When Gerard Cotten, the CEO of the defunct Canadian crypto exchange, Quadriga, died, he took his secrets to the grave, as well as $135 million of 115,000 customer’s funds—that didn’t even exist! The tale is as strange as they come: allegations of faked deaths, luxury yachts and fraud run rife amongst rumor mills. Here are the five strangest things to come out of the story:

1. Lawyers want Cotten’s body exhumed.

Canadian law firm Miller Thomson has requested that Cotten’s body be dug up by the Royal Canadian Mounted Police, following rumors that Cotten is not, in fact, dead, but has instead ran away with the money for good.

In a letter posted on its website, dated December 13, Miller Thomson said, “The purpose of this letter is to request, on behalf of the Affected Users, that the Royal Canadian Mounted Police (the “RCMP”), conduct an exhumation and post-mortem autopsy on the body of Gerald Cotten to confirm both its identity and the cause of death given the questionable circumstances surrounding Mr. Cotten’s death and the significant losses of Affected Users.”

“Given decomposition concerns,” Miller Thomson request that the exhumation and autopsy be completed by spring. Faking his own death would mean that Cotten could evade authorities, and keep the cash to himself. His funeral was a closed casket, meaning that those attending his funeral wouldn’t be able to confirm his death and took place before his widow revealed that he had died.

Cotten was supposed to have died suddenly while on a honeymoon in India. He suffered from Crohn's disease. Jayant Sharma, his doctor, had said his blood tests came back showing high levels of white blood cells, which indicates sepsis. Brian Feagan, a specialist in Crohn’s disease, said Cotten’s death makes sense, as this can happen to Crohn’s disease sufferers who are also in septic shock.

Unsurprisingly, The lawyer for Jennifer Robertson, the widow of Gerald Cotten, said she was “heartbroken to learn of this request.”

2. Cotten used money to fund lavish a lifestyle

When it was revealed that the cold wallets were by and large empty, many observers started speculating where the funds had gone. Kraken CEO Jesse Powell told Decrypt a bug might have resulted in the exchange losing a lot of cryptocurrency before the 2017 bull run.

But it was also revealed that Cotten siphoned millions of dollars worth of funds off the exchange to a mock accounts, called “slush accounts.” Cotten credited these slush accounts with fake funds. He then traded those fake funds with genuine users for real funds, before moving his loot off the exchange.

With Cotten’s money, which was shared with his wife, the couple took luxurious vacations and bought a host of expensive assets, including properties, a plane, a yacht, and luxury cars.

