In brief

- Despite increasing mainstream adoption of Bitcoin, there are major concerns about the cryptocurrency's carbon footprint.

- Many Bitcoiners dismiss the concerns out of hand, but Bitcoin uses a ton of electricity no matter which metrics or comparisons you use.

- An executive from mining operation Bitfarms says: "We will likely always consume a lot of energy."

Bitcoin recently broke $60,000 for the first time, cementing its perch as the “big dog” of cryptocurrencies. It has been embraced by groups as disparate as politicians, NFL stars, and Tesla CEO Elon Musk.

And the fact that cryptocurrency is entirely digital makes it sound, in theory, as though it would be the greenest currency the world has ever seen. After all, unlike paper money, no trees have to be cut down to create Bitcoin.

But people and press have become increasingly concerned about whether Bitcoin eats up a tremendous amount of power.

The Guardian ran a video explainer on “Why Bitcoin is so bad for the planet.” Reuters recently criticized Elon Musk for advocating clean energy while also dumping $1.5 billion into “energy intensive” Bitcoin, speculating that it “could complicate the company’s zero-emissions ethos.” An op-ed in the Washington Post declares that “buying a Tesla with Bitcoin would be environmentally unfriendly.”

A recent Cambridge University analysis concluded Bitcoin consumes more energy in a year than Argentina. That same analysis suggested that if Bitcoin were a country, it would be in the top 30 energy-consuming countries in the world.

What still remains unclear is how much Bitcoin contributes to the world’s total carbon footprint. Almost any use of the internet today—sending an email, scrolling social media, sending money online via your bank—contributes to humanity’s carbon emissions.

When put into context, is Bitcoin’s energy consumption a major contributor to carbon emissions, or is the fear of Bitcoin as an environmental villain overblown?

Bitcoin’s carbon footprint: The data

Annual energy consumption is typically calculated in terawatt hours (TWh). This tracks a unit of energy equal to outputting one trillion watts for one hour, and it’s used to track the annual energy consumption of entire countries.

