In brief

- Michael Novograz, CEO of Galaxy Digital, was asked about the biggest trading mistakes people make on the latest episode of Anthony Pompliano’s Off Chain podcast

- He said that rushing in; not observing what was happening on the margins, and focusing on short-term strategies were the most common and costly mistakes.

- Novogratz said Bitcoin’s rise will depend on its deflation.

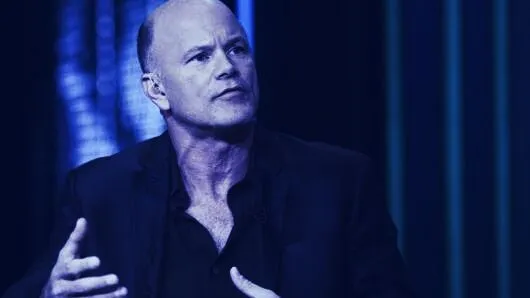

Michael Novogratz, founder and CEO of crypto-focused merchant bank Galaxy Digital, detailed the most common and costly mistakes market traders make today, and underlined his current lack of confidence in Bitcoin

Novogratz is a former Goldman Sachs partner, and spent his early career trading currencies and observing emerging markets.

Today, Off the Chain podcast host and Bitcoin fan Anthony Pompliano grilled him on the chaos that’s infected markets and the US Federal Reserve’s unprecedented response to the economic fallout.

But with Bitcoin and other cryptocurrencies emulating stocks and other assets right now, Pompliano also wanted to know what the biggest mistakes traders make are, and how they can be avoided. Here’s how Novagratz replied:

1.“The biggest mistake that people make is that, when a market breaks, everyone thinks it’s time to get back in way too early. Shit always gets worse than you think it’s going to. I sometimes make the mistake, but I tell myself ‘Hey, when you want to buy something, go on a long walk, then come back a week later and look at it,’ and it’s usually worse off. Once they start going bad, they kind of stay bad for a while.

2.Pick a story where the fundamentals are turning positive—are things getting better at the margins, or worse at the margins? So, if you can see things turning better at the margins, that usually starts the cycle where things get better.

3.This doesn’t mean you can’t buy bombed out things and sell them, but what you’re really trying to do, when there is this evisceration, is buy things that you can hold for a long time.”

Novotgratz went on to provide an example of a racing track stock, Churchill Downs (CHDN) which owns the annual Kentucky Derby. “It went from $160 to $80 in the past six weeks,” he said. Even if the Kentucky Derby is cancelled—and they made $100 million a year on the Derby—it was a $5 billion company, now worth half as much. You do your homework, with companies like that; you find out where the value is, he said, and even if it jumps right away, you don’t need to sell it.

But what of Bitcoin? “I don’t think we’ll see an acceleration of Bitcoin unless we see there’s deflation,” said Novogratz. He was referring to Bitcoin’s revolutionary halving mechanism, where the number of coins that can be produced diminishes over time. The next halving is in 52 days.

Last week, when Bitcoin touched a new yearly low of $5,301, Novogratz tweeted that confidence in the cryptocurrency had evaporated.

$btc was always a confidence game. All crypto is. And it appears global confidence in just about anything has evaporated. What brings it back to $btc.

— Michael Novogratz (@novogratz) March 13, 2020

In fact, he attempted to warn crypto investors that a black swan event, such as the coronavirus crisis, could be very bearish for Bitcoin. On March 1, he tweeted that investors tend to liquidate all their assets during such events.

As well as Galaxy Digital, Novogratz also has a private equity business. So what’s he backing right now, Pompliano asked.

“We’ve been looking at food,” Novogratz replied. “People have to keep eating.”