Jiro, a developer at decentralized crypto exchange SushiSwap, has proposed a method “to enhance operational efficiency and accelerate protocol development.”

However, with less than a day left to vote, skeptics have been vocal on X in expressing concerns about a move that would centralize the protocol’s $53 million treasury. Some users have even alleged voter manipulation.

“The leadership team has been laying the groundwork for several months to reach this pivotal moment,” former SushiSwap contributor B.Naïm told Decrypt. “I am both concerned and unsurprised.”

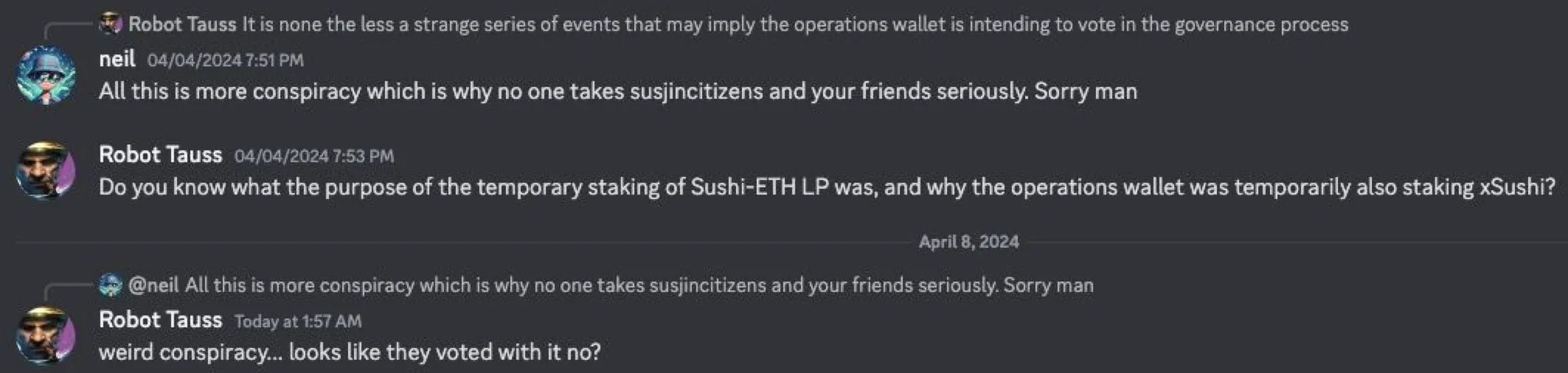

B.Naïm has been vocal on Twitter since the proposal was put forward, creating multiple threads claiming that the core team are trying to manipulate the vote.

"[This is] factual conspiracy," Neil Bhasin, who's been involved with the SushiSwap Compensation Committee, told Decrypt. "Anyone with on-chain prowess can debunk those conspiracies."

Put simply, B.Naïm claims that the SushiSwap team added liquidity to freshly created wallets moments before the next snapshot was created to increase the core team’s voting power. By doing so, he posits they wanted to give themselves more influence on the final tally. Soon after the proposals were listed and the voting snapshots were taken, the team withdrew the liquidity from the new wallets.

“How can so many addresses be funded 10 minutes before the creation of the vote and then removed minutes after?” B.Naïm said, “Does that seem normal to you?”

But SushiSwap Head Chef Jared Grey said Naim and the people who agree with him represent a small minority in the larger community, and that some of the wallets that Naim called out in his post are unlisted and don't belong to members of the SushiSwap core team.

"Naim is a former Sushi contributor who has not actively participated in the community or governance since I joined more than 1.5 years ago." Grey, told Decrypt via email, "He does not represent the community. He represents a small subset of adversarial participants, which number less than a dozen, and have actively engaged in a governance attack for the past six months."

When putting forward the proposal, both the “signal” and “implementation” proposals were designed at the same time. In really simple terms, a proposal asking permission usually needs to pass before one describing its implementation gets drafted.

For both to appear at the same time has been flagged as an unusual move which, to the Sushi community, shows that the core team are confident their vote will pass. It also prevents community members from buying more voting power to block the implementation proposal.

#Sushiswap : Here is how the Sushiswap team is trying to manipulate the vote:

- They added liquidity by borrowing money between 01:52 and 02:07 AM

- The next snapshot was created at 02:23

- Immediately afterwards, all liquidity was removed between 2:38 and 3:14 pic.twitter.com/kFiurbwa7N— Naïm Boubziz (@BrutalTrade) April 4, 2024

And now, as a result, there are concerns over the legitimacy of the proposal vote.

At the time of writing, the proposal is winning with 62% of votes. This proposal is the first time the official Sushiswap team address, Sushigov.eth, has ever voted. The wallet has 5.5 million SUSHIPOWAH and another 3.1 million delegated to it from other community members—making it far and away the biggest voter.

“The team assert that this was fully legal and condoned by their legal team.” Tom McClean, Senior Researcher at Vega Protocol, told Decrypt. “Whether ethically the community expected those tokens to be available to the team for use backing their own views on governance votes is another question," he added.

Multiple Telegram and Discord messages show that the SushiSwap community did not expect the core team’s wallet would ever be used in governance. Other top voters include notable community members (voting no) and wallets included in B.Naïm’s threads (voting yes).

“In regards to if centralizing a treasury is bad, it’s a question of how much you trust the team,” McClean said. “If passed, the proposal would create a structure similar to what has been adopted for some other protocols, with a centralized ‘Labs’ team able to directly control funds however they see fit. Once given up by the DAO, such power is hard to claim back.”

But Grey doesn't the proposal as an effort to centralize the treasury.

This is the latest in a saga of mistrust with the team at Sushi Swap, such as the handling of the SEC subpoena of Sushi Head Chef Grey. This fractured relationship was compounded when the core team allegedly removed four snapshots, deleted the governance forum, and actively censored the Discord server.

It's worth pointing out that Grey says the governance forums in question that people thought were deleted were actually migrated.

“By removing the possibility of organizing new elections, etc., they will now be able to award themselves whatever salaries and bonuses they want,” B.Naïm suggested. “ Even if Sushiswap stagnates, they will continue to comfortably hold their positions, without the possibility of demanding change.”

The Sushi community is seemingly fighting an uphill battle and many are resigned to the fact that this proposal will go through—B.Naïm laughed at the idea of the proposal not passing.

“In an absolute worst case, the team could simply take the money and run, but that seems an unlikely scenario given the profile of the project and ‘doxxed’ status of many contributors.” McClean finished, “In a more realistic scenario, the decisions and direction the team take could be contrary to that desired by the rest of the community and the DAO ends up sidelined.”

Editor's note: This story was updated to add a comments from Neil Bhasin and correct his title. This story was again updated on Tuesday, April 16 to add comments from SushiSwap Head Chef Jared Grey.

Edited by Stacy Elliott.