The race to make Ethereum faster is heating up.

With Polygon rolling out new zero-knowledge technologies, StarkWare announcing a token airdrop, and NFT marketplace OpenSea integrating Optimism, there are plenty of contenders to scale the top crypto network for DeFi and NFTs.

“Ultimately, it's a large space, and it's a large pie,” CEO and co-founder of the layer-2 network Arbitrum Stephen Goldfeder told Decrypt at Mainnet. “There are a lot of different opportunities for different teams to experiment, basically, with different scaling technologies and different trade-offs.”

Arbitrum is one of many so-called rollup solutions which effectively move Ethereum operations off-chain to reduce congestion on the network’s mainnet. Once the activity is concluded, it's then compressed into a single transaction on the blockchain.

Of these trade-offs, though, Goldfeder says there are three “critical” points that teams need to consider: Scalability, security, and compatibility. These scaling solutions need to be fast, reliable, and interoperable with the wider world of crypto.

But doing all three at once is the tricky bit.

“If you want it to scale the EVM [Ethereum Virtual Machine] by sacrificing security, we know how to do that. Everyone knows how to do that,” he said. “Just turn it up and make it very, very difficult to run a node but increase the capacity.”

What Goldfeder means is that as you turn up throughput, the hardware requirements for individual nodes also increase. As this rises, so too do the costs of operating and maintaining the node, nudging out individual crypto enthusiasts, and making the only eligible entities larger firms.

Essentially, this route would recreate the large, centralizing aspects of Google-sized data farms.

Not only does this limit a network’s ability to decentralize, but it can be a security issue as there are fewer nodes monitoring a network for any malicious behavior.

Goldfeder and his team aren’t newcomers to security issues either. Just last week, a white hat hacker discovered a bug in Arbitrum that could have led to the theft of over $530 million.

“We're extremely grateful for the white hat, and users can rest assured that it's been well mitigated and was not exploited. And all funds on the system are currently not vulnerable,” he told Decrypt.

Arbitrum’s adoption and compatibility

And as for the final point, Goldfeder argues compatibility, not just between different projects, but also among developer teams, is crucial for growth.

“If you're a developer, and you've written code in Ethereum, your code will work out of the box on Arbitrum,” he said. “That's why we have such broad adoption because it's so easy for these developers to launch.”

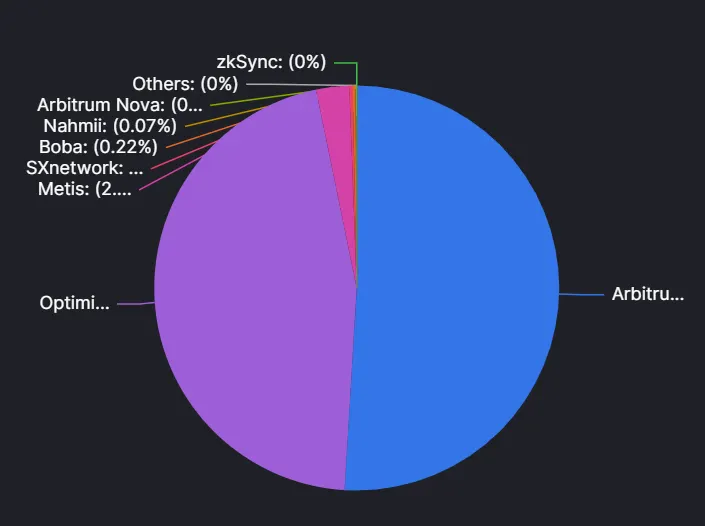

Currently, Arbitrum is leading adoption among other rollup solutions, boasting integrations with over 120 different protocols, according to metrics site DeFi Llama.

The protocol adoption has also been matched by market share; Arbitrum currently commands more than $977 million in total value locked, a metric that approximates the amount of funds flowing through protocols or applications on a given network.

The runner-up isn’t far behind, though, with Optimism hosting over $878 million in total value locked across 74 protocols.

In such early days, this gap could quickly close too. Perhaps that’s why Goldfeder says the Arbitrum team is cooking up some “really good initiatives” to be announced “very, very soon.”