$68,990.00

2.59%$2,019.13

3.89%$636.53

3.25%$1.37

1.26%$0.999906

-0.01%$85.20

3.84%$0.285115

-0.80%$1.024

0.00%$0.091934

3.62%$55.08

2.29%$0.99994

-0.01%$0.258422

2.53%$454.76

1.56%$9.06

0.30%$32.68

6.98%$345.45

2.03%$8.92

3.74%$0.999373

0.02%$0.1478

-3.04%$0.151831

1.64%$0.999044

-0.06%$0.00886487

-0.81%$54.20

1.80%$0.095843

0.84%$1.00

0.01%$9.28

4.28%$0.928415

4.05%$214.03

8.17%$1.34

-0.03%$0.00000544

2.68%$0.075523

1.31%$5,047.22

-1.82%$0.100645

3.47%$1.53

2.33%$5,085.90

-1.69%$1.50

2.52%$3.90

5.59%$0.669215

-0.62%$0.21544

5.71%$1.12

0.00%$96.71

-0.63%$1.00

0.00%$196.12

10.69%$0.708566

3.02%$0.998048

0.06%$0.074171

2.36%$0.999845

-0.02%$107.29

0.22%$1.26

1.93%$0.999606

-0.04%$2.18

0.78%$0.0000016

-0.06%$0.00000332

3.16%$2.50

1.40%$0.999183

-0.04%$8.24

1.86%$0.252883

2.71%$0.00197085

3.51%$7.03

0.34%$0.370348

-0.28%$8.10

2.64%$1.92

3.35%$11.01

0.01%$0.097704

2.91%$0.058184

4.31%$62.86

-2.18%$1.10

-1.20%$0.896739

2.43%$1.75

0.89%$0.103001

3.52%$1.21

-0.38%$0.99905

-0.03%$0.03022884

2.96%$0.00895212

0.70%$0.963966

2.41%$114.50

0.00%$0.084011

1.53%$1.027

0.04%$1.00

-0.02%$1.40

3.18%$0.01310606

-10.64%$0.946403

0.32%$2.98

-2.40%$0.03179127

-2.54%$0.079919

-0.05%$0.00706363

2.72%$0.999991

0.01%$0.098624

2.94%$0.164933

0.93%$1.097

0.03%$1.002

0.44%$1.001

0.06%$0.02693129

-11.40%$0.00000592

5.37%$29.52

4.36%$0.279926

-5.81%$0.01264686

0.38%$0.999882

0.04%$0.258189

1.35%$1.089

0.07%$1.16

-0.14%$1.37

4.50%$0.050953

1.35%$0.672964

4.70%$0.006957

6.87%$0.062089

-3.29%$0.561658

8.15%$32.51

4.61%$2.02

0.63%$166.16

-6.02%$0.03842018

6.45%$0.367212

0.44%$0.999659

0.06%$0.244275

3.86%$0.999611

-0.01%$0.493214

27.99%$126.64

2.89%$0.00000034

-0.21%$0.145023

1.63%$0.325795

-8.30%$0.00000032

-0.24%$1.022

0.05%$0.999737

-0.02%$0.0161129

0.78%$0.3271

2.45%$3.09

0.24%$0.050732

-2.35%$0.00597082

9.10%$2.91

2.58%$0.324882

2.42%$0.309183

1.50%$0.065568

3.23%$0.782867

-1.80%$0.00002846

3.67%$0.02552685

0.73%$0.990009

0.12%$0.04696185

1.82%$0.998478

-0.06%$17.09

-1.01%$13.19

-2.95%$0.075968

3.12%$1.60

0.85%$0.224046

2.86%$0.04949124

4.39%$12.97

-13.89%$0.119723

3.75%$1.012

-5.79%$1.12

4.65%$0.137776

-5.84%$0.00256076

-0.10%$0.286465

0.79%$5.44

-11.73%$1.88

-0.35%$0.00004249

2.94%$0.02117978

-0.22%$0.00000109

-0.72%$0.998302

-0.22%$5.91

3.38%$0.00221377

-0.91%$0.081363

3.18%$0.984042

0.00%$1.16

0.23%$1.00

0.01%$0.0390638

2.77%$2.33

4.13%$0.094781

