Last week we dug into some interesting updates around O.G. DeFi protocol Maker.

There were many notable changes, including a new fixed-yield mechanism called “D3M” as well as adding staked Ethereum (stETH) as collateral to the protocol. The project’s native stablecoin, DAI, is also officially decentralized now that Ethereum is the number one asset backing the coin.

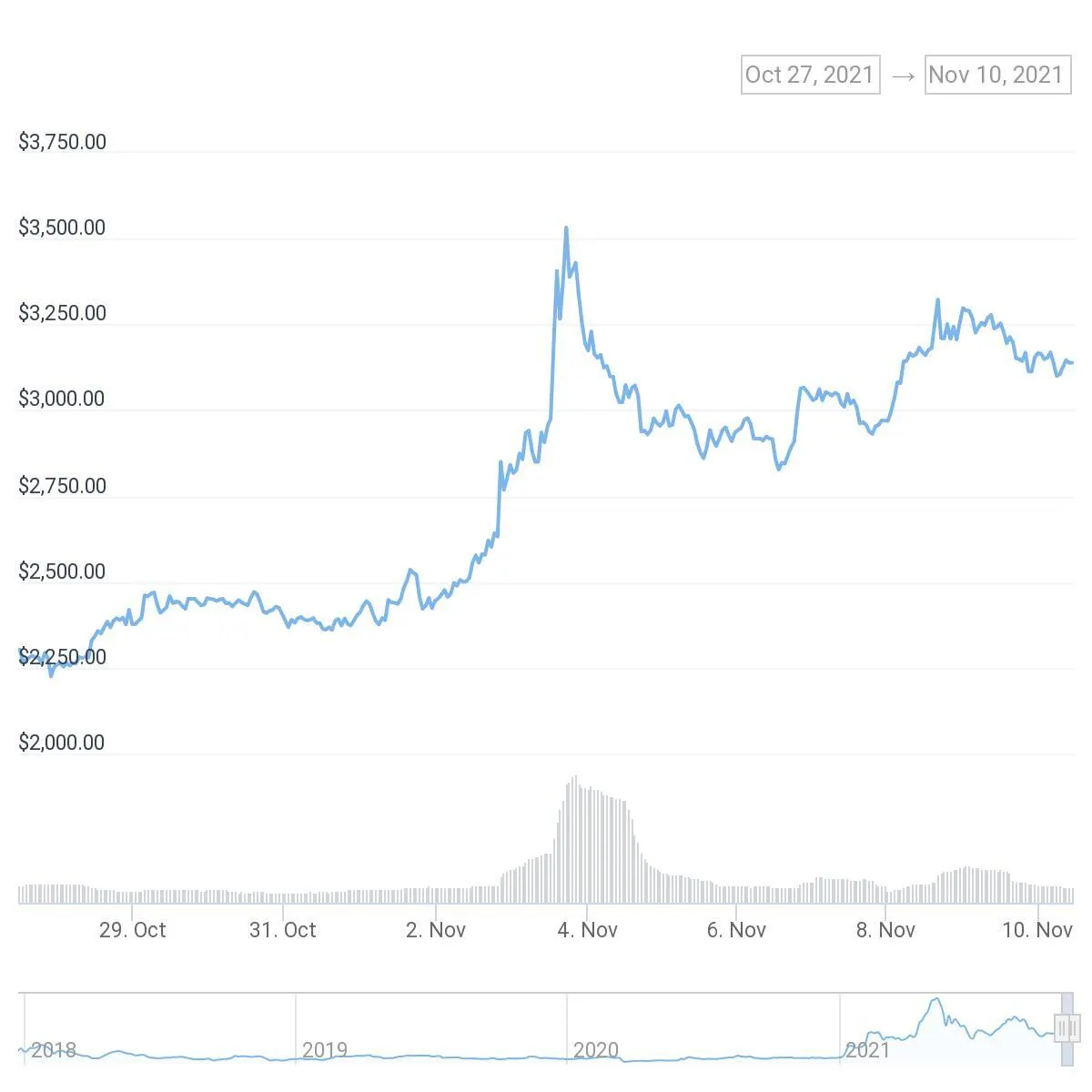

These updates were incredibly bullish for MKR, Maker’s governance token. Last Wednesday, the token enjoyed a nice mid-week boost to $3,532, before dropping back down to $2,855 at press time.

