In brief

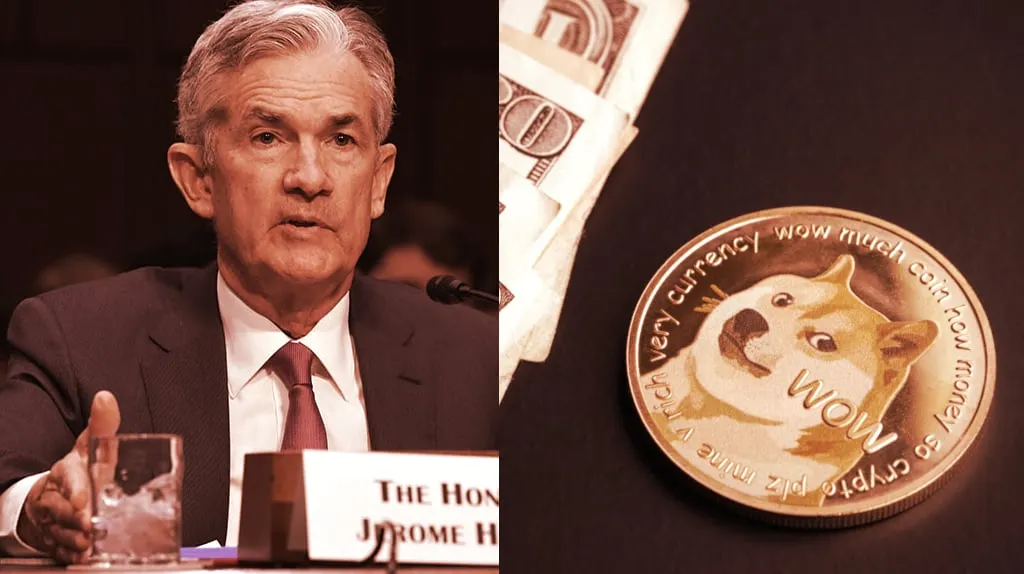

- Federal Reserve Chairman Jerome Powell was asked about the sudden rise in value of some assets, such as Dogecoin (DOGE).

- He suggested that some things are getting “a bit frothy."

For all the hype around the sizable gains posted by the market-leading Bitcoin and Ethereum in recent months, it’s actually a goofy meme coin that has had one of the most meteoric rises so far in 2021. And now Dogecoin (DOGE) has even drawn comment from United States Federal Reserve Chairman Jerome Powell.

During a streaming press conference yesterday, Yahoo Finance reporter Brian Cheung asked the Chairman whether recent market events—including the GameStop stock surge and Dogecoin’s massive value increase—suggested a relationship between low rates and easier monetary policy towards such things. Cheung also asked if the Fed was concerned about financial stability, given such wild price swings.

“Some of the asset prices are high. You are seeing things in the capital markets that are a bit frothy. That’s a fact,” Powell responded. “I won’t say it has nothing to do with monetary policy, but it also has a tremendous amount to do with vaccination and reopening of the economy.”

“Froth” is an investment term that suggests that an asset price is no longer in line with its intrinsic value. It is typically used when the price of an asset rises past its objective value. It can be a precursor to a market bubble popping, something that longtime crypto enthusiasts know well given the early 2018 market crash, and points to overconfident investors attempting to push an asset’s value beyond what it is reasonably worth.

In Powell’s view, the United States’ monetary policy—including low interest rates and recent COVID-19 stimulus payments—has played a part in such asset value rises. However, he also sees renewed market participation from people getting their COVID vaccines, spending money, and returning to pre-pandemic habits and activities.

Dogecoin’s value has skyrocketed from less than $0.01 per coin in January up to a peak price just under $0.42 earlier this month. The rise has been spurred by high-profile backers such as Tesla CEO Elon Musk—whose tweets consistently lead to a price boost—and billionaire investor Mark Cuban, whose Dallas Mavericks NBA team began accepting Dogecoin as a payment option for team merchandise in March.

This week, Cuban tweeted that mobile trading platform Robinhood, which doesn’t currently let users withdraw or spend the DOGE they buy within the popular app, is holding back further growth of the meme coin. Cuban points to the Mavericks’ success with Dogecoin orders, with an estimated 6,000 such purchases expected for the month of April, as evidence that DOGE is a cryptocurrency that people actually want to spend rather than simply hold for future value.

Still, the investment definition of “froth” can’t help but recall last week’s so-called “Doge Day,” a social media-led effort by Dogecoin investors to further push the value of the coin to $1 or more on April 20. The plan backfired: ultimately, the price of Dogecoin fell 20% within 24 hours.

Still, at a current price of $0.31, Dogecoin is up 469% over the last 30 days, per Nomics, and is worth 31 times more than it was just before the price jumped in late January. Froth or not, that has a lot of investors high on the so-called “joke” cryptocurrency right now.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.