Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$68,432.00

4.57%$2,073.71

8.61%$1.45

5.12%$629.27

4.82%$0.999887

0.00%$88.21

7.17%$0.286378

-0.04%$0.100282

7.46%$1.031

-0.24%$51.13

4.59%$0.295014

9.41%$500.99

1.64%$0.999652

-0.02%$8.79

1.27%$29.05

8.28%$0.174713

7.67%$9.29

8.61%$347.22

3.10%$0.999122

0.01%$0.164743

6.83%$0.999494

-0.00%$0.00959518

2.05%$0.103061

5.41%$56.27

6.61%$0.999758

-0.04%$246.40

2.66%$9.37

8.06%$0.966165

8.46%$0.00000617

2.75%$0.117488

2.72%$0.07852

4.01%$1.29

-0.45%$1.62

25.42%$5,159.76

-0.25%$4.06

14.59%$5,193.32

-0.28%$1.35

-5.51%$0.657947

9.57%$1.00

0.00%$189.56

7.67%$1.12

-0.00%$0.72013

2.95%$115.56

-2.13%$0.997182

-0.02%$0.00000406

1.41%$79.29

5.08%$1.00

0.04%$0.070046

5.47%$0.169206

2.39%$0.999686

-0.02%$2.23

0.59%$0.00000163

-1.56%$1.14

12.85%$9.04

6.72%$0.275413

7.36%$2.42

10.74%$0.999231

-0.02%$0.412001

2.37%$0.111105

-3.01%$11.00

0.01%$8.69

1.74%$7.17

3.98%$0.00185185

5.11%$0.060074

4.82%$0.11757

15.75%$1.93

-5.44%$64.84

-0.77%$0.01707639

1.09%$0.858539

3.13%$0.03198268

8.83%$0.837093

7.37%$1.00

0.06%$0.00979938

4.87%$3.55

3.49%$0.090797

5.58%$1.021

11.85%$1.48

5.22%$1.24

0.12%$1.00

0.04%$0.967999

12.86%$114.41

0.01%$1.027

0.00%$1.12

1.18%$0.03536847

6.07%$1.86

3.03%$0.00775222

6.46%$0.03447721

20.29%$0.080453

0.27%$0.101677

8.55%$1.096

0.01%$0.998026

