In brief

- Venezuela's petro could help stimulate the country's economy, according to an economist for the American Institute for Economic Research.

- AIER's William Luther believes that will come at the cost of a loss of privacy for Venezuelas

- Some experts disagree and say the petro is no different from the way all governments treat traditional banks.

Use of the state-backed petro "cryptocurrency" could become a double-edged sword for Venezuelans. While it might marginally improve the country's economy, it will come at the cost of strengthening an authoritarian regime, according to William J. Luther, director of the Sound Money Project of the American Institute for Economic Research.

Luther laid out his views in an article for AIER late last month. In it, he explained that the petro is capable of boosting the Venezuelan economy by changing the dynamics of the way it does business internationally (mostly through skirting US sanctions). But, domestically, ordinary Venezuelans will suffer, he concluded. What's more, the petro could be used by the government of Nicolas Maduro for "internal monitoring."

While the digitalization of the country's currency would make money transmission easier, it could have a chilling effect on, say, funding political activity for Maduro's opposition, since the government would have real-time access to all financial activity in the country. "By requiring petro use, the Maduro regime tightens its grip on power," Luther argued.

"By making it easier to avoid sanctions, the petro enables the government to regain some of its lost oil revenues. By making it easier to monitor domestic transactions, the petro aids efforts to stamp out political opposition," the economist wrote.

The petro: Big Brother for Venezuela?

The theory that Venezuela's national government created the petro as a way to evade US sanctions is widely accepted as fact by geopolitical analysts. But the idea that the petro could act as a Big Brother mechanism for the government is the source of much debate, especially after Maduro's government withdrew support for the only petro wallet that did not require KYC.

By making it easier to monitor domestic transactions, the petro aids efforts to stamp out political opposition.

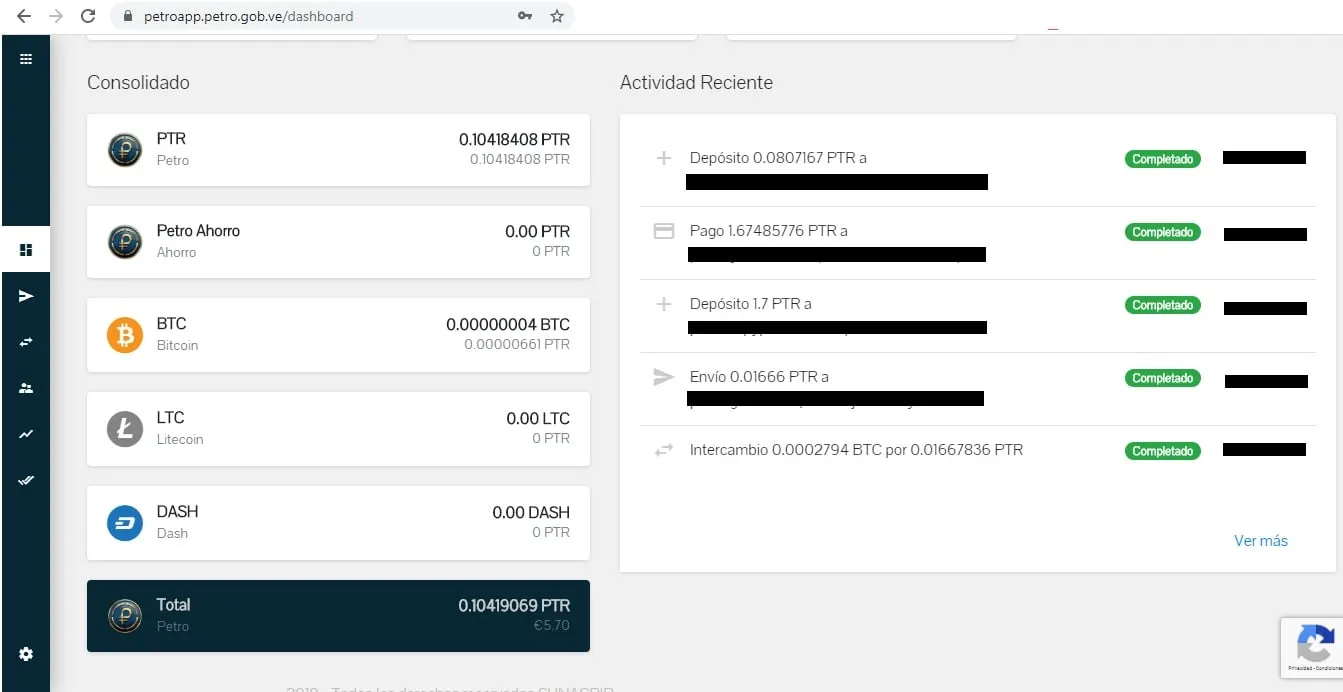

At the moment, the only way to use Venezuela's official cryptocurrency is through a the state's web-based wallet that supports petro, Bitcoin, Litecoin and Dash, in addition to serving as a payment gateway. The address associated with each user ID is static, which allows constant monitoring of all transactions made by each citizen—a figure that totaled 1.2 million transactions in a matter of days by the end of 2019, according to government data.

