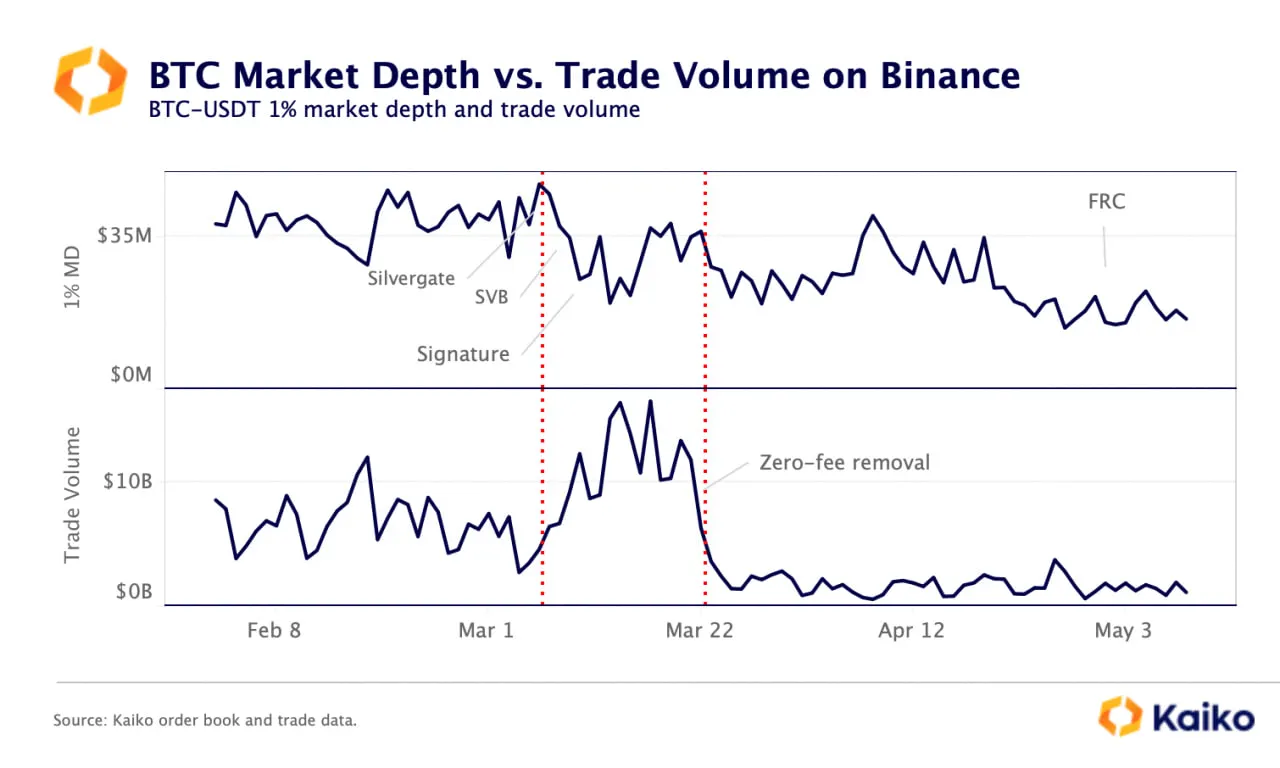

Binance trading volumes and liquidity have been steadily declining in the first quarter of 2023 amid the spate of U.S. banking failures and after ending its zero-fee promotion.

The result?

It’s led to even more chop for the price of Bitcoin, Kaiko analyst Dessislava Aubert told Decrypt.

Aubert said that "Overall, Bitcoin liquidity on Binance has more than halved relative to the start of February from around $45 million to $16 million in early May."

The primary reason for the decline in liquidity was the removal of Binance’s 10-month zero-fee promotion for 13 different BTC pairs, which also caused market makers to leave the platform.

Specifically, monthly trading volumes for the exchange’s most-traded pair, BTC-USDT, volume fell from $16 billion in March to $2 billion in April, said the Kaiko analyst.