0.31%$0.00000641

7.99%$0.160303

7.71%$0.999975

0.00%$0.292548

12.16%$30.20

8.03%$0.01287144

-0.58%$0.999179

0.04%$0.265632

6.46%$0.071388

5.08%$1.087

-0.06%$0.708831

-0.39%$0.999831

-0.00%$1.18

0.16%$0.00727744

7.82%$35.60

5.34%$1.33

4.91%$0.39644

5.60%$0.04694876

2.22%$166.30

-0.08%$0.522597

2.77%$1.00

0.02%$0.256299

6.76%$0.16654

6.28%$0.085446

6.31%$1.48

6.11%$1.041

1.23%$1.66

132.93%$0.380869

15.33%$0.03412048

0.48%$0.999773

0.01%$130.90

6.15%$0.467864

25.04%$1.02

0.04%$0.00000034

2.04%$0.057038

4.40%$0.00000033

0.23%$16.41

2.43%$3.24

1.56%$1.57

5.99%$3.21

0.08%$0.01626208

-1.69%$0.053596

2.50%$0.329339

10.02%$0.071014

4.78%$0.34376

9.15%$0.00603838

4.23%$0.02740744

3.55%$0.998225

0.31%$0.00003016

4.75%$0.07933

5.91%$0.324307

6.09%$0.238025

4.48%$17.53

2.08%$0.983866

-0.58%$0.051596

3.33%$1.43

3.36%$0.124797

6.04%$1.59

-1.35%$0.00269971

4.70%$0.13835

1.25%$6.47

5.09%$0.04507374

7.94%$0.00246243

-0.87%$0.02231497

10.49%$0.086939

7.52%$0.999133

-0.00%$1.35

4.30%$1.82

5.13%$0.098896

11.93%$0.999997

0.00%$1.32

3.80%$0.985501

-0.29%$0.999882

0.02%$0.216402

9.64%$1.075

0.01%$0.0021798

3.36%$0.50216

-1.79%$22.79

0.00%$0.00000098

2.45%$0.0000367

3.44%$10.21

9.65%$0.09819

-1.16%$0.884217

14.94%$5,248.17

0.18%$0.198137

7.87%$2.81

5.72%$0.053927

2.11%$0.196549

-2.04%$0.098849

7.15%$1.00

