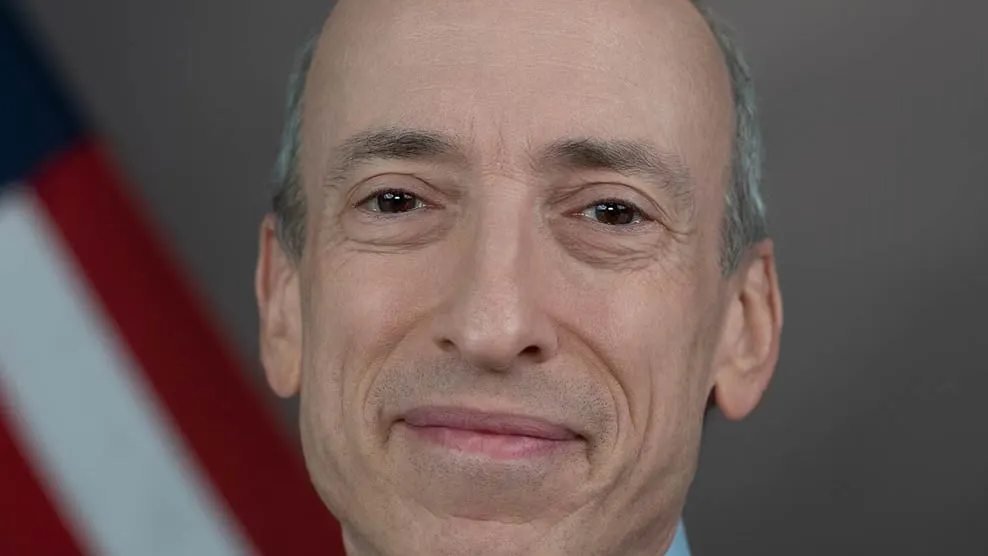

The ongoing legal battle between Coinbase and the Securities and Exchange Commission (SEC) focused squarely on the rights of Chairman Gary Gensler in federal court on Thursday.

Coinbase’s lawyers served Gensler with a subpoena last month, seeking extensive information that touches on digital assets and the registration of cryptocurrency exchanges. The company’s move came after a judge let the SEC’s case against Coinbase proceed on most charges.

In response, the SEC called upon U.S. District Judge Katherine Polk Failla to hold an informal conference and “quash [the] improper subpoena.” Arguing the subpoena seeks nothing of relevance, SEC counsel also wrote that it would create an “undue burden” on the agency.

“I was sort of surprised and not in a good way,” Failla said of Coinbase’s written justifications for the subpoena. “I was not moved by basically any of the arguments.”

Although Failla said she would not make a decision on the SEC’s parallel request for a protective order Thursday, she noted that the “reservoir of credibility that [Coinbase] had built up with me throughout this litigation” had been drained.

Coinbase attorney Kevin Schwartz argued that Gensler is “uniquely situated as a prominent voice on crypto’s regulatory status.” He accused the SEC of stonewalling a subpoena for “relevant communications on [Gensler’s] personal device.”

“The SEC is broadly refusing to search for or produce and log communications from Mr. Gensler within its possession as the SEC,” Schwartz said.

Throughout the hearing, however, Failla seemed more sympathetic to the SEC, appearing somewhat frustrated with Schwartz at times. At one point she suggested Schwartz move on from arguments defending the subpoena that she had already found were unpersuasive.

“The [requests], read together, seek essentially all SEC documents, from 2017 to the present, that in any way, shape, or form touch upon the crypto asset markets,” the SEC wrote in a filing before Thursday’s hearing, adding that Coinbase’s desired scope of documents wrongfully runs fours years prior to Gensler joining the agency.

Coinbase’s subpoena also sought relevant information from Gensler on the SEC’s DAO Report and a 2018 speech from William Hinman, a former SEC official, who said that Bitcoin and Ethereum should not be considered securities because they are sufficiently decentralized.

The SEC argued in court that Gensler’s actions as an agency official are separate from those as an individual, and that most of the documents Coinbase seeks aren’t subject to discovery.

“It is an improper intrusion into a public official’s private life, based on his decision to serve,” the SEC wrote, explaining that the subpoena should be directed at the agency, not Gensler.

In response to the SEC’s filing, Coinbase had argued that the subpoenas are relevant, and that notion is easily supported by the company’s so-called fair notice defense.

The SEC claimed in a lawsuit last year that Coinbase failed to register as an exchange, clearing house, and broker—all while providing those services to investors. The SEC has also alleged that Coinbase offered and sold unregistered securities through its staking service.

Additionally, the SEC claims that several tokens on Coinbase’s platform constitute securities, including major altcoins like Solana, Cardano, and Polygon. Coinbase has denied the claims and argues that “none of these assets are securities” on America’s leading exchange.

Schwartz indicated that Coinbase plans to press forward with the subpoena, planning to submit the necessary filings to Failla’s court by Monday.

Edited by Ryan Ozawa.