Aubert added that the drying liquidity “has been more pronounced” after the spate of banking failures earlier this year. The collapse of two key on-ramps for the industry in Silvergate and Silicon Valley Bank also hit specific firms, including Ripple, Circle, Yuga Labs, and many others.

The 1% market depth, a measure of liquidity calculated using the bids and asks within 1% of the mid-price, on Binance declined significantly after the banking failures.

Low Bitcoin liquidity—So what?

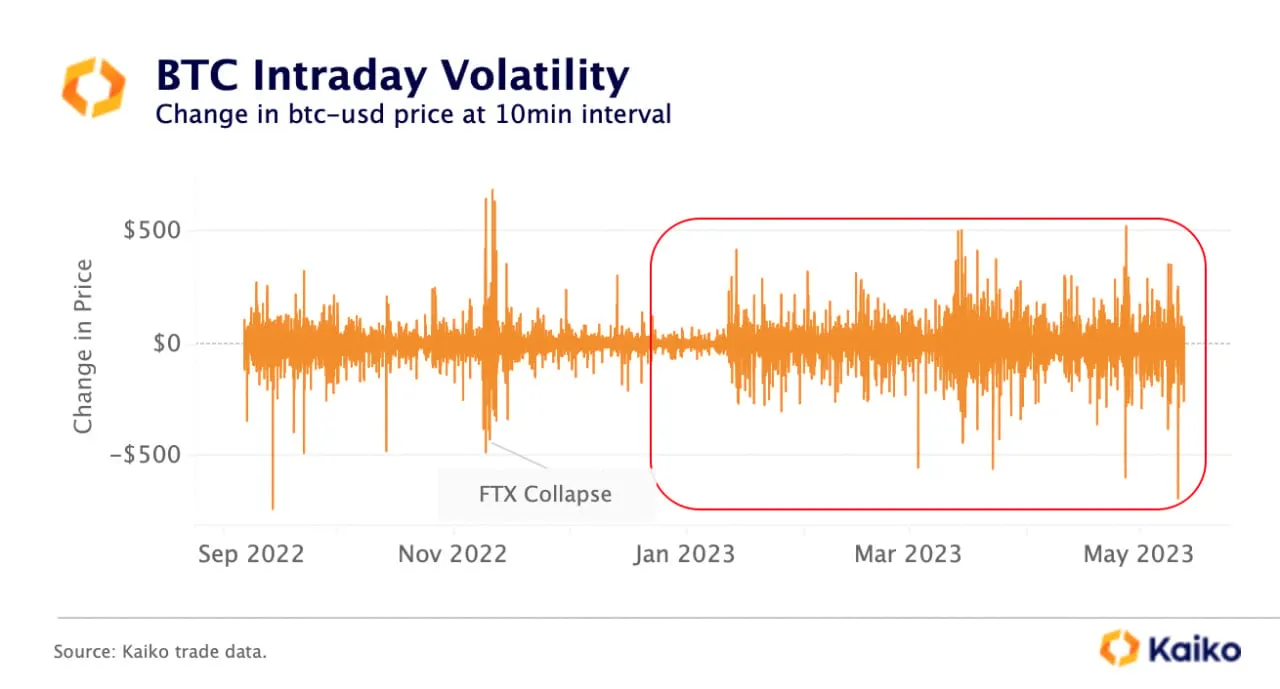

The result of reduced liquidity and volumes on Binance has been increased volatility.

Kaiko’s intraday volatility metric for the 10-minute interval surged considerably around the time liquidity began dropping on Binance.

Low-liquidity conditions mean thin order books on exchanges which provide room for wild price swings from large orders.

“We have seen this with BTC's recent sudden price move which did not have a clear catalyst,” said Aubert. “Volatility is unlikely to go away especially after some larger market makers (Jane Street and Jump Crypto) revealed they were reducing down their crypto exposure.”

Notably, Bitcoin’s price dropped this week despite favorable conditions such as a positive CPI report and market expectations largely inclined toward an interest rate cut in the future by the U.S. Federal Reserve.

A low-interest rate environment enables cheaper debt in the economy which fuels a rise in speculative assets like Bitcoin.

However, the asset failed to stage an uptrend likely due to poor liquidity.