Proposal 131 has passed with quorum. ✅

Proposal 131 pauses supply for cZRX, cBAT, cMKR, and cYFI on Compound v2.

The proposal will be applied in two days. https://t.co/WHPJVt5zyQ

— Compound Governance (@compgovernance) October 24, 2022

$66,845.00

1.07%$1,933.62

0.23%$1.40

-0.18%$603.64

0.31%$0.999999

0.00%$82.61

2.83%$0.284725

1.78%$0.096811

-0.50%$1.029

-0.29%$543.81

-0.02%$50.09

0.29%$0.272294

0.43%$1.00

0.02%$8.71

0.67%$28.92

2.50%$0.999099

0.01%$330.74

0.59%$8.52

0.63%$0.157927

-1.27%$0.158496

0.08%$0.999215

-0.03%$0.00951127

-0.86%$255.35

-1.11%$0.09759

1.22%$53.13

1.79%$0.999828

-0.05%$8.98

2.67%$0.00000623

0.89%$0.926537

2.47%$1.33

-3.47%$0.077558

0.67%$0.116211

-0.09%$5,008.99

0.74%$1.34

-0.90%$5,038.85

0.89%$1.28

0.15%$3.35

0.56%$0.616455

0.04%$1.00

0.00%$120.37

-0.47%$0.997057

0.03%$0.00000409

-2.70%$0.694876

0.34%$174.63

-1.34%$78.09

0.94%$2.33

0.97%$0.999873

-0.01%$1.12

0.00%$0.0000017

0.32%$0.171495

-5.46%$1.00

0.02%$0.062151

-0.84%$0.998867

0.00%$1.014

1.42%$8.26

0.06%$0.258568

0.16%$11.00

0.01%$0.00206878

3.56%$2.13

-2.62%$2.34

1.20%$7.08

-0.12%$0.104536

-0.41%$8.33

0.73%$0.376189

1.39%$0.060301

0.82%$0.01823914

-0.70%$65.50

-0.13%$0.107324

-3.17%$0.869877

3.27%$0.999301

-0.01%$3.55

4.57%$1.49

7.97%$0.02983384

-0.73%$0.088594

-0.70%$1.23

0.12%$0.00925017

0.74%$1.43

3.65%$0.999634

0.01%$1.027

0.02%$114.35

0.01%$1.12

0.68%$0.03499057

-1.75%$0.903845

-0.60%$0.85278

-0.59%$0.00762555

-0.85%$0.080235

0.13%$0.998402

0.52%$1.095

0.02%$0.03023114

2.33%$0.0933

-8.64%$0.0000061

-0.11%$0.999744

-0.01%$0.01289798

-0.33%$0.152221

-0.69%$0.997781

-0.01%$0.495281

0.24%$0.27048

17.60%$0.999945

0.02%$1.087

-0.22%$0.069637

-1.92%$1.18

0.05%$0.249295

1.05%$33.12

-3.57%$0.00661767

0.52%$1.25

-1.21%$0.383072

1.56%$0.621967

3.11%$23.55

6.48%$0.998898

0.04%$161.09

0.74%$1.084

1.80%$0.04241216

1.79%$0.161772

0.72%$0.03550922

-7.17%$1.44

-3.26%$0.081617

0.27%$0.238322

0.38%$0.999719

0.01%$0.452056

-0.99%$0.00000034

-0.85%$0.00000034

0.10%$0.01697297

-0.53%$3.26

0.67%$0.055147

1.03%$15.87

-1.27%$1.02

0.03%$116.77

2.51%$1.49

6.19%$3.12

1.34%$0.165003

1.79%$0.052053

-0.20%$0.316426

-2.87%$0.067956

1.03%$0.997614

0.14%$0.00002958

-0.64%$0.308074

-1.68%$0.02615833

-0.50%$0.00566111

0.55%$0.316292

-0.56%$0.990993

0.14%$0.319574

-0.04%$17.15

-0.28%$0.125527

-11.51%$0.00276572

3.91%$1.41

-5.32%$0.050548

-0.09%$1.60

3.76%$0.221936

-2.18%$0.072482

3.17%$0.01964523

-0.41%$0.00251277

-1.02%$6.43

1.07%$0.04459547

-0.33%$0.99881

-0.09%$5,906.22

-1.92%$1.16

39.79%$0.02031087

0.46%$1.075

0.01%$1.00

0.00%$0.081482

1.31%$0.988238

0.47%$0.999828

-0.04%$1.27

3.46%$0.214356

-1.30%$0.508264

-1.52%$22.86

0.00%$4.68

24.91%$0.00000096

0.61%$0.0020516

2.08%$0.092533

3.43%$0.00003578

3.27%$1.17

0.70%$0.053031

-0.28%$0.192641

0.37%$0.188142

-1.81%$2.68

0.58%$1.00

0.00%$1.52

3.90%$0.00505763

2.84%$0.079467

1.25%$0.09551

0.76%$1.00

0.00%$0.178038

-1.35%$0.00374776

-1.17%$1.93

-0.74%$0.11799