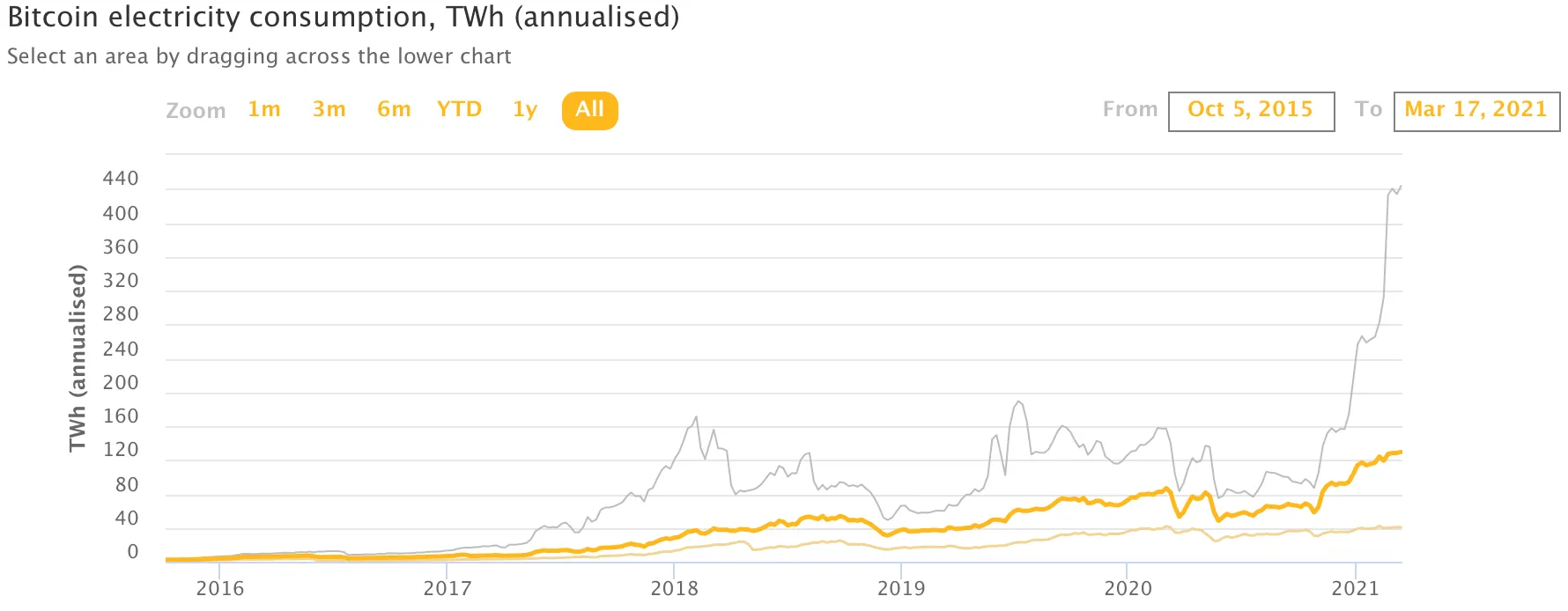

And Bitcoin’s figure is in constant flux. Cambridge University’s Centre for Alternative Energy uses an index called the Bitcoin Electricity Consumption Index (BECI) to calculate Bitcoin’s energy consumption. The BECI updates every thirty seconds, and provides an estimate energy consumption figure alongside a theoretical upper and lower limit. At the time of writing, the BECI is at 129 TWh. The high and low estimates vary greatly, and are currently 444 TWh and 40 TWh, respectively.

So what does the BECI estimate figure actually mean in terms of Bitcoin’s carbon footprint? And how does the cryptocurrency’s carbon footprint compare to other large sources of carbon emissions?

Putting Bitcoin’s energy consumption into context

To calculate Bitcoin’s actual carbon footprint, we have to convert terawatt hours (TWh) to metric tons of carbon dioxide emissions (Co2). That also allows for apples-to-apples comparisons for Bitcoin’s footprint to other high-energy-usage industries.

Calculating this is complicated. There are some key variables and assumptions that have to be taken into account—most importantly, the type of energy that’s being used.

The US Environmental Protection Agency provides a calculator that helps us get some of the way there. It can be used to tell us what Bitcoin’s carbon footprint would be if every miner in the world used carbon-intensive means of production and excluded all forms of renewable energy like hydropower.

According to a September 2020 report from the Cambridge Centre for Alternative Finance, 39% of crypto mining energy is renewable. Meanwhile, CoinShares estimates the figure is as high as 77.6%. That's a large discrepancy. (And you have to consider the source: CoinShares, a crypto asset manager, has skin in the game of downplaying Bitcoin's environmental impact.)

If we conservatively use the Cambridge Centre study’s 39% estimate, 78.7 TWh of Bitcoin’s annual total of 129 TWh is based on non-renewable energy. Thus, according to the EPA, Bitcoin’s non-renewable electricity consumption equates to 61 billion pounds of burned coal, 9 million homes’ average electricity consumption for the year, or 138 billion miles driven by an average passenger vehicle. For perspective, Pluto’s greatest distance from Earth at any time is 4.6 billion miles.

It’s also important to know where this consumption takes place. We know Bitcoin mining is big business in Asia, and companies like Bitfarms lead the way in North America. In 2019, a study published in science journal Joule estimated the regional footprint of Bitcoin by tracking IP addresses, and found that almost 70% of Bitcoin mining energy is consumed in Asia, with 17% happening in Europe and 15% in North America.

Bitcoin’s defenders rush to point out that a lot of Bitcoin mining uses clean energy to fuel the network, mostly in areas of China where hydropower generates the majority of the electricity used for Bitcoin mining. But Bitcoin mining also takes place—as the Joule study notes—in regions with heavy reliance on coal power like Inner Mongolia, where the government recently proposed closing Bitcoin mining farms.

So how does Bitcoin match up with other sources of carbon emissions?

According to the Global Carbon Project, the world produced 34 billion metric tons of carbon emissions in 2020. That is about 620 times more than Bitcoin’s current estimated average annual carbon emissions (if you’re using Cambridge Centre’s 39% renewable energy estimate for Bitcoin). Thus, Bitcoin represents a mere sliver of the world’s total carbon footprint.

So if Bitcoin’s carbon footprint is so comparatively low, what is all the fuss about? One reason Bitcoin gets criticized so heavily for its energy usage is because it’s far less environmentally friendly than the longstanding alternative—government currencies.

According to research conducted last month by Digiconomist (which hosts the BECI), the energy consumption for one Bitcoin transaction is the same as 453,000 Visa transactions. In carbon footprint language, this means that a Bitcoin transaction is 710,000 times “dirtier” than a Visa transaction.

