What’s moving the metaverse?

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$68,290.00

3.56%$2,059.92

7.45%$1.43

3.09%$628.68

5.16%$0.999898

-0.00%$88.52

7.92%$0.285856

0.26%$0.100776

7.24%$1.031

-0.25%$0.296815

11.00%$50.99

3.62%$0.999878

-0.01%$495.73

-0.89%$8.79

1.01%$28.20

2.19%$9.22

7.66%$0.17114

6.01%$346.02

4.27%$1.00

0.07%$0.162869

5.87%$1.00

-0.01%$0.00957825

0.88%$0.101241

3.58%$56.62

7.67%$0.999996

-0.09%$248.65

-0.16%$9.53

10.60%$0.96123

7.36%$0.00000621

2.39%$0.078502

4.15%$0.116062

0.79%$1.28

-2.85%$1.67

29.69%$5,164.47

-0.05%$4.00

13.89%$5,201.28

0.02%$1.34

-5.86%$0.620858

3.54%$1.00

0.00%$1.12

0.00%$119.19

0.67%$0.997065

-0.05%$181.94

5.37%$0.702423

-0.79%$0.0000041

0.40%$77.85

2.89%$1.00

0.01%$0.069721

4.33%$2.26

1.58%$0.999985

0.00%$0.168099

1.59%$1.17

17.09%$0.00000164

-0.72%$9.16

7.35%$0.274401

7.22%$2.42

9.96%$0.999265

-0.05%$0.113195

-1.96%$0.410867

5.46%$11.00

0.01%$8.71

2.27%$7.10

3.20%$0.00189758

7.10%$0.05998

4.41%$1.96

-6.03%$0.01764511

9.41%$64.35

0.35%$0.108978

7.57%$0.867887

3.36%$0.0312121

5.75%$1.00

0.04%$0.00970831

3.90%$3.50

1.29%$0.09063

5.58%$1.03

13.60%$1.48

6.92%$1.24

0.30%$0.977135

13.72%$1.00

0.01%$114.41

0.01%$0.74747

-9.17%$1.027

0.00%$1.11

0.19%$0.03438688

2.91%$0.00776072

6.64%$1.84

2.70%$0.08052

0.43%$0.03232455

12.59%$0.09916

4.57%$1.096

0.01%$0.00000645

8.51%$0.161858

8.64%$0.996756

-0.03%$1.00

0.01%$0.288582

7.56%$0.01295892

-0.04%$28.71

3.01%$0.999354

0.00%$0.264218

7.74%$0.071355

5.11%$1.088

-0.07%$1.18

0.40%$0.999765

0.00%$0.00720191

7.93%$0.689145

5.94%$35.16

4.93%$1.32

6.92%$0.397183

5.80%$0.04564784

-0.69%$167.81

1.16%$0.525537

3.27%$1.00

0.01%$0.166921

6.58%$0.253123

8.43%$0.085054

5.43%$1.053

0.89%$1.47

0.40%$0.03498903

1.93%$0.99974

0.00%$129.67

5.14%$0.368674

7.58%$0.057849

6.59%$1.019

-0.12%$0.00000034

1.97%$0.00000033

0.25%$16.34

1.25%$3.24

1.04%$0.01641035

-0.61%$3.21

1.39%$0.053929

3.38%$1.53

-1.74%$0.346617

11.17%$0.070672

5.00%$0.02754363

4.42%$0.316678

5.35%$0.0000303

5.31%$1.00

0.26%$0.00587374

2.48%$0.326288

5.60%$0.239259

9.72%$17.54

-0.69%$0.982901

-0.92%$0.051651

4.19%$1.43

-2.23%$0.124811

3.32%$0.075511

5.32%$0.356906

7.06%$1.60

-2.28%$0.00272024

5.03%$6.62

6.65%$0.00247911

-0.27%$0.133442

-8.01%$0.04445388

4.55%$0.02191312

6.64%$0.08762

9.01%$1.37

7.06%$0.998088

-0.13%$0.101527

13.25%$1.79

5.94%$1.00

-0.00%$0.985665

-0.29%$0.216879

8.02%$0.999817

0.02%$1.075

0.01%$1.29

4.56%$0.00218151

2.45%$0.507299

-0.80%$22.79

0.00%$0.00000097

2.05%$0.097948

-1.72%$0.199229

8.26%$5,258.87

-6.87%$0.00003628

2.32%$2.80

5.24%$0.925605

32.52%$0.099939

8.32%$0.196328

-0.87%$0.05355

1.93%$1.00

0.00%$0.080095

-1.09%$0.187273

3.06%$0.00500326