Relative to the rest of DeFi, Maker has been around a long-time. It’s faced various ups and downs, governance scandals, and its primary service as crypto’s de-facto decentralized central bank was put to the test during Black Thursday last year. But it has survived.

And since that fateful day in March 2020, DAI has absolutely boomed. The stablecoin’s market cap rose from just under $100 million on March 12, the day of the crash, to more than $8.5 billion today. With key updates like those outlined last week, expect this figure to continue rising.

But today’s dispatch isn’t about Maker. Instead it’s about another key DeFi protocol: Aave. And like Maker, the team isn’t resting on its laurels.

Originally called ETHLend in 2017, the industry’s most popular multi-asset lending and borrowing protocol has come a long way. Now, following a majority yay vote, Aave is rolling out v3.

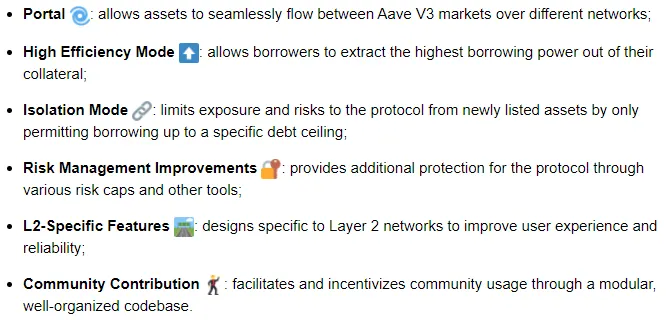

And, boy, it is packed with tons of brand new features.

Some of these features are pretty self-explanatory, while others far more technical and nuanced. Portal, however, is a game-changer for the protocol.

Here’s why.

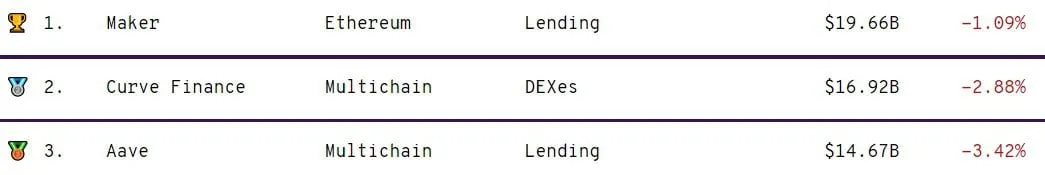

Heavyweight DeFi projects like Maker, Uniswap, and Aave all enjoy a serious edge in the market when it comes to brand recognition. They’ve been around for some time, are managing billions of dollars in assets, and have a visible team working on the project. Essentially, they’re battle-tested and have earned the market’s trust.

This type of trust is invaluable, especially in an industry that sees record-breaking hacks seemingly every week. With Portal, Aave is essentially bringing this powerful brand to any number of other blockchains.

Thus, any lending and borrowing protocol that already exists on, say, Solana or Avalanche will now go head-to-head with what the industry has essentially determined to be the standard.

Even at a glance, this seems pretty bullish for Aave.

For those of you in the back yelling that moving to a new chain opens the protocol to new risk, well, I’d say that Aave’s new risk management tools are a suitable retort.

This suite of tools gives the protocol (as well as its community) much more granularity as to how it adds assets, establishes liquidity ratios, and a so-called “Oracle Sentinel” to monitor accuracy of pricing data between Layer 1 and Layer 2 networks.

Here’s a simple way to understand how one of these tools could work in practice.

Say, the DingaLing community wants to bring its coin, called DING, to Aave. But because the coin has such a small capitalization, and is thus extremely volatile (i.e. plenty of liquidation risk), previous attempts to get it listed as collateral on the platform were shot down almost immediately.

