In brief

- Markets saw sizeable gains and losses within a short period.

- Bitcoin and Ethereum suffered the most, with huge swings.

- Bond Markets are worrying investors as inflation and yield rates eat into investor confidence.

The crypto markets have been bubbling a lot recently. So much so Market Watch will be doing deep dive into the rise of the microbubble next week - stay tuned for that.

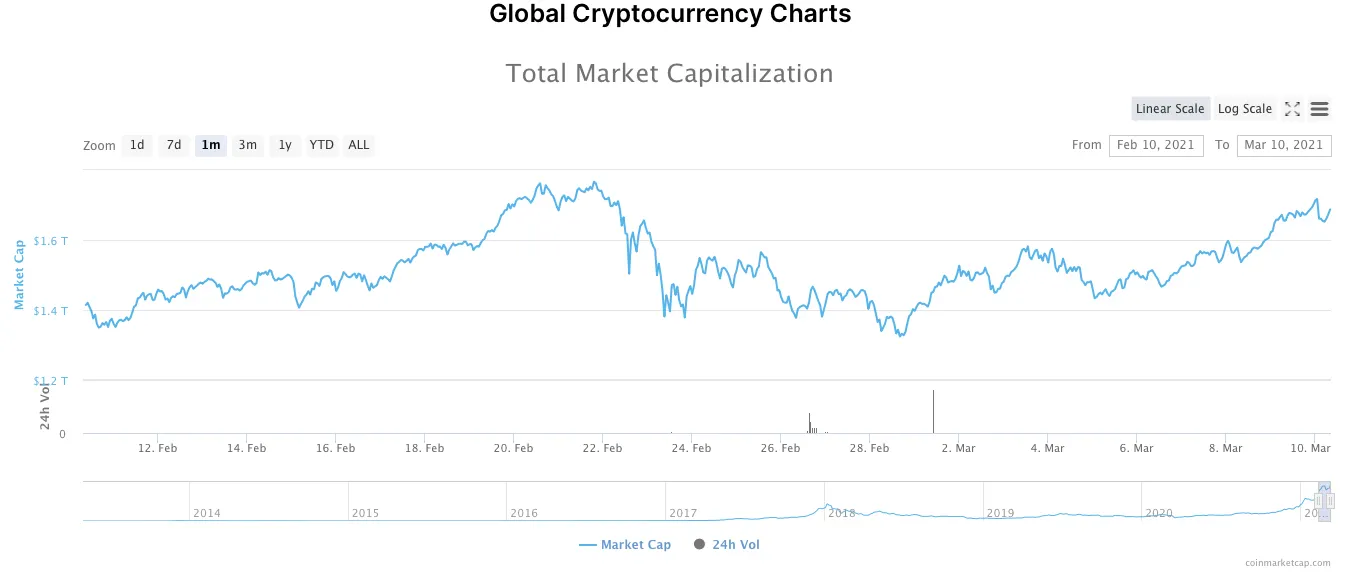

Yesterday the global market cap was on a tear, adding to the 6% gain it made on Monday, to reach $1.72 trillion, just shy of the all-time high of $1.78 set on February 21.

But within three hours it dropped back to $1.66 trillion. At the time of writing, it appears to be on its way back to $1.7 trillion. It was the sharpest drop this month, and bore all the hallmarks of the ‘great plunge’ of February 23. But things, for now, appear to be on the mend again.

The big caps, Bitcoin and Ethereum followed the same line. Bitcoin rose as high as $55,472 according to Nomics, before taking a dive back to $53,200 within three hours. At the start of European trading, it’s back into the $54,000s and climbing.

Ethereum’s price did exactly the same. It climbed to $1,858, testing its own all-time high of $1,959 set in the bull run of February. But it too took a dive, back into the $1,700s, and is now on the road to recovery again.

What on earth is going on? Bitcoin’s volatility is back up in to the 5% range after spending much of 2020 closer to 2%. Taking a look at flows in and out of exchanges, something interesting has happened: the Bitcoin supply held on all exchanges has just hit 2-year lows, according to on-chain analytics firm CryptoQuant.

According to @cryptoquant_com, 15,700 $BTC ($850M) flowed out of Coinbase yesterday. The #Bitcoin supply held on all exchanges has also just reached a 2-year low. pic.twitter.com/2DbQwuuyrg

— Bloqport (@Bloqport) March 9, 2021

That sizable movement suggests most of that money has gone into some form of cold storage, which is creating pressure on prices as there’s a lot less Bitcoin to go around.

Then there’s news that JP Morgan has filed a set of documents with the SEC for a ‘cryptocurrency exposure basket’ that would provide investors with indirect exposure to Bitcoin via companies who had invested in it, like MicroStrategy and Square.

And on top of that several Asia-based companies are trying to lure institutional investors into the crypto markets with a raft of new infrastructure.

Externally, the $1.9 trillion stimulus passed by the US government seems to be helping elevate things further.

“We have seen an increase in interest levels from institutional players globally,” Annabelle Huang of crypto financial-services firm Amber Group told Bloomberg. “In China, a lot of high net worth individuals have been inquiring on how to add Bitcoin to their portfolio.”

But as we’ve seen in previous Market Watch reports, there are still strong headwinds in other parts of the global economy that could unsettle prices.

The biggest one this week is the sale of $38 billion worth of US government bonds. The auction, which traditionally hasn’t attracted much attention is now being studied intensely by investors for signs of what may lie ahead for America, and the world's economy.

The last time the government tried to auction off bonds to help ease the country’s $22 trillion worth of debt last month, sales flopped. That led to a cascade of uncertainty across global markets as US government debt is used as a benchmark for everything from car loans to credit cards. Bitcoin and crypto suffered.

Why is this important for investors with shorter term investment horizons? If the sale isn’t a success, the government will have to offer higher interest rates on the debt to drum up more interest. This sets the scene for what could be fireworks between the government's ability to raise capital and the investors who traditionally buy them.

During the 1980s, so called "bond vigilantes" held the US government to ransom by refusing to buy bonds because they disagreed with government policy. The $1.9 trillion stimulus bill is a point of contention among some investors as the influx of new money could force up inflation and interest rates, which companies want to prevent as it's allowed them to spend and borrow their way through COVID.

Interest rates are what have been spooking investors recently. In a slew of business surveys carried out by the Fed, businesses were paying the highest prices in a decade, and that an index of raw industrial commodities, led by copper, has shot up faster than it did after the financial crisis.

The increase in the cost of doing business is being interpreted by some as a warning sign that the US economy could be overheating. The frothyness that we’re experiencing in markets now, especially in tech stock’s miraculous performance on the Nasdaq yesterday, could be little more than a dead cat bounce, Frances Newton Stacy, director of strategy at Optimal Capital, told Yahoo Finance.

Tread with caution.

Sponsored post by AAX

Learn More about partnering with Decrypt.