3. Quadriga CX’s co-founder, Michael Patryn, might be a convicted felon

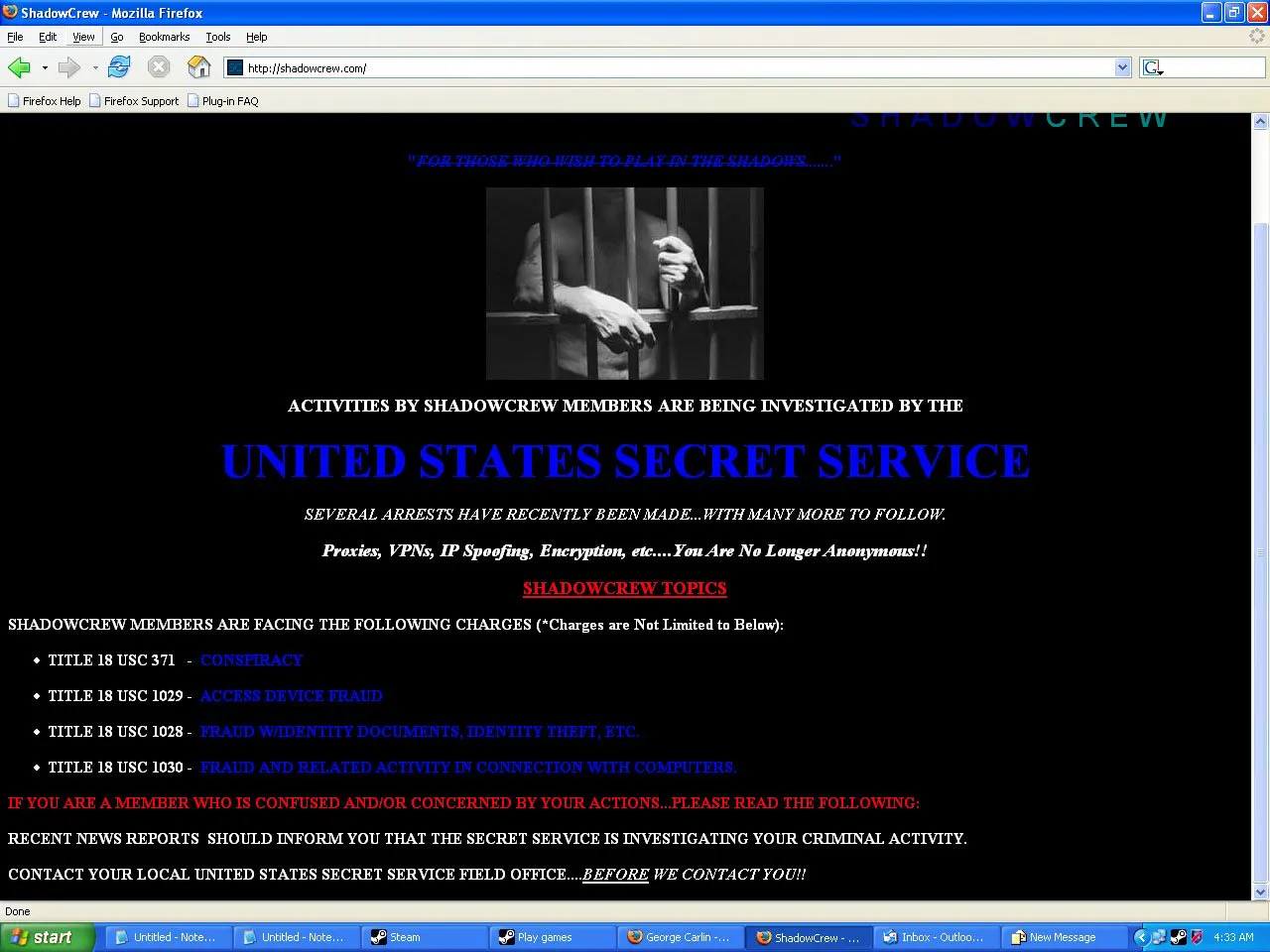

Michael Patryn, Quadriga CX’s co-founder, could be linked to past criminal activity, according to reports. A Globe and Mail report found that Patryn could be the pseudonym of Omar Dhanani, a felon who spent 18 months in prison for credit-card fraud, and was convicted of money-laundering charges for playing a role in a criminal organization called “ShadowCrew.”

Patryn denies he is Dhanani, but The Globe and Mail found that Patryn started a website called Midas Gold Exchange, which was owned by “Omar Patryn,” a mélange of the two names. There was other evidence linking the two entities together too.

4. Quadriga had a surprising lack of developers

Just one man, Alex Hanin, made sure that Quadriga was running smoothly. Hanin, as “chief architect,” completed the work of dozens of developers. To fill the same role, crypto exchange Kraken, once Quadriga’s competitor, hires over a hundred developers. Jesse Powell, CEO of Kraken, told Decrypt that, if true, this meant that Quadriga was massively cutting corners.

Powell was surprised that the exchanged only performed hourly backups. Only performing backups every hour meant that, if the exchange went down, up to an hour of transactions would be lost, meaning that it would be hard to work out who owned what. A nightmare for an exchange

In fact, a motley crew of just four ran Quadriga’s main operations, with just a handful of support staff on retainer. Back in March, Powell said, “You’ll probably find this business is basically a façade with nothing really going on behind the scenes.”

5. Management lost over a hundred bitcoin of customer funds

Quadriga closed on January 28. But just a few weeks later, on February 12, professional services firm Ernst and Young (EY) published a report detailing how the exchange had accidentally sent 103 bitcoins, worth $470,000 at the time, to an inaccessible bitcoin wallet.

Ernst and Young didn’t say who was responsible, but in its next report blamed “management” at Quadriga for sending the bitcoins to the inaccessible wallet. “The inadvertent transfer occurred due to a platform setting error,” it said. Creditors were furious, blaming EY for the loss under its watch. The Quadriga Committee refused to investigate. But then again, they’ve probably got their hands full.