The chart shows one #Bitcoin transaction versus 100,000 VISA transactions, because any less VISA transactions wouldn’t even be visible pic.twitter.com/hxqSQaad6K

— Digiconomist (@DigiEconomist) February 6, 2021

But Bitcoin doesn’t just size up badly against Visa transactions. It also doesn’t look so green when it’s compared to some of our everyday gadgets.

For example, Bitcoin’s annual carbon emissions are currently equivalent to 7 billion charging smartphones—enough energy to equal every single person in the world owning an iPhone. In addition, all the world’s physical data centres account for roughly 200 TWh, according to the International Energy Agency (IEA), or about 1% of the world’s total electricity demand per year. That's currently more than Bitcoin, but not by much.

Mining with hydroelectric power

Bitfarms—the largest Bitcoin mining operation in North America—is at the forefront of Bitcoin’s energy usage challenge. Notably, Bitfarms is not burning any carbon to power its mining operation at the moment—it’s all hydroelectric.

But it’s unclear whether Bitfarms can stick with hydroelectric power for good, as president Geoff Morphy acknowledges: “As we expand, can we stay with pure hydroelectricity? We don’t know," he told Decrypt. "If we do switch to some type of carbon because the world has an opportunity where there’s surplus somewhere, and we can take advantage of that surplus, then we will."

Morphy added that Bitfarms would never use coal to power its operations and would instead look to natural gas as an alternative. But he also frames energy usage as a necessary evil for the crypto industry. “We will likely always consume a lot of energy,” Morphy said. “In the scheme of importance, it’s necessary to drive the decentralized economy.”

And some of Bitfarms’ future energy consumption might take place in South America, where Morphy says the firm is considering expansion. That inevitably means more energy consumption, but it also provides that region—which is going through a tremendously challenging economic period—an opportunity for growth.

“If we set up there and pour hundreds of millions of dollars into that area and employ hundreds of people at a new facility, that’s really giving back to that area as well,” Morphy said.

Taking a look in the mirror

Many big-name Bitcoiners dismiss the cryptocurrency’s environmental impact seemingly out of hand, arguing it shouldn’t be an issue.

Pierre Rochard, strategist at cryptocurrency exchange Kraken, described Bitcoin’s accusers as intellectually lazy. “Listen to the scientists, look at the data, don’t politicize the facts. Bitcoin is good for the environment,” he tweeted.

Intellectually lazy: “#bitcoin is bad for the environment”

Intellectually honest: “CCP subsidizing coal electricity production is bad for the environment”

Listen to the scientists, look at the data, don’t politicize the facts.#Bitcoin is GOOD for the environment.

— Pierre Rochard (@pierre_rochard) February 28, 2021

CoinShares CSO Meltem Demirors told Decrypt the moral argument against Bitcoin's energy use doesn’t necessarily match up with its actual consumption, or its utility.

“Christmas lights are a horrible use of energy, yet there is no energy police telling people to turn them off,” she said, adding, “Free markets dictate where and how energy is captured and used. Bitcoin is the only tool we know of that can effectively be a money battery to convert stranded renewable energy into economic value.”

And Crypto Twitter is full of people who, in jest or otherwise, shrug off Bitcoin’s environmental impact with a single tweet. “A banker saying Bitcoin is bad for the environment is the pinnacle of hypocrisy,” one Twitter user named Morpheus tweeted, adding, “Learn to see through the lies and manipulation of these people.”

A banker saying Bitcoin is bad for the environment is the pinnacle of hypocrisy. How about 1000’s of armored trucks driving around transporting fake fiat monopoly money, and brick and mortar banks sucking energy. Learn to see through the lies and manipulation of these people.

— Morpheus (@morpheus444000) March 6, 2021

Bitcoiners also commonly retort that comparing Bitcoin’s energy use to Visa transactions or other power-hungry machines isn’t a fair apples-to-apples comparison.

Bitcoin’s network encapsulates all the energy required to make the system work—creation, security and transport. The traditional banking sector however is not so one dimensional. A payment processor like Visa is only part of a wider system, so a better comparison would include the cost of printing money—which has been estimated to demand 5 TWh of energy per year—the cost of central bank servers, the cost of physical security and money transportation, on top of payment processors like Visa.

After all, what is a payments system without a banking system?