But not all Venezuelans share Luther's concerns. One of his detractors is Carlos Gil, CEO of PetroShop Venezuela, who is witness to transactions, sales and trades made in petros happen through his Telegram group on a daily basis. The group has nearly 5,000 active members, according to Gil.

"You have the same privacy with the petro as you have [trading crypto] with Binance, Coinbase, [and so on]," he told Decrypt. "Everyone asks for KYC, because it is an international standard to prevent crimes like money laundering or financing of terrorism," said Gil. "I think that the privacy of each person is in much more danger with social networks like Facebook, which are instruments of control and surveillance used by the government of the United States."

But why did the government remove the standalone APK wallet that didn't require KYC details from its users? Aníbal Garrido, who teaches crypto-trading at Venezuela's University of Carabobo, believes it comes down to political strategy.

"The development of the Patria platform [a state network for the distribution of social benefits] has received significant attention, instead of the development of the Petro App [the standalone mobile wallet]," he said in an interview. Instead of promoting a "project of a cryptographic nature and the use of the blockchain as a mechanism to be able to validate transactions," the government prefers to use the "black box" of the Patria system, "which in no way resembles a blockchain platform," Garrido said.

Garrido said this could also explain the compatibility problems between the Patria and Petro App platforms when attempting to send tokens between the two.

Nevertheless, the professor believes there's no reason for Venezuelans to be alarmed by Luther's claims. "The fact that the petro was conceived by the government implies a centralized character per se, so the issue of privacy is irrelevant," he said. "On the other hand, it is a way for the government to avoid economic sanctions and consequently obtain liquidity, fast international transactions, and, in general, all the advantages of cryptocurrencies when it comes to mobilizing money."

Does the petro violate Venezuelan's privacy?

Enforcing KYC and anti-money laundering procedures will necessarily involve the state's ability to demand detailed information from banks regarding their customers' operations. Banks in Venezuela have the ability to retain, reverse, correct and report banking transactions in the event of suspicious or irregular behavior.

But by forcing Venezuelans to use petros and abandon cash, citizens are not be allowed to choose whether they want to trade privacy for convenience—they are being compelled to do so.

That could potentially violate Venezuelans' legal right to privacy under the country's own constitution and several international treaties. But Ernesto Portillo, a member of the Venezuelan Association Criptojuris, doesn't see it that way:

"I am of the opinion that the petro complies with the law, unlike the lawyers of the IESA," Portillo told Decrypt. "Many lawyers do not understand that we are experiencing a change in paradigms. It is the people who have historically chosen their means of payment. Every time there are technological changes, the methods of payment also change," he said.

According to Portillo, Venezuelans have never been exempt from government oversight over their financial transactions. The idea of the petro posing a new threat to privacy is an "absurdity," said the lawyer, since "banks already have an obligation to keep a record of all transactions and are obliged to hand over information whenever required by state institutions."

For Portillo, the petro is simply a way to free the country from sanctions, and nothing more.

Some local crypto enthusiasts, however, aren't so willing to give up ground to the petro. Venezuelan crypto trader Ernesto Ochoa told Decrypt, "I prefer a thousand times more to use Bitcoin with my own wallet, where I own my keys, instead of using the PetroApp. In Venezuela, I doubt very much that anyone would think it is a good idea to have money in a bank," he said.

In Venezuela, there is a real hunger for cash, wether it's bolivars or US dollars, Ochoa said. "Giving the government control over our funds seems to me as stupid as giving it to a bank, even more so if we are talking about such authoritarian governments as Venezuela, or even the United States, where anything you do must be in line with their ideology," said the crypto trader.

In the end, the threat of mass surveillance of economic activity may be the least of Venezuelan's problems. Considering that Venezuela's minimum wage is below the international poverty line according to the United Nations, there isn't much banking activity for the government to surveil.