Bitcoin pulls crypto market lower

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$117,552.00

1.96%$3,747.69

4.31%$3.15

2.87%$784.03

3.93%$185.99

5.01%$0.999898

0.01%$0.237315

5.67%$3,742.85

4.51%$0.317575

1.95%$0.825176

4.05%$117,642.00

2.15%$44.28

6.88%$4,518.66

4.07%$3.99

10.81%$0.440773

6.39%$18.36

5.58%$4,022.41

4.32%$0.269064

14.98%$554.79

7.32%$4,014.72

4.28%$24.07

4.80%$113.47

4.12%$3,748.01

4.47%$8.99

0.02%$0.00001407

6.94%$3.34

9.09%$0.999954

0.01%$1.001

-0.00%$0.999577

-0.17%$44.13

2.22%$10.52

7.70%$4.12

5.68%$117,660.00

2.03%$323.98

-2.78%$0.00001259

6.20%$4.58

2.30%$297.67

5.34%$0.133193

6.83%$1.19

0.02%$424.92

4.38%$0.587278

21.63%$2.87

9.57%$23.26

7.56%$0.443284

1.76%$1.046

6.29%$4.79

4.77%$5.64

5.37%$226.91

5.45%$48.21

1.52%$0.00003556

7.58%$0.04282283

17.52%$0.099298

4.12%$0.76549

3.36%$1.00

0.00%$0.269645

6.82%$0.44812

7.30%$3,745.29

4.06%$0.02585095

6.99%$1.001

0.04%$4.21

7.24%$4.70

3.61%$0.234477

4.43%$17.61

1.08%$1.16

5.92%$10.12

4.18%$0.093991

13.54%$4.53

0.84%$0.736749

3.35%$0.329414

6.25%$197.72

4.87%$1.97

16.66%$2.65

5.00%$121.63

4.07%$4,266.50

4.27%$117,641.00

2.31%$3,925.83

4.31%$0.554323

6.16%$1.06

0.03%$0.02353898

6.79%$5.08

2.21%$5.42

6.99%$11.69

-2.48%$0.999651

0.02%$1.033

6.05%$3,940.83

4.47%$1.95

8.66%$0.086835

5.03%$4,007.89

4.48%$14.15

7.99%$0.999415

0.06%$1.00

0.13%$4,047.92

4.39%$1.36

2.37%$1.31

1.58%$0.00013342

10.02%$0.807867

7.67%$0.726253

8.21%$3,940.70

4.27%$1.00

-0.01%$117,441.00

1.77%$209.45

4.99%$0.334686

5.16%$1.073

6.64%$0.567265

7.04%$0.105039

5.87%$783.34

3.60%$1.58

5.11%$30.80

12.93%$0.999192

-0.22%$1.098

5.59%$0.164062

3.86%$2.78

7.54%$3,736.63

4.17%$3,352.98

-0.43%$0.896932

6.49%$117,489.00

2.02%$244.23

5.44%$0.0026236

10.60%$0.180773

2.36%$0.350485

-0.28%$118,679.00

3.11%$1.11

0.02%$0.57571

3.85%$1.00

0.06%$0.884134

6.17%$0.01714255

4.67%$3,334.79

-0.75%$0.208238

6.20%$3.03

4.86%$3,746.32

4.21%$0.0176454

5.61%$4,003.58

4.34%$3,908.86

3.75%$0.905935

4.89%$0.305463

5.34%$0.129151

7.29%$4.49

7.54%$8.95

-16.26%$1.97

2.53%$111.94

0.02%$1.093

0.03%$0.99841

-0.06%$0.00000068

2.18%$117,806.00

2.59%$0.413869

5.20%$0.999693

-0.00%$0.396904

19.58%$40.60

4.81%$0.546672

-7.41%$3,746.30

4.43%$3.42

3.40%$0.461022

10.19%$1.94

5.17%$0.00877588

0.64%$0.317343

4.83%$0.23728

5.88%$0.00000153

10.82%$3,976.53

4.26%$0.99752

-0.00%$29.06

2.56%$0.999918

0.01%$117,650.00

1.99%$0.562921

-1.76%$0.558749

4.26%$0.056542

8.35%$116,802.00

1.25%$0.00606786

4.76%$3,748.00

4.30%$4,130.83

4.22%$0.0156407

3.79%$1.00

0.01%$0.074515

-0.62%$0.657158

3.89%$1.49

5.74%$0.00883244

8.05%$44.33

7.30%$7.70

8.76%$1.19

10.64%$1.00

0.15%$4,020.69

3.57%$0.410527

2.62%$0.636847

5.82%$1.054

11.96%$0.132755

7.10%$16.39

5.13%$6.59

4.43%$0.185353

9.96%$1.16

0.03%$0.00000047

0.56%$49.04

5.14%$4,534.24

4.37%$5.59

16.78%$0.00002276

5.44%$3,732.12

4.13%$0.40178

3.27%$0.00847363

11.01%$2.60

6.11%$3,746.58

4.23%$1.35

7.78%$7.46

3.21%$10.76

0.01%$0.415084

-6.05%$0.04249641

5.59%$1.094

0.00%$0.056211

6.21%$44.07

6.68%$0.997061

-0.36%$0.999927

0.01%$13.64

2.12%$0.190767

-4.57%$0.084404

5.42%$1.00

0.01%$1.003

0.32%$0.279179

4.11%$204.21

5.44%$0.575259

3.10%$145.78

4.50%$24.09

4.78%$29.29

4.70%$0.01961421

5.96%$1.37

3.63%$0.143523

2.69%$0.38199

8.91%$0.921496

