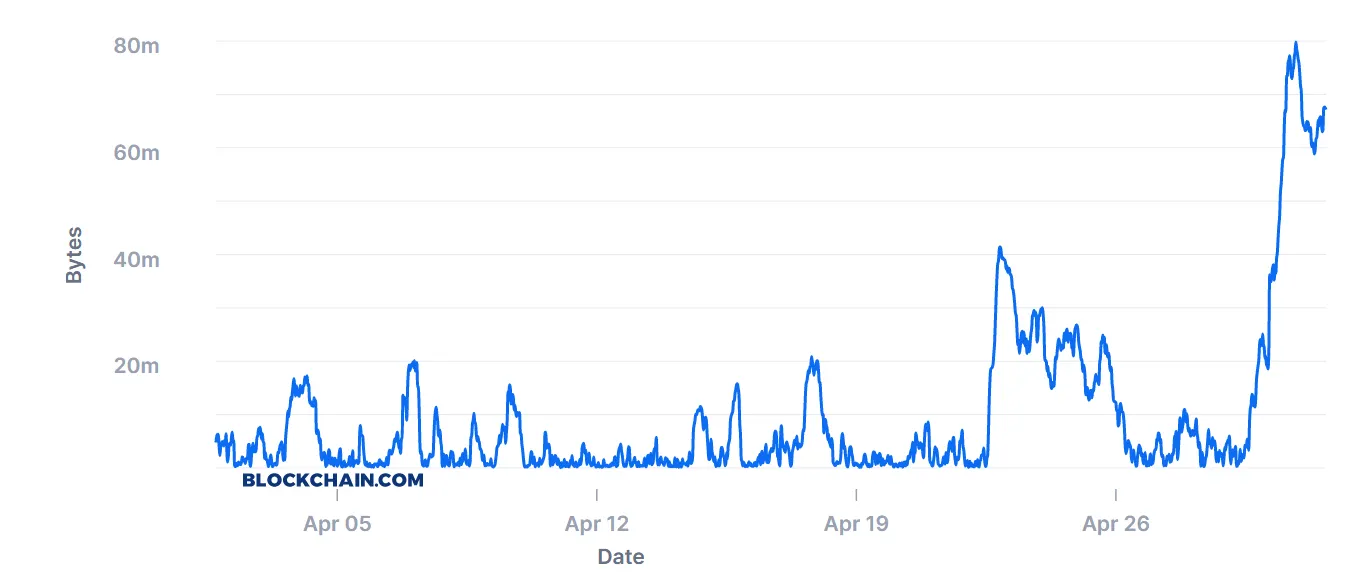

Mempool data from Blockchain.com shows a massive backlog of Bitcoin transactions awaiting confirmation. The mempool represents the amount of data (in the form of transactions) that still have to be confirmed and processed by Bitcoin’s miners.

These mempool backlogs invariably result in higher transaction fees, as users attempt to outbid each other to have their own transactions included in the next block. During Bitcoin’s all-time high in December 2017, transactions took days to confirm, and average fees spiked to over $55.

High fees, while not ideal in any situation, can be viewed as an increase in demand for space on the Bitcoin network. With the Bitcoin halving just over a week away, and as the economy remains uncertain in light of the COVID-19 lockdown, the surfeit of demand could be a good thing.

Conversely, critics may point out the inefficiency of having a digital payment system where payments take several hours to confirm. Such high fees make Bitcoin useless for micropayments, for instance.

Transaction speeds on Bitcoin are partly limited by its 1MB block size. The current 67MB backlog displayed on Blockchain.com will have to be cleared one block at a time before fees revert to normal levels. Based on Bitcoin’s ten minute block times, that could take in excess of ten hours.