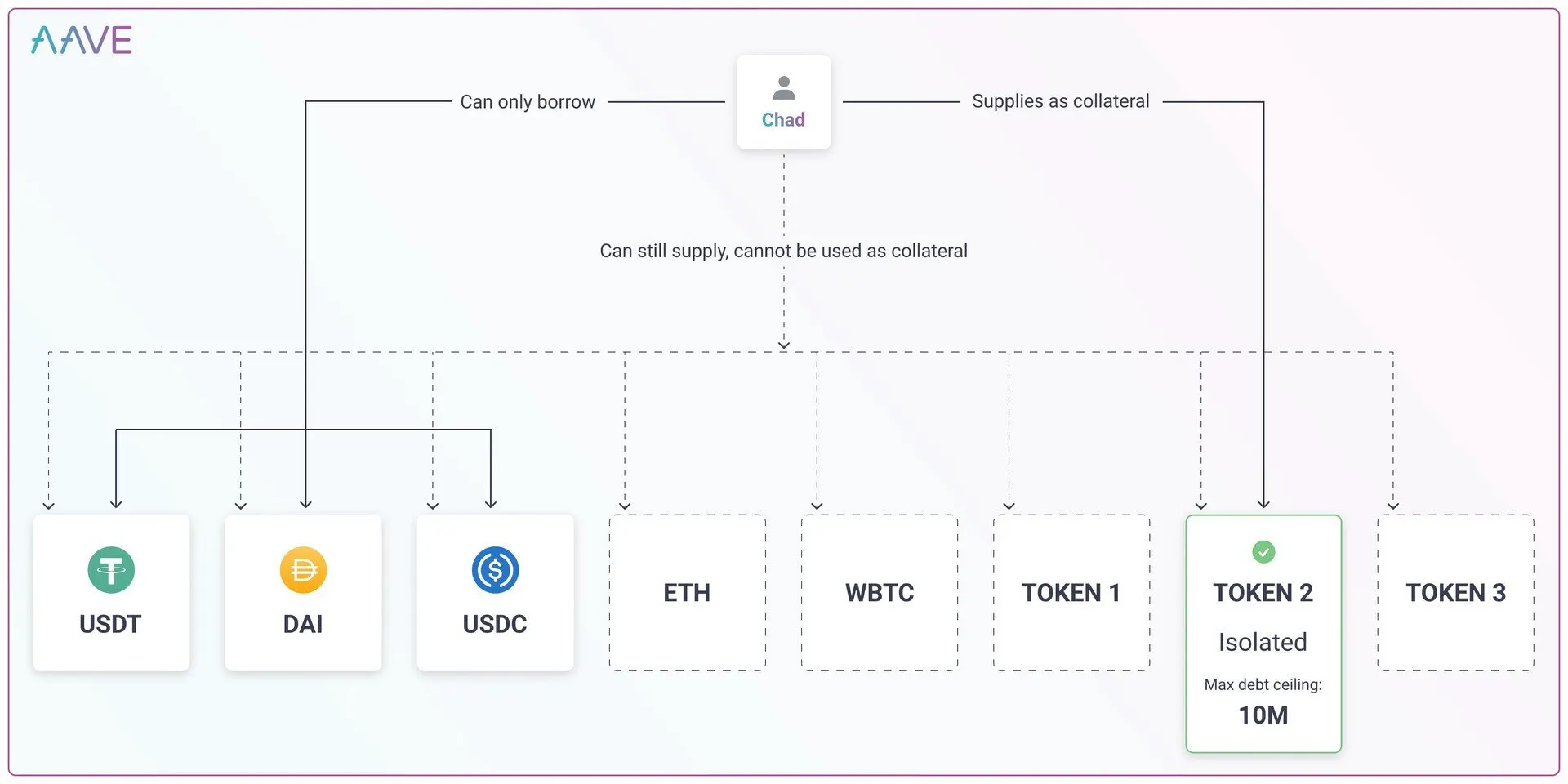

Now, with v3, these listings may happen, but under the condition that the coin is used as “isolated collateral.”

DING could be included as collateral, but the user who supplies the coin would have limited options as to what they can borrow against it. This reduces the risk of catastrophic failure in the case of DING’s value plummeting.

Though technical, isolation mode allows Aave’s services to reach smaller crypto communities whose token may not be well-established. Tapping into these communities is how other protocols, namely Cream Finance and Rari, have made a name for themselves. This edge becomes all the sudden much duller with Aave’s v3.

If you haven’t already, I recommend a full reading of the update. It’s worth your time, and it will expose to you how powerful many of these incumbents really are. Insofar as smaller projects can profit off forgotten features, with a single Thanos snap of the fingers, the advantages become immediately less significant.

Anyway, that’s the DeFi tea for today, folks. Thanks for reading and see you next week!

DeFi Friday is Decrypt's Friday email newsletter, led each week by this essay. Subscribers to the email get to read the essay first, before it goes on our site. Subscribe here.