DAI never says die.

Some have called DAI's over-collateralized design capital-inefficient, but one of MakerDAO’s protocol engineers says that’s why DAI has become the largest, longest-running decentralized stablecoin on the market.

“From first principles for the design of the entire system, we've gone for resilience and safety,” said Sam MacPherson at Messari’s Mainnet conference in New York last month.

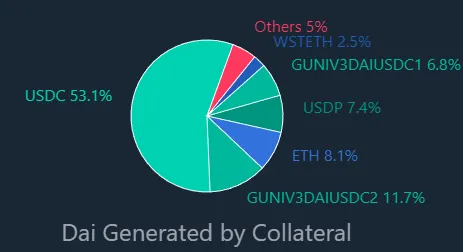

Launched in 2017, that over-collateralized design means that each $1 of DAI in circulation is backed by more than $1 in another cryptocurrency. The specific ratio can vary depending on which cryptocurrency you use to mint, with more volatile or less-established cryptocurrencies commanding a much higher ratio.

Having more collateral than there is DAI circulating keeps the system from falling apart should crypto markets swoon and dive (as they have been known to do lately).

This design is quite different from that of Tether’s USDT and Circle’s USDC.

“These are centrally collateralized off-chain,” said MacPherson, speaking of the two largest stablecoins by market cap. “People will give U.S. dollars to a custodian like Circle, and then they will mint USDC against that. This IOU can then be later redeemed for the U.S. dollars that they originally deposited.”

Those centralized stablecoins are also reportedly backed by more traditional financial instruments, like treasury bills and actual dollars, rather than assets like Ethereum (ETH) or Wrapped Bitcoin (WBTC).

Maker’s design also differs dramatically from the smoldering stablecoin experiment that was Terra’s UST.

In May, UST, which at the time enjoyed a market cap of $18.6 billion and the title of the fourth-largest stablecoin on the market, imploded, wiping out investors globally.

Unlike Tether and Maker’s DAI, UST was an "algorithmic stablecoin," backed by a unique burn-and-mint mechanism tied to Terra’s governance token LUNA. To mint 1 UST, users first needed to buy LUNA and then swap $1 worth of the token, effectively “burning” it and removing it from circulation.

They could move in the opposite direction, too, burning 1 UST for $1 worth of LUNA.

This mechanism gave speculators an arbitrage opportunity. Each time UST dropped below $1, for example, users could buy the discounted stablecoin for, say, $0.98, swap it for $1 of LUNA (as per the protocol’s design) and then sell that $1 to pocket the $0.02. Obviously, it's only pennies, but large holders could turn a pretty profit leveraging this mechanism at scale.

The bottom fell out when many of those same large holders began exiting the ecosystem amid Bitcoin’s simultaneous slide. Just as the No. 1 cryptocurrency fell from $39,700 to roughly $28,900 in the span of three harrowing days, UST’s market cap collapsed to just over $1 billion.

Today, UST trades at $0.03 and has a market capitalization of a little over $304 million.

Besides wrecking investors, Terra’s destruction has also brought renewed scrutiny to the entire crypto space—and in some mainstream circles it has made the concept of a "stablecoin" a punch line. ("Not very stable," as the obvious joke goes.)

Two paths for MakerDAO

Rune Christensen, the founder of MakerDAO, recently penned a massive proposal that laid out two paths forward for the project. It could either become the next fully-regulated neobank or go full goblin mode and be “treated as something else.”

The post garnered traction throughout the industry, specifically for its implications for DAI. Still, Macpherson explained that the future of Maker isn’t quite so simple.

“I don't think it's quite so extreme that we need to become a regulated bank,” he said. “There is this middle ground that DAI has always maintained, where you get the best of all worlds where we are actively investing into real-world assets that are regulated companies.”

Alongside various decentralized cryptocurrencies, a portion of DAI is also backed by assets like freight forwarding invoices and trade receivables from real companies in the meat space. Recently, Maker partnered with Huntington Valley Bank, offering the bank a $100 million loan, effectively becoming a “wholesale credit line,” said MacPherson.

This kind of collateral is called a real-world asset (RWA).

The engineer’s middle ground would thus continue to onboard more businesses into crypto while maintaining the permissionless, decentralized protocol “at its core.”

And amid a broader regulatory crackdown, he hopes to see regulation that prevents events like the Terra, rather than swiping with “a giant axe that harms a lot of well-intentioned projects in the space.”

It remains to be seen whether regulators will share MacPherson’s faith in the project.