3.92%$0.02002551

-0.56%$0.819684

4.32%$0.122705

1.72%$9.35

6.43%$0.00385438

8.32%$1.00

0.00%$18.54

2.41%$1.92

6.54%$3.97

6.11%$0.055063

5.52%$0.99927

-0.01%$0.634651

5.34%$2.10

1.99%$2.14

6.05%$0.167483

5.99%$1.81

0.82%$0.02277979

-3.10%$0.02008466

0.53%$3.51

2.47%$48.00

0.01%$0.04238865

5.28%$0.00000799

3.82%$1.26

1.01%$0.953657

-4.23%$0.149816

0.06%$0.995879

-0.47%$0.998517

0.03%$0.330494

6.62%$0.173746

5.60%$0.413105

3.15%$1.012

-0.21%$0.666049

0.60%$0.303422

-0.89%$0.096405

7.34%$0.083177

3.66%$4.59

4.95%$0.133384

4.80%$0.6175

2.66%$0.262905

2.99%$0.131455

3.85%$0.02311657

-7.95%$1,096.52

-0.10%$0.080155

6.15%$0.292923

2.86%$0.073834

-1.71%$0.00150528

3.09%$0.313017

-2.55%$0.366711

-2.02%$0.254602

0.00%$11.45

-0.56%$0.00404443

1.52%$0.130186

-0.67%$0.995602

0.02%$0.219761

0.24%$1.001

0.00%$2.40

5.92%$0.197407

-0.24%$0.344646

4.56%$0.559573

8.92%$1.47

1.74%$1.75

-8.73%$0.999893

-0.01%$1.062

-0.08%$0.999813

-0.00%$11.67

5.28%$0.999947

0.96%

Gaming and NFT-related cryptocurrencies, including Flow (FLOW), Stepn (GMT), Axie Infinity (AXS), Decentraland (MANA), and Gala (GALA), have posted severe losses over the past week.

FLOW, the token powering all things on the layer-1 blockchain flow, has dropped more than 23% in the last week, as per data from CoinMarketCap. FLOW has been bullish since Instagram’s integration earlier this month.

After a week of bearish action, FLOW is now trading at $2.09, up .02% over the past 24 hours. Despite today’s modest recovery, FLOW is still down 95.50% from its all-time high of $46.16 in April 2021, as per data from CoinMarketCap.

Interestingly, FLOW-based NFT trade volumes increased by 52.64% over the past week, suggests data from CryptoSlam.

Meanwhile, the token price of the Solana-based “move-to-earn” game STEPN governance token has fallen 31% over the past week, making it the worst performer among NFT-related tokens, indicating data from CoinMarketCap.

Despite STEPN’s partnership with the soccer club Athletico de Madrid last week, GMT ended deep in the red.

Today, GMT is up by a meager 0.3% and trades at around $0.76, as per data from CoinMarketCap.

Over 454.11K in GMT trades have been liquidated over the past 24 hours, suggests data from Coinglass. Of those liquidations, 86.46% were long positions.

Not just GMT and FLOW, other widespread metaverse and NFT-related tokens also posted severe losses last week.

Axie Infinity’s AXS governance token fell nearly 22% last week, Ethereum metaverse game Decentraland’s MANA token also lost 20%, and play-to-earn platform Gala’s GALA token has dropped more than 22% over the past week.

The primary reason behind last week’s bearish price action across the market can likely be blamed on further calls for further rate hikes in September.

