Ripple at last unveiled its smoking gun last week—a batch of emails the U.S. Securities and Exchange Commission wanted kept secret.

Only it didn't quite have the effect that the crypto company had hoped. Most legal experts were underwhelmed, suggesting that the details of how former SEC Director William Hinman prepared for a 2018 speech about cryptocurrencies weren't as damning as promised. But for Ripple, releasing the Hinman emails is a key part of a defensive strategy aimed at putting the SEC on the back foot, arguing that the regulator failed to give the company "fair notice" and help it stay within the bounds of federal securities laws.

And if Ripple succeeds, it could not only help the XRP software company escape a billion-dollar lawsuit, but also help another crypto giant in the SEC's crosshairs: Coinbase, the largest cryptocurrency exchange in the United States.

In the Hinman emails, SEC officials flagged multiple assertions in the former director’s draft for a much-publicized June 2018 speech. The emails revealed that officials at the Commission worried Hinman's arguments—specifically regarding Ethereum, the second-largest crypto asset by market cap—would confuse the market. In the speech, Hinman reasoned that Ethereum should not be considered a security because its blockchain network had become "sufficiently decentralized." Ripple’s defenders say Hinman’s views still guide SEC actions and should be disavowed.

The SEC, in 2020, charged Ripple and two of its executives, co-founder Christian Larsen and CEO Bradley Garlinghouse, with unlawfully raising more than $1.3 billion by selling unregistered securities in the form of XRP, which was the third-largest crypto asset by market cap at the time the lawsuit was filed. Since then, Ripple has tried multiple times, and failed, to have the lawsuit dismissed.

The SEC has only intensified its scrutiny of the crypto industry over the last few years, filing a lawsuit against Coinbase earlier this month that alleged the company is operating an unregistered exchange and dealing in unregistered securities. Coinbase has vowed to fight the charges, and legal experts say a "fair notice" defense could come into play.

James Murphy, a lawyer with a background in securities law, said that a fair notice defense is “not the strongest argument” on its own, but the SEC's refusal to set rules while punishing alleged rule-breakers can work against it.

"If the SEC believed that the entire business of Coinbase was illegal, they shouldn't have allowed it to sell stock to the public in 2021," Murphy told Decrypt. "They had a chance to take notice, but they didn't."

For the better part of a year, Coinbase executives outlined what they say has been their attempt to stay within the law, only to be cold-shouldered by the SEC. The company has also made it a point to question why the SEC allowed it to go public in 2021 if it considered its business illegal.

Ashley Fickel, a member attorney at the Los Angeles office of law firm Dykema, said that the SEC’s enforcement-driven approach to crypto might support Coinbase’s argument that the agency was unwilling to engage when the company was looking for guidance to stay within the law.

“I think that is really going to open the door to the fair notice defense,” Fickel told Decrypt.

In the most glaring example of this, the SEC labeled multiple tokens traded on Coinbase securities in its lawsuit against the exchange, including Solana and Polygon. It shared its reasoning for the move in the filing, but left open the question of why Coinbase was not warned to stop allowing trades in these tokens sooner.

