After facing a massive debt crunch in November, Iris Energy announced on Monday that its hash rate is recovering to pre-FTX levels.

Over the coming months, the Bitcoin mining firm’s self-mining capacity is slated to increase from 2.0 exahashes per second (EH/s) to 5.5 EH/s. One exahash equals one quintillion hashes—proposed answers to the complex math problems required to mine Bitcoin blocks.

“Iris Energy has successfully utilized remaining prepayments of US$67 million under its 10 EH/s contract with Bitmain... to acquire 4.4 EH/s of new S19j Pro miners without any additional cash outlay,” stated the company.

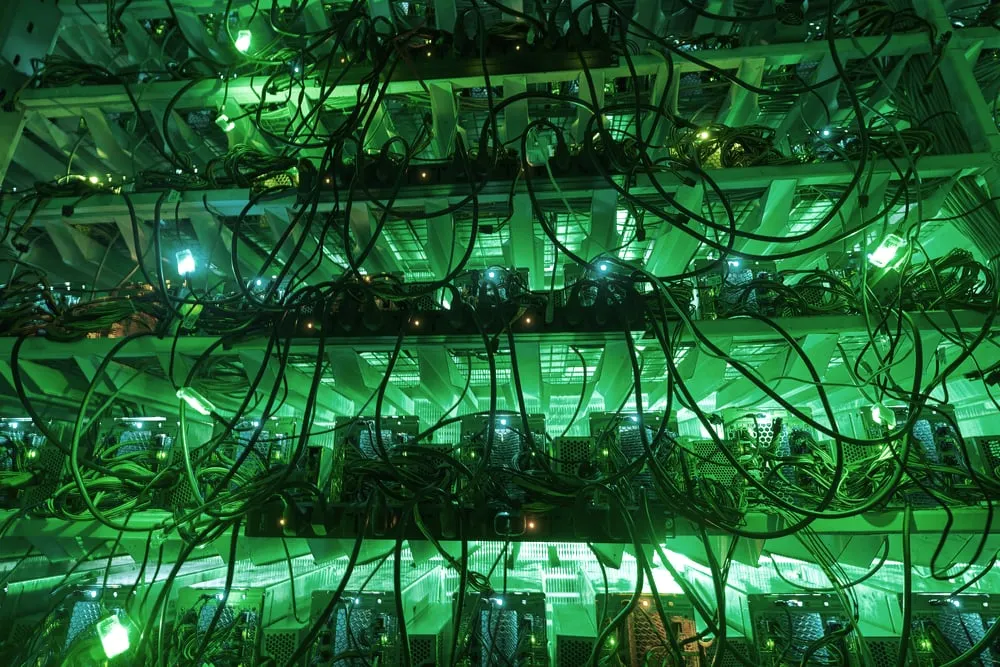

Bitmain is the manufacturer of Antminer cryptocurrency mining servers.

The hash rate increase more than compensates for the company’s 3.6 EH/s loss in November, when it was forced to unplug a swath of mining machines used as collateral for $103 million in loans from creditors.

Like many mining firms at the time, a combination of rising energy costs and Bitcoin’s descending price left it unable to produce enough cash flow to cover its debts. North America’s largest Bitcoin mining facility Core Scientific filed for bankruptcy in December, while Argo Blockchain’s Bitcoin production that month was crippled by a winter storm surrounding its Texas facility.

However, Iris now states that its existing obligations under its 10 EH/s contract with Bitmain are now “fully resolved,” and that the firm is now “debt free.”

To raise further funds, Iris is also considering selling any surplus miners that bring it beyond 5.5 EH/s in mining capacity. This will be reinvested into “growth initiatives and/or corporate purposes.”

The self-mining fleet is expected to generate greater revenue than a third-party hosting alternative, whereby external buyers rent Argo’s mining machines for profit-sharing purposes.

“We would like to thank Bitmain for their ongoing support and partnership, particularly during a challenging period for both the industry and markets more generally,” said Daniel Roberts, Iris Energy’s Co-Founder & Co-CEO.

According to analysis from Glassnode, Bitcoin’s return above $20,000 in January brought the average Bitcoin miner back into a position of profit, despite the related costs of running a mining machine.