0.00%$0.189416

4.78%$0.080611

3.65%$4.25

7.67%$0.02014783

1.01%$0.00493372

2.66%$0.0038204

7.84%$18.67

3.17%$1.00

0.00%$0.117015

-2.76%$1.90

3.95%$1.00

0.04%$0.055198

6.76%$0.171712

10.05%$2.15

6.23%$0.629185

4.01%$0.02335104

-2.35%$0.02052508

1.69%$3.60

4.48%$1.80

0.50%$2.02

-2.51%$48.00

0.02%$0.04238754

6.25%$0.00000795

4.25%$0.994811

-0.08%$1.26

-0.06%$0.999427

0.16%$0.33305

6.07%$0.149158

-0.37%$0.998187

-0.00%$0.172905

4.55%$0.414618

3.84%$1.012

-0.18%$0.303202

-0.09%$0.656149

1.06%$0.137298

9.70%$0.096399

6.27%$4.59

3.92%$0.625573

1.22%$0.082631

2.31%$0.132458

3.38%$0.264965

3.23%$1,096.51

-0.11%$0.07435

-1.96%$0.080205

6.29%$0.22887

3.88%$0.372399

2.80%$0.290216

-0.96%$11.59

0.02%$0.312585

-2.31%$0.00149876

2.70%$0.02200367

-4.29%$0.252497

0.34%$0.00406936

3.01%$0.130659

-0.09%$0.204823

5.37%$12.58

7.64%$1.001

0.00%$2.38

2.23%$0.04640148

12.73%$1.47

2.13%$0.995744

0.05%$0.336057

1.96%$1.73

-10.06%$1.00

0.01%$1.063

0.13%$0.999622

0.00%$0.0295777

1.99%

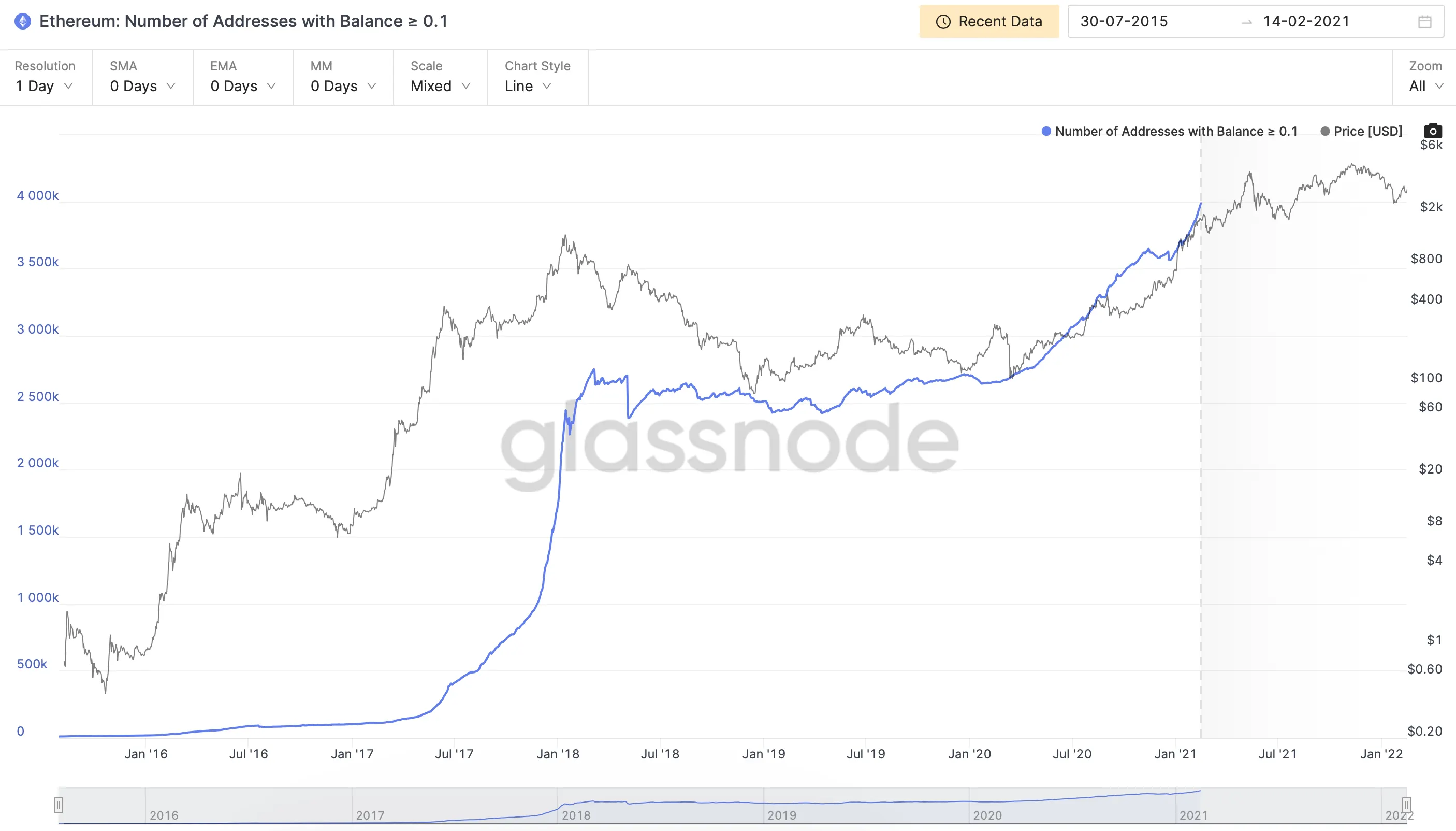

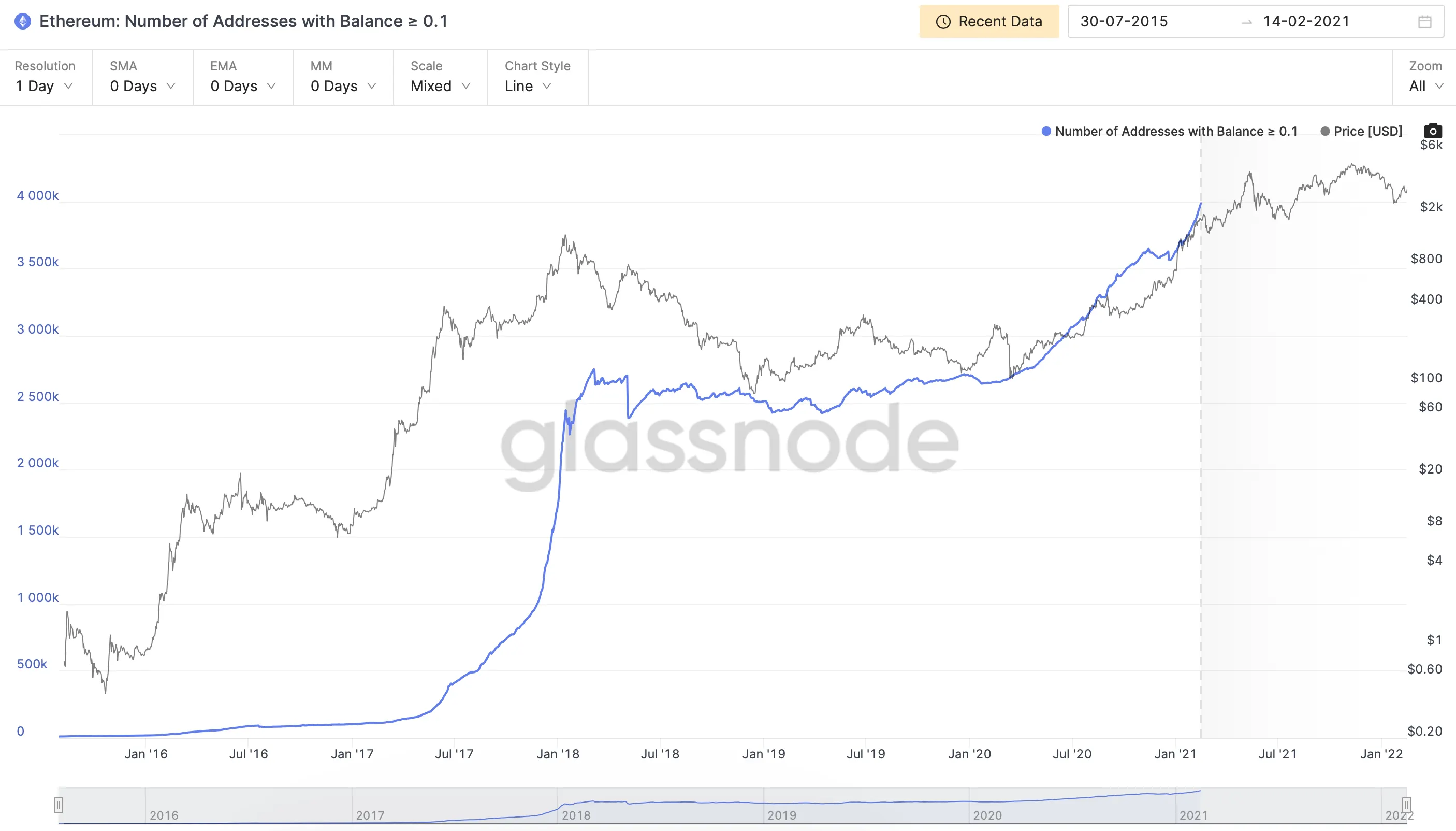

According to Glassnode data, the number of addresses holding at least 0.1 Ethereum (ETH) has hit an all-time high. The holdings are still small, but it's a metric of adoption that has already made waves among Bitcoin holders.