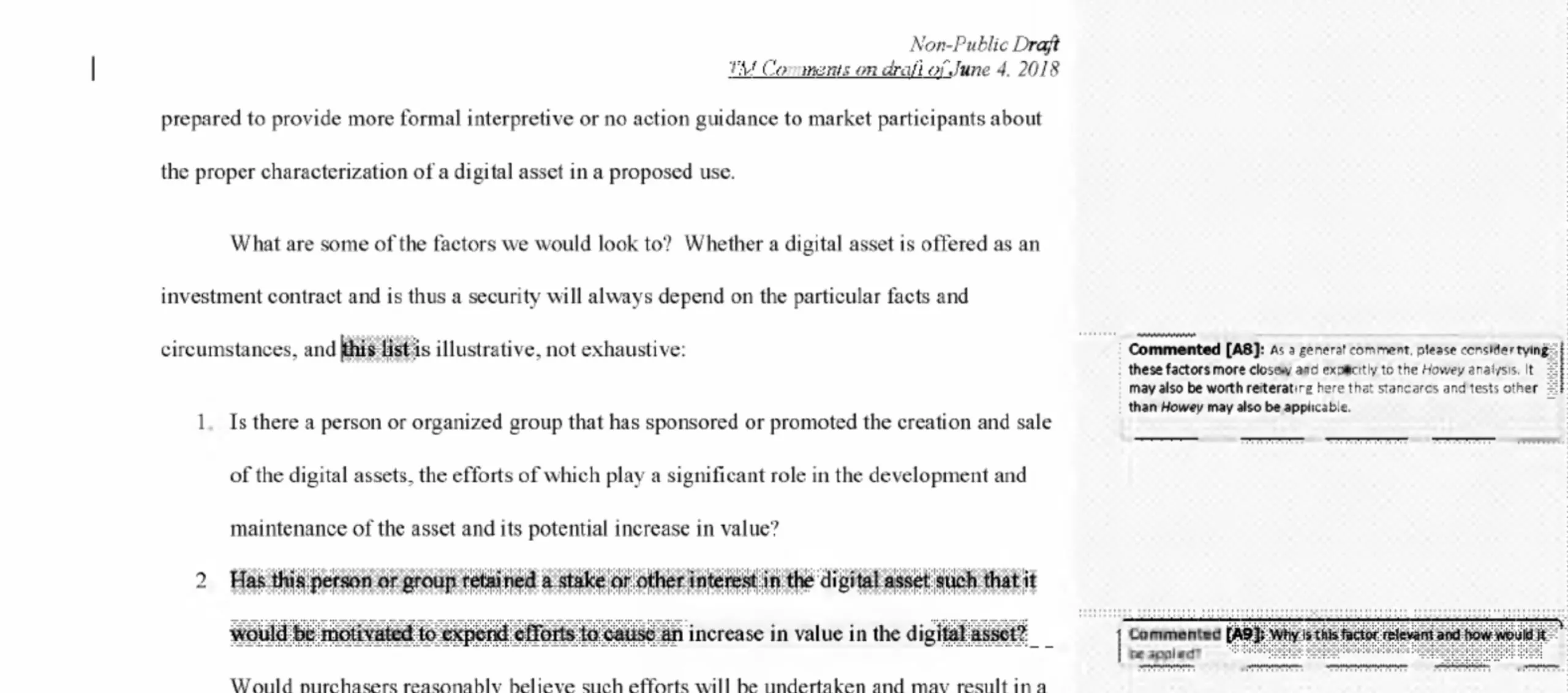

Both Coinbase and Ripple executives say the Hinman emails are problematic for a number of reasons. Ripple executives point to comments made on Hinman's drafts by an official that flagged concerns with how he was characterizing the so-called Howey Test. The test, which originated from a Supreme Court case in 1946, is what's used today by courts to determine what qualifies as an "investment contract," a type of security. In one comment, the official urged Hinman to tie his analysis more closely to the test, something Ripple said he ignored.

Jeffrey Blockinger, chief legal counsel at decentralized exchange Vertex Protocol, said that the emails do not impact the Howey portion of the SEC’s case. Instead, he said the bickering over how to approach digital assets likely provides ammunition for "those looking to create political problems" for the agency.

“Even in 2018 the digital asset industry was already a pretty significant industry and you still see the SEC struggling with how to position itself," Blockinger told Decrypt. "It shows a certain uncertainty within a regulator that presents itself as one-minded and absolutely certain that it's correct.”

Already Ripple and Coinbase executives have made this point in the wake of the email release, with Ripple's chief legal officer Stuart Aldertoy calling for an investigation into Hinman and the SEC. Coinbase chief legal officer Paul Grewal also seized on the emails, touting them as proof that securities laws are ill-designed to regulate all digital assets.

"Unelected bureaucrats must faithfully apply the law within the constraints of their jurisdiction," wrote Alderoty in a tweet. "They can’t—as Hinman tried—create new law."

Ripple's case could come to a close as soon as this year, and with its conclusion answer questions about the SEC's authority over crypto. If Ripple wins, it would bolster Coinbase’s own odds and create some clarity for the industry going forward, said Alan Silbert, the North America CEO of crypto exchange INX.

Though he noted his own firm is federally registered, Silbert said he still finds the SEC’s current approach concerning. The executive expressed hope a resolution to the Ripple case would establish some precedent to restrain the agency's enforcement.

“Anything helps,” Silbert told Decrypt. “This current M.O. of declaring what securities are in lawsuits over rules is a poor way to execute.”

But even if Ripple is victorious, that may not mean the SEC will change tact—which is to say, the Coinbase lawsuit will continue. Federal judges are only bound by precedents set by appellate courts and any outcome from a district court would not be binding on the SEC.

Without any concrete clarification, Blockinger said that the SEC will likely keep pursuing crypto firms with enforcement. And in the current regulatory environment, it only needs one victory to have a dramatic effect.

“If the SEC only needs one coin named a security to win, it looks like they have 258 chances,” said Blockinger, referring to the number of tokens traded on Coinbase. “I think if you’re in Vegas, a lot of people would take these odds.”