-0.78%$1.076

0.00%$4.46

15.17%$0.207849

0.61%$22.75

0.00%$0.494141

2.08%$1.22

2.42%$0.00201125

1.12%$0.196606

2.96%$1.13

-0.20%$1.00

0.00%$0.052386

3.18%$0.342118

19.05%$0.098561

0.56%$0.18163

1.18%$2.24

6.60%$0.02206212

-0.92%$1.00

0.00%$0.00475062

0.71%$2.52

1.76%$0.177812

-0.33%$0.091278

0.36%$0.075233

1.84%$0.055879

3.88%$0.999468

-0.05%$0.075997

3.45%$2.17

1.78%$0.01828164

-1.65%$0.0230038

-0.10%$1.80

-0.80%$0.163358

6.26%$48.00

-0.01%$16.78

1.80%$0.00341563

4.86%$4,259.62

-7.19%$0.593878

4.41%$0.994781

0.03%$1.25

-0.89%$0.03215971

-10.46%$0.153439

-2.97%$0.04022195

5.17%$0.02522846

4.79%$0.998656

-0.15%$0.148075

0.49%$0.420925

1.33%$0.097176

1.40%$0.311822

2.31%$0.00000691

1.86%$0.999218

0.11%$1.015

0.07%$0.28752

-0.13%$0.153974

1.41%$1,094.26

-0.15%$0.093141

2.83%$0.232371

7.18%$0.25986

0.25%$1.083

0.03%$0.125177

0.98%$0.132084

1.59%$0.076824

-0.85%$4.21

2.88%$0.57522

1.71%$0.532441

-0.66%$0.069608

-6.54%$1.004

0.03%$0.186995

4.08%$0.295689

0.28%$0.00139354

0.94%$11.18

0.00%$0.2621

3.44%$0.115828

0.08%$0.999965

0.06%$1.065

0.03%$0.226413

-1.21%$2.28

1.39%$0.363337

2.37%$1.00

0.04%$0.382608

-2.49%$1.40

1.54%$0.318169

3.77%$0.00355624

0.03%$0.996924

-1.18%$0.991624

-0.29%

Binance traders on Binance appear far more concerned with fees than the actions of U.S. authorities.

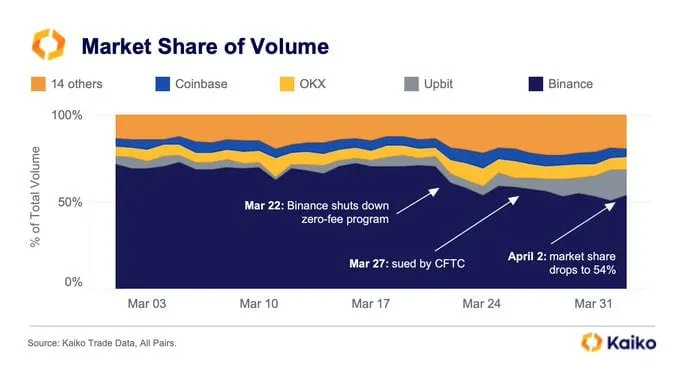

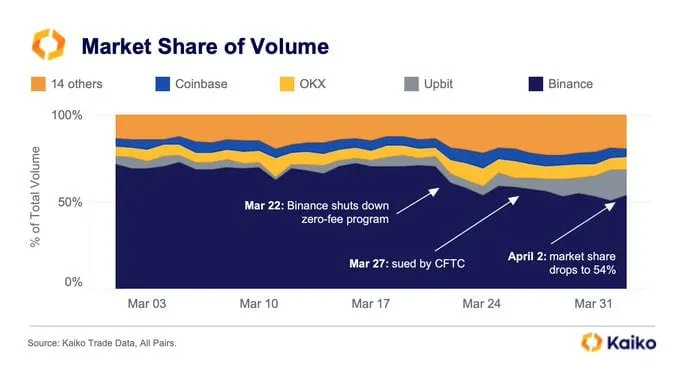

Binance’s market share in spot trading volume has dropped roughly 16% over the past two weeks, with many pointing to the CFTC’s charges against the exchange for the decline.

However, Binance’s market share had already dropped below 60% prior to the regulatory action. Instead, Kaiko’s latest research suggests that liquidity exited the exchange after it ended its zero-free trading program on March 22.

The situation appears merely to be exacerbated following the CFTC charges on March 27, bringing its market share down to 54%.

Moreover, the use of other Binance products like derivatives and its American trading desk, Binance.US, has held steady, suggesting that traders are ignoring the regulatory risks for now.

“I think traders are far more cost-conscious,” Kaiko’s director of research Clara Medalie told Decrypt. “The CFTC lawsuit barely made a dent in derivatives volume or volumes on Binance.US, which was not part of the end of the zero-fee program.” The U.S. branch still offers zero fees across Bitcoin, Ethereum, and stablecoin pairs.