As of this writing, nearly $134 million worth of positions has been liquidated over the past 24 hours as crypto prices continue to tank, as per data from Coinglass.

A closer look at overall NFT sales paints a bearish picture too. The overall volume has dropped by 15.71% over the past week, as reported by NFT data platform CryptoSlam.

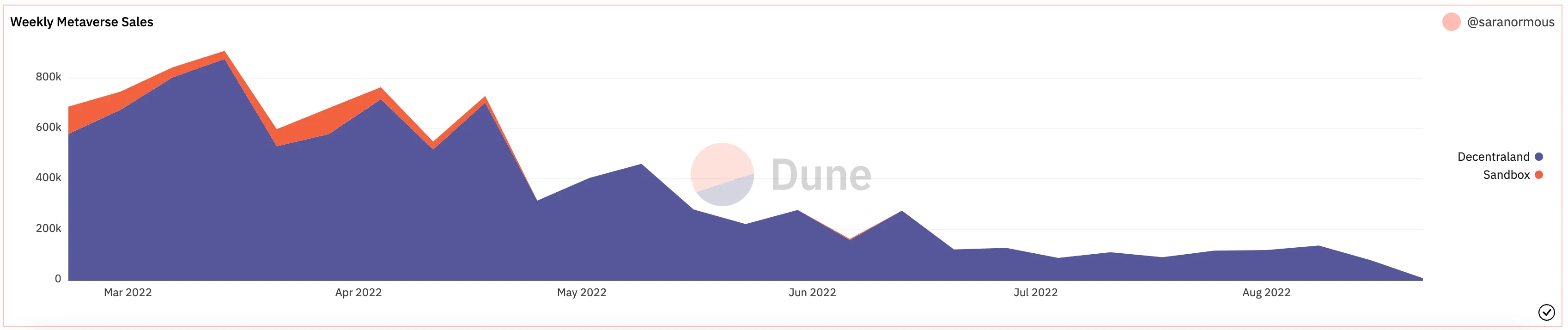

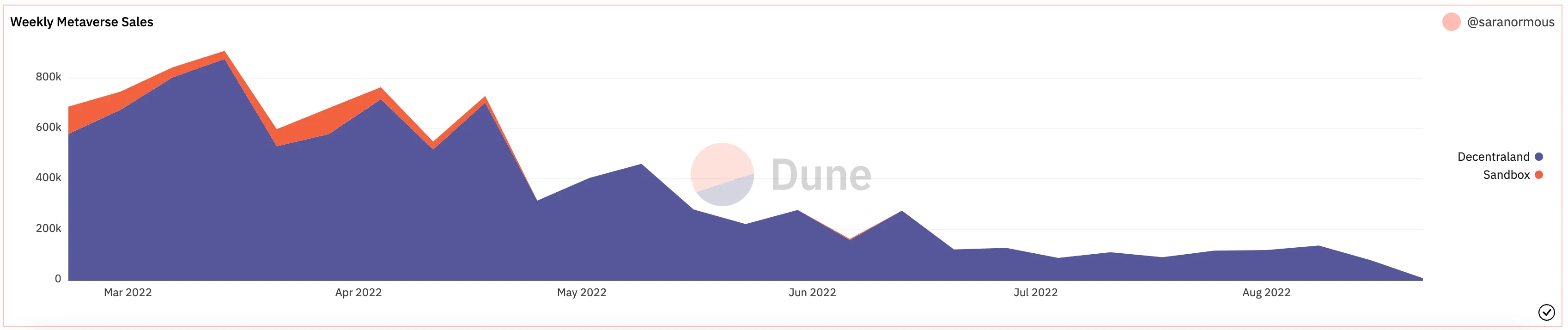

Weekly metaverse sales on Decentraland and Sandbox hit a new all-time low last week, too, as per data from Dune Analytics.

Decentraland sales were down nearly 90% from $78,897 just two weeks ago to $7,613 last week.

As for market leaders in Bitcoin and Ethereum, they too have lost significant value over the past week. Bitcoin dropped 10.5% over the past week, and Ethereum shed 14.3% over the same period.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.