23.60%$0.369905

25.84%$0.560104

3.40%$0.03705978

0.91%$0.03428529

6.87%$22.25

1.38%$0.00363574

3.29%$0.00526419

8.55%$0.80296

5.63%$0.00000086

13.46%$0.00006346

4.81%$117,165.00

1.35%$117,499.00

1.97%$0.748289

0.83%$0.234418

4.42%$0.0039392

0.96%$1.39

6.21%$0.80435

3.62%$0.00375146

14.08%$0.999851

0.01%$0.00389258

3.34%$3,926.73

4.09%$4,214.76

3.89%$0.998804

-0.13%$0.997974

0.01%Reading

Bitcoin has once again slumped below the psychological mark of $20,000 on Wednesday morning, a level last seen on June 22.

At the time of writing, the leading cryptocurrency is trading at $19,998, down 5.27% over the past 24 hours, according to data provided by CoinMarketCap.

The rest of the market is firmly in the red too.

Ethereum, the industry’s second-largest cryptocurrency, fell 7.45% in the day and is currently priced at around $1,128.

Other top cryptocurrencies have also fallen. Solana (SOL) is down by 9.8%, trading at $35.16, Avalanche (AVAX) fell 6.82% to $18.21, Binance Coin (BNB) fell 8.39% to $219.62.

The latest price action, which also saw the cumulative market capitalization of all cryptocurrencies plummet below $900 billion, can be seen as yet another sign of investor uncertainty and the increasing pressure on the industry’s major players.

According to the latest CoinShares report, outflows for Bitcoin-specific funds totaled $453 million, essentially wiping off all the inflows made over the past six months. In other words, investors feel less comfortable about risky assets and are rotating out of cryptocurrencies.

The deteriorating sentiment among investors was further evidenced on Tuesday, as Canada-based investment firm Cypherpunk Holdings sold 100% of its Bitcoin and Ethereum holdings.

Per the company’s announcement, Cypherpunk sold 205.8 Ethereum for $227,600 and 214.7 Bitcoin for $4.7 million. The firm said it accrued a total of $5 million in proceeds from the sale of the two largest cryptocurrencies while maintaining cash and stablecoins on hand.

“We continue to see systemic risks propagating throughout the crypto ecosystem and, in our assessment of the risk-reward and opportunity costs involved in holding asset tokens, we believe that the most prudent approach is to sit on the sidelines as we wait for the volatility and illiquidity contagion to come to its logical conclusion,” Jeff Gao, Cypherpunk President and CEO, said.

The market downturn is also forcing more companies to assess their cost management practices, with leading European crypto broker Bitpanda joining the growing list of firms to announce staff layoffs.

The Vienna-based company, which last August was valued at $4.1 billion, decided to slash its headcount from 1,000 employees to 730, citing changing market sentiment, geopolitical tensions, rising inflation, and concerns of a looming recession among the reasons for the layoffs.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Public Keys is a weekly roundup from Decrypt that tracks the key publicly traded crypto companies. ETHA hits warp speed BlackRock’s iShares Ethereum Trust, which trades under the ETHA ticker, just became the third-fastest ETF to reach $10 billion. It reached the milestone in 251 days. And was beat by BlackRock’s iShares Bitcoin Trust and Fidelity’s Wise Origin Bitcoin Fund—which did it in 34 days and 53 days, respectively. There was much hand wringing and head scratching on Wall Street when the...

