In brief

- A long-awaited report calls for Congress to pass laws to regulate stablecoins as banks.

- The recommendations could challenge the business model or even the existence of firms like Tether.

The U.S. government published a long-awaited report on stablecoins on Monday, outlining proposed measures that could pose challenges to the business model, or even the very existence of some companies that issue the digital tokens, which are designed to hold the same value as fiat currencies like the dollar.

The report, published by a consortium of federal agencies including the Treasury Department, calls for Congress to pass laws that would require stablecoin issuers to become "insured depository institutions"—or, in other words, banks.

This designation would be a major shift for certain stablecoin issuers, especially Tether, which have long operated in the regulatory shadows. It would place restrictions on the types of collateral they could use to back their stablecoins and force them to pay for compliance, insurance, audits, and other measures that go with being a bank.

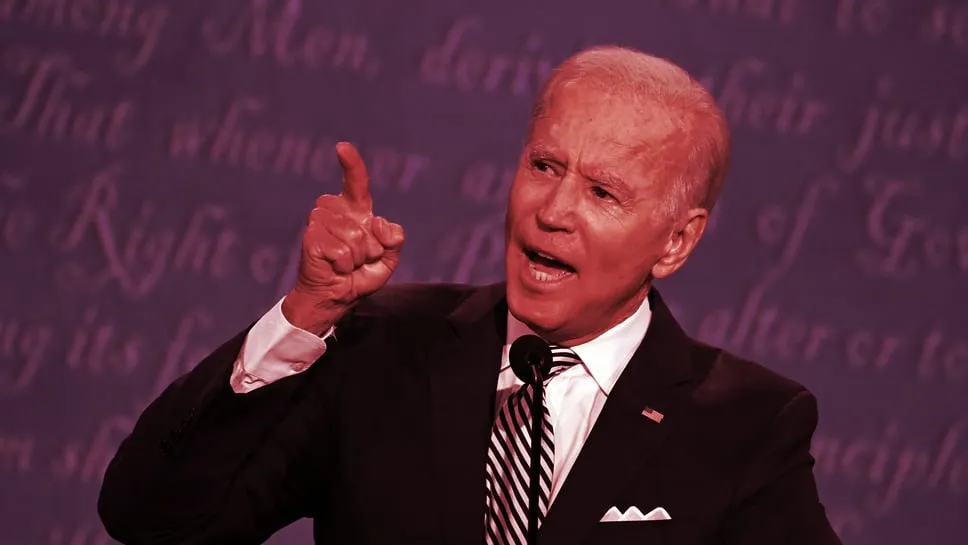

The report came about at the behest of the Biden White House, which tasked the President's Working Group on Financial Matters—an inter-agency group that also includes the Securities and Exchange Commission and the Federal Reserve—with developing a regulatory framework to oversee the stablecoin market, which is now valued at around $130 billion.

Tether, which issues a token by the same name and trades as USDT, has long been the biggest player in the stablecoin market, but it has also been the subject of criticism that its reserves are not fully backed by dollars. The company was recently fined by the Attorney General of New York and is reportedly the subject of investigations by the Justice Department and other law enforcement agencies.

The new rules will also affect Circle, which is the second biggest stablecoin issuer and which works closely with the San Francisco-based cryptocurrency exchange Coinbase. Circle's CEO, Jeremy Allaire, has long touted its USDC token as highly regulated, but the company came under scrutiny this summer when smaller rival Paxos published a blog post showing that company's reserves included assets like bonds and commercial paper.

In response, Circle pledged to hold only dollars and short-term Treasury bills and to apply for a federal bank charter. In a statement, Allaire praised the report's recommendations.

“We are fully supportive of the call for Congress to act and establish Federal banking supervision for stablecoin issuance. The rapid scaling and strategic importance of this to dollar competitiveness in the age of crypto and blockchains is critical," he said.

Paxos, for its part, has long touted that its reserves have always been backed only by dollars, and that it is registered as a regulated trust company—a designation that is not the same, however, as an "insured depository institution."

"We’ve established a culture of productive engagement with regulators and policymakers because collaboration on this crucial technology will foster growth and benefits for all Americans. We look forward to engaging further with all policymakers regarding the future of stablecoins," said a Paxos spokesperson.

Both Circle and Paxos have treated new rules for stablecoins as a potential opportunity, hoping that their close ties with regulators will afford them a chance to expand their marketshare at the expense of Tether and other firms that operated more loosely.

According to Maya Zehavi, a prominent crypto investor who has worked closely with regulators, the strategy of the Biden White House is likely to cripple Tether while allowing more regulated competitors to exist. Such a strategy would recognize the reality that it would be impossible to regulate crypto out of existence—as some in Washington may wish to do—so that it makes sense to bring parts of crypto, especially stablecoins, under the regulatory umbrella of the banking system.

But while the new rules could help build the legitimacy of cryptocurrencies like USDC, they will also make it harder for stablecoin issuers to build profitable businesses. Companies like Circle earn much of their revenue from interest they earn on their reserves—a challenging situation at a time when bank account and Treasury bill yields are close to zero. If they must also pay for additional insurance and compliance measures, the chance of earning a profit becomes still harder, especially as they do not operate loan businesses like conventional banks.

Meanwhile, Sen. Cynthia Lummis (R-Wy), a pro-crypto member of Congress, expressed general support for the goals of the report, but objected to the recommendation to require stablecoin issuers to become banks. "However, proposing that only insured depository institutions may issue a stablecoin is misguided and wrong. As of now, it’s not even clear that FDIC insurance is available for stablecoins," she said in a statement.

Monday's report also called for laws to restrict stablecoin issuers' "affiliation with commercial entities." The report provided little further detail on what such a restriction would mean in practice, but the obligation—if enacted—would further increase the business challenges of stablecoin issuers.

The report, it should be noted, is simply a policy document and does not amount to a new law or regulation. The recommendations it proposes would take an act of Congress, which has been bogged down in gridlock. This means Tether and other stablecoin issuers are unlikely to be forced to make changes in the near future.