“How do we truly and accurately quantify the hydrocarbon emissions from mining, transporting, fabricating and installing a bank vault with multiple foot-thick steel doors through global supply chains? How accurately can we quantify the carbon emissions from fleets of Guarda trucks that are powered by fossil fuels?” Jesse Phillips, business development manager at Binance Pool, told Decrypt. “Based on the lack of transparency and centralization in the banking sector, these costs are much more difficult to accurately quantify.”

But even then, the Bitcoin network doesn’t look so good. Phillips is right that it is difficult to quantify the total environmental impact of the banking industry, but some estimates still don't favor Bitcoin over traditional banking.

This 2017 Hacker Noon post by Carlos Domingo, CEO of crypto compliance company Securitize, suggests sections of the traditional banking system, like ATMs, demand approximately 100 TWh per year. That is still a full 29 TWh below what Bitcoin’s network currently consumes, according to the BECI.

And in all likelihood, this problem is only going to grow as Bitcoin continues to gain a foothold in mainstream society. Bitcoin’s supporters have to take a long hard look in the mirror and be honest about the challenges and bad optics their industry faces.

What’s next for Bitcoin?

Bitcoin has made some massive strides toward mainstream adoption recently.

Companies like MicroStrategy and Tesla have poured billions into Bitcoin, Tesla and PayPal both intend to accept Bitcoin as payment, and Citibank recently predicted Bitcoin could become the currency of choice for international trade.

If Bitcoin gets anywhere close to that level of widespread adoption, the energy demand for Bitcoin transactions will likely skyrocket.

The idea that Bitcoin’s energy usage will grow as its price increases is no mere assumption; the data backs it up, too.

A new study this month by Digiconomist founder Alex de Vries, who has a master’s in economics from Erasmus University Rotterdam, estimates how much electricity the Bitcoin network consumes at a given Bitcoin price level. He uses mining costs as a way to approximate energy consumption, and estimates that the primary costs of mining are hardware (roughly 40%) and electricity (roughly 60%). He assumes miners pay for electricity at around $0.05 per KWh—an estimate that has previously been used in similar studies.

Based on these assumptions, de Vries theorized that with Bitcoin at $42,000 (the price back on January 10, 2021), Bitcoin miners would earn around $15.3 billion annually and the total Bitcoin network would consume up to 184 TWh per year—much higher than what the BECI estimates. 184 TWh per year is in fact “not far from the amount of energy consumed by all data centres globally,” de Vries writes, a figure the IEA pegs at 200 TWh.

And Bitcoin’s price is currently much higher than $42,000—it’s hovering around $60,000.

In other words, using de Vries’s method, the network’s total consumption is likely already very close to the 200 TWh used by all the world’s data centres. (That said, all the data centres in the world combine to only 1% of the world’s energy demands.)

At 184 TWh per year, de Vries concludes Bitcoin’s carbon footprint is already "roughly comparable to the carbon emissions produced by the metropolitan area of London," one of the biggest and busiest cities on the planet.

If Bitcoin’s energy consumption grows as its price increases, you’d be forgiven for assuming that the problem would go away if Bitcoin’s price fell, because the financial incentive to mine Bitcoin would shrink. But not so fast: As de Vries notes, Bitmain—one of the largest manufacturers of Bitcoin mining machines in the world—recently announced that it’s already sold out on stock all the way up until August 2021, and according to a post on its website, it doesn’t allow order cancellations. So, regardless of what happens to Bitcoin’s price for the rest of this year, Bitcoin mining won’t likely slow down.

In fact, according to Cambridge University’s BECI, Bitcoin’s electrical needs are already surging rapidly. Since October 2020, Bitcoin’s electrical consumption has increased from an estimate of 58 TWh to an estimate of 129 TWH. That represents an increase of over 120% in just five months, and much like Bitcoin’s price, the cryptocurrency’s electrical consumption has generally increased ever since institutional investors came knocking.

So Bitcoin is at a crossroads. On one hand, Bitcoin holders can point to its recent price surge as a sign of its sustainable appeal for retail and institutional investors.

But its underlying system is more energy inefficient than anything the financial world has ever seen. Supporters can dismiss these issues or approach them like a joke, or they can retort that its carbon footprint is only a fraction of the world’s total carbon emissions, but the argument is completely context-dependent: when compared to Visa transactions, or smartphone charging, Bitcoin looks anything but green.