U.S. Bitcoin miner CleanSpark today announced the closing of a $144.9 million deal to purchase 45,000 of Bitmain’s Antminer S19 XP Bitcoin mining machines, which will be delivered by the end of September to its facility in Sandersville, Georgia.

The first wave of 25,000 miners will arrive in batches throughout August with the rest arriving the following month; all machines are expected to be deployed by year's end.

Once deployed, CleanSpark’s fleet in Georgia will have added 6.3 exahashes per second (EH/s) of computing power to the company's current capacity of 6.7 EH/s, making for a 95% increase.

CleanSpark also purchased 20,000 miners in February, which are currently being delivered to the company’s Washington facility, which is also in Georgia. When these machines are up and running later this quarter, the Washington facility will add 2.44 EH/s to the company’s total operational hash rate.

CleanSpark now claims to have a total of 15.9 EH/s either deployed or under contract, with an end-of-year target of hitting a staggering 16 EH/s.

To put that into perspective, according to an estimate by CoinWarz, the total hash rate of the Bitcoin mining network sits at a little under 322.53 EH/s today.

So if all the machines were to come online today, CleanSpark would have cornered roughly 5% of Bitcoin’s global computing power.

Clean mining

Like their peers at TeraWulf, CleanSpark's genesis predates Bitcoin mining and has its roots in the power industry.

CleanSpark was founded in 1987 as a software and energy solutions company and took its first steps into running Bitcoin mining facilities relatively recently in 2020.

The company markets itself as “sustainable Bitcoin mining” and aims to achieve 100% renewably-sourced energy across its mining operations. Today, CleanSpark says carbon-free energy accounts for 90% of its total energy mix.

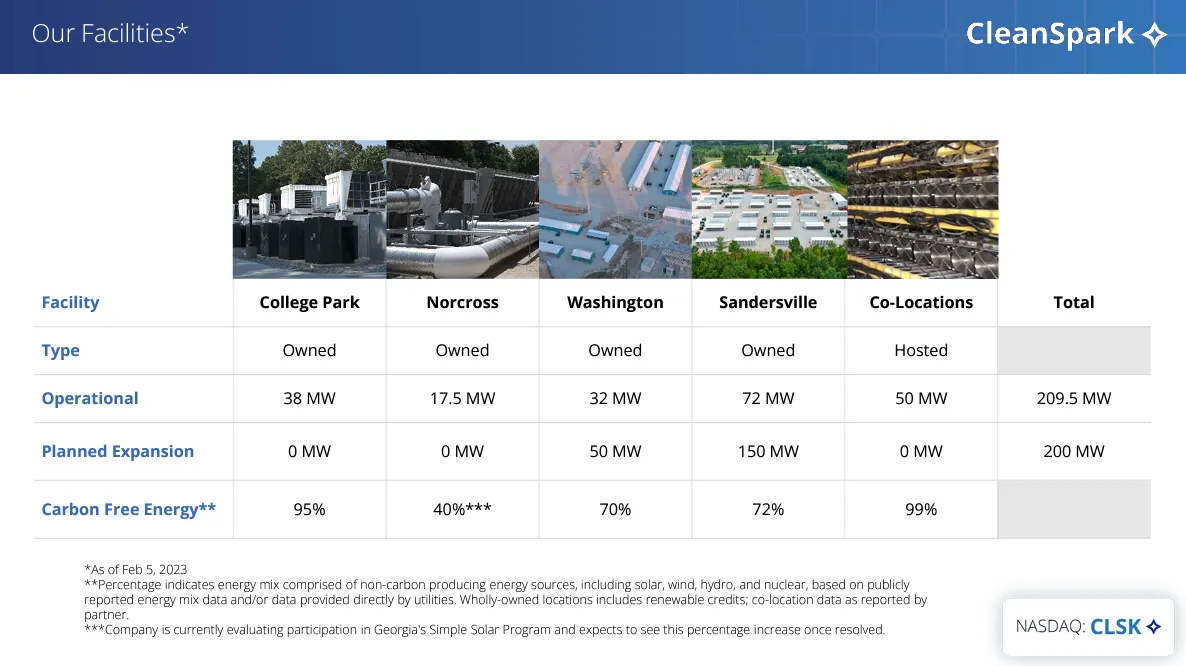

At the company’s largest facility in Sandersville, it has so far achieved 72% carbon-free energy, according to its most recent energy disclosure.

As for choosing Georgia to set up much of its shop, CleanSpark's chief communications officer Isaac Holyoak told Decrypt that“Georgia, and particularly the communities we work in, view our data centers as important sources of economic strength.”

“Sales tax on our energy bills pour hundreds of thousands of dollars a month into local programs and infrastructure," he said. "We work hard to cultivate strong relationships at the community level, with mayors, city councils, and local residents and do our best to give back. Our major power provider in Georgia, MEAG, sources large sums of low carbon energy and has been a great partner.”

Throughout the last two quarters of 2022, many miners felt the full force of the bear market, which led to several high-profile bankruptcies, while operations like Core Scientific and Argo were dumping their Bitcoin to shore up their balance sheets.

CleanSpark was one of the few operations that saw it through the tough times, according to Holyoak.

“We’ve been using the bear market to build. So, far from being a difficult time, it has been a time of tremendous growth for us. We acquired two new data centers and expanded our fleet with tens of thousands of miners purchased at some of the best market prices possible,” he said.

“Regarding selling Bitcoin, we’ve always been pragmatic HODLers," said Holyoak. "We’ve long had a strategy of selling a portion of the Bitcoin we mine to fund our growth and operations—so no changes there for us.”