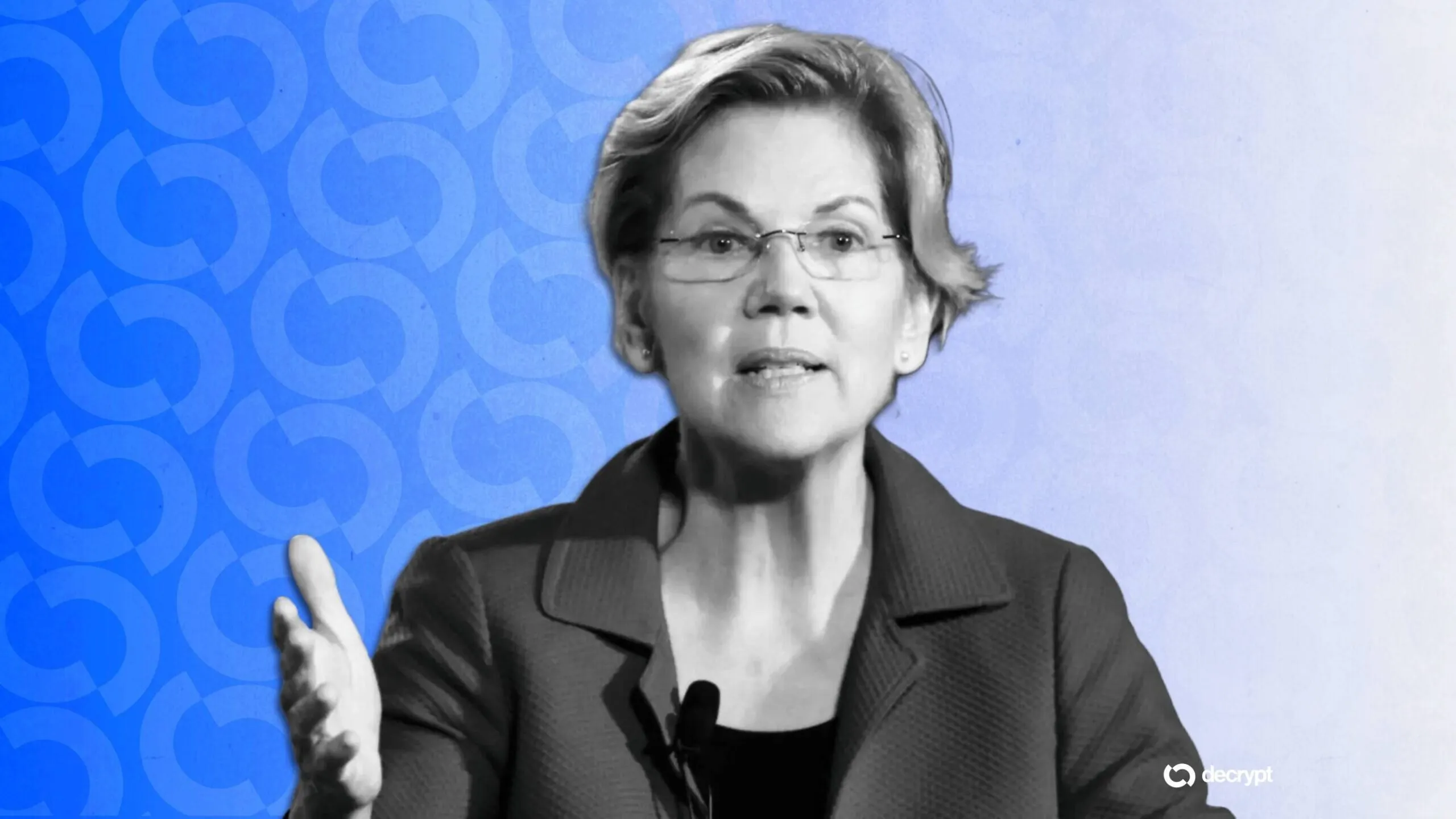

Sen. Elizabeth Warren (D-MA) has slammed the recently passed GENIUS Act, saying the American people will “pay the price” for the groundbreaking crypto legislation. The act, which was signed into law by President Donald Trump earlier this month, provides legal clarity for stablecoins. It establishes a framework for issuing and trading stablecoins, which has prompted increased interest in them from banks and major retailers. In an interview with Vanity Fair, Warren acknowledged the U.S. needs “str...

Analysts warned that large scale Bitcoin holders moved billions in Bitcoin to exchanges early Friday morning. Popular CryptoQuant analyst Maartunn said on X that crypto financial services firm Galaxy Digital shifted $3.7 billion worth of Bitcoin early this morning. He said of the 35,568 BTC that had been moved to exchanges in the past 10 hours, 26,100 worth of Bitcoin—including a portion moved by Galaxy—was moved by short-term holders and sold at a loss. Galaxy oversees asset management and cust...