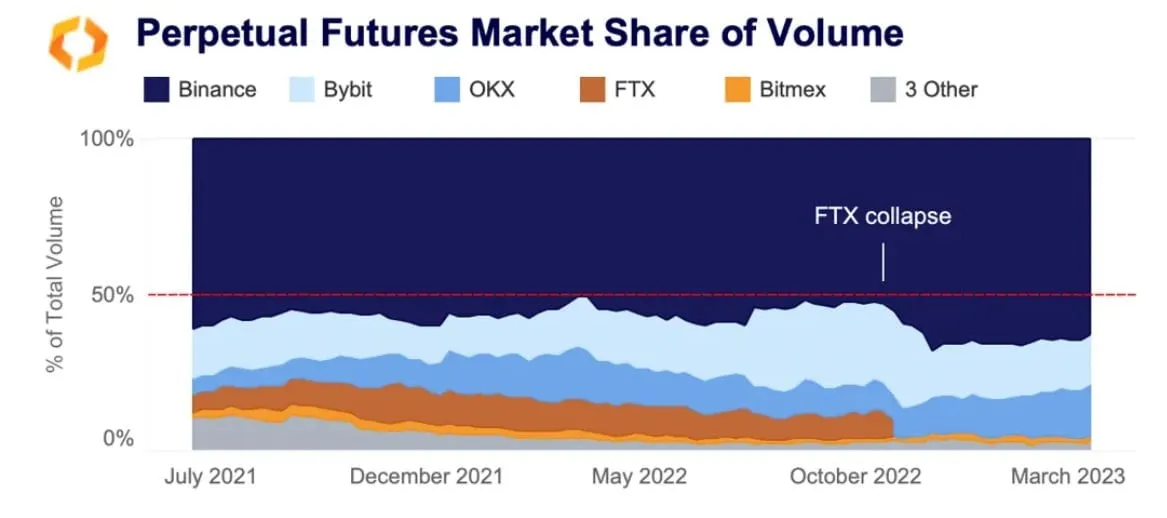

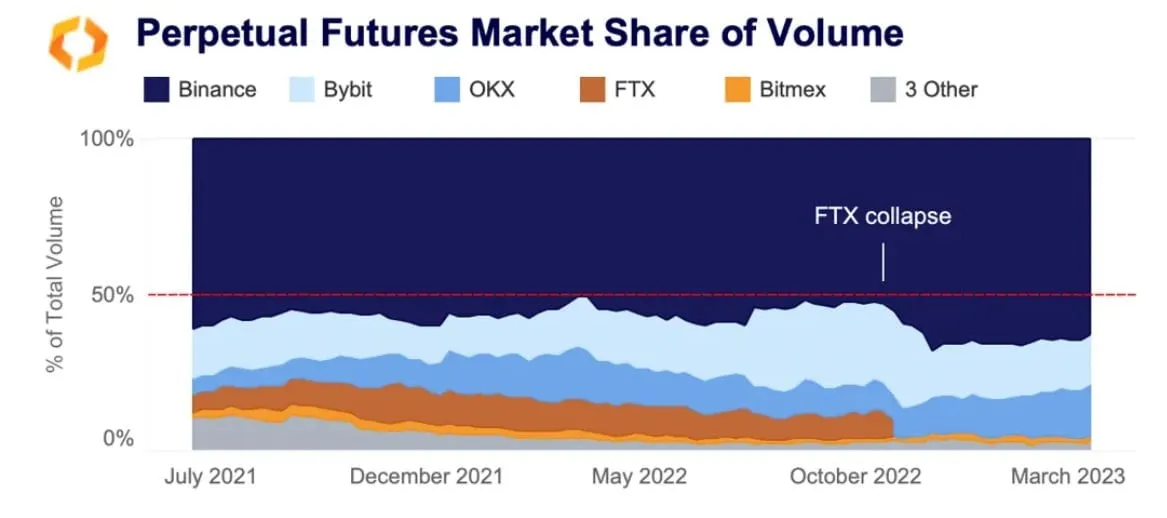

Binance’s share of trading volumes for perpetual futures, a popular derivatives product, dipped only by 2% after the CFTC lawsuit, maintaining its massive lead of 63% over the rest of the market.

The Kaiko report also shows that Binance’s American subsidiary has grown its market share in spot trading volumes three-fold since the start of 2023.

Binance.US has also started eating into the market share of Coinbase, whose dominance in the country dipped from 60% to 49% in the first quarter.