According to a previous report on Bitcoin holders from the data provider, those holding less than 1 BTC are considered “shrimps” in the crypto food chain.

The report includes crabs (0-1 BTC), octopuses (10-50 BTC), fish (50-100 BTC), dolphins (100-500 BTC), sharks (500-1,000 BTC), and the larger holders, whales (1,000-5,000 BTC) and humpbacks (more than 5,000 BTC).

It's unclear the exact underwater creature a mini-ETH holder would resemble, but this population of crypto enthusiasts is nonetheless growing faster than giant kelp.

At the time of writing, the number of addresses with at least 0.1 ETH has hit 3,978,224. By today’s prices, 0.1 ETH is worth approximately $310.

As the graph shows, the total number of Ethereum addresses holding at least 0.1 ETH has been steadily increasing for some time.

At the start of last year, 3,638,204 addresses held 0.1 ETH, indicating the total number of addresses holding 0.1 ETH has increased by almost 10% in just over a year.

Going back two years to date, the number of ETH addresses holding 0.1 ETH was at 2,654,853, meaning this metric has increased by an eye-popping 50% in the last two years.

During this time, Ethereum’s price has also increased by 1,061% from $267 to $3,102.

With such an uptick in Ethereum holders, the data suggests that much of the latest accumulation was due in part by the asset’s meteoric rise since 2018.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.