-1.68%$17.98

0.08%$0.999223

0.05%$2.17

1.91%$0.631872

2.78%$0.757105

-0.56%$0.02336587

11.36%$0.168147

-2.25%$1.80

-0.07%$15.23

1.12%$0.052737

1.27%$47.99

0.00%$2.06

-1.90%$0.218686

0.01%$0.04179392

-1.80%$0.995447

0.08%$1.27

-1.09%$0.00000778

0.72%$0.998908

0.07%$1.013

-0.12%$7.75

-7.80%$0.999353

-0.07%$0.332866

1.30%$1.00

4.18%$0.30871

-0.94%$0.656081

9.92%$0.139989

15.22%$1.78

-5.72%$0.392268

-0.47%$8.99

-0.08%$0.272337

3.55%$0.574666

28.14%$0.13468

12.00%$0.30689

8.19%$0.15826

1.03%$0.327611

-0.12%$4.47

1.72%$0.131246

-1.06%$1,097.37

0.14%$0.08026

0.58%$0.01590146

13.51%$0.079912

2.62%$0.09106

0.11%$0.072906

-1.32%$0.592874

4.01%$0.00150611

0.48%$0.257997

0.23%$1.92

1.99%$0.366512

16.81%$0.00411695

0.64%$0.994217

-0.08%$0.130792

0.06%$0.359401

-1.84%$0.995734

-0.53%$0.118427

1.11%$0.05946

-19.59%$0.00223191

0.17%$0.191079

0.02%$2.29

0.33%$0.01997754

9.63%$0.119349

4.82%$0.999938

0.01%$0.999583

0.03%

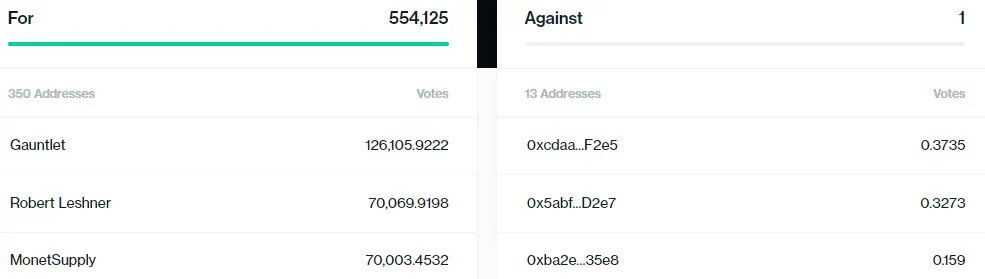

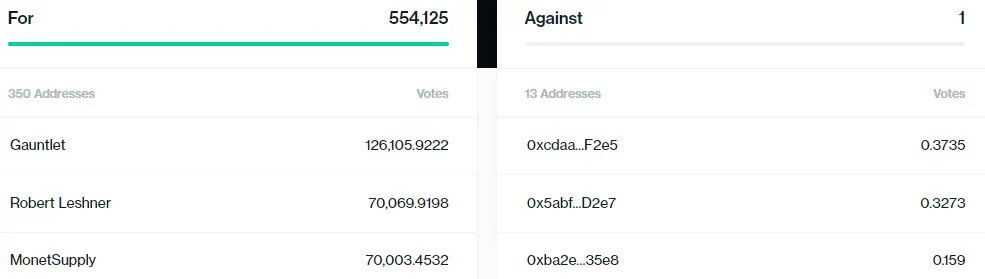

After two days of voting, the DAO powering Compound Finance has approved “proposal-131,” which will prevent users from being able to lend relatively illiquid assets on the protocol.

In this case, Illiquid assets are cryptocurrencies that cannot be readily sold or exchanged without a substantial loss in value.

Generally, these types of assets are volatile and can be easily manipulated.

This initiative to remove illiquid assets is also expected to protect the protocol against market manipulation like the $100 million exploit on Mango Markets, claims the proposal.

Nearly 99.9% of all voters supported the proposal, with 554,126 Compound (COMP) tokens used in the voting process.

Robert Leshner, the founder of Compound Finance, also voted in favor of the proposal.

Four tokens, namely 0x (ZRX), Basic Attention Token (BAT), Maker (MKR), and Yearn Finance (YFI), are to be paused temporarily from Compound finance.

According to the proposal, these tokens have less liquidity in open markets and are vulnerable to price manipulation that could exploit the protocol.

Proposal 131 has passed with quorum. ✅

Proposal 131 pauses supply for cZRX, cBAT, cMKR, and cYFI on Compound v2.

The proposal will be applied in two days. https://t.co/WHPJVt5zyQ

— Compound Governance (@compgovernance) October 24, 2022

Since September 2, Compound’s governance has scrutinized the manipulation risk involved with less-liquid assets.

On October 11, Mango Markets, a Solana-based trading platform was exploited for nearly $117 million. The exploiter used a combination of efforts to drive the price of MNGO (Mango Market’s native Token) higher.

Later, using the over-valued MNGO, the exploiter took out a $117 million loan, wiping Mango’s treasury.

The exploiter then drained the assets, which included Solana, USDC, USDT, BTC, and MNGO.

Shortly after the exploit, the MNGO price hit rock bottom before the exploiter staged an artificial pump.

The exploit was made possible because of the illiquid nature of the MNGO token.