In brief

- Markets show signs of recovery after huge losses of last week.

- Investor confidence is returning after bond yields caused market jitters.

- Joe Biden's stimulus plan passed the house but some fear it could cause inflation to rise.

Investors opening their crypto wallets today will breath a sigh of relief as relative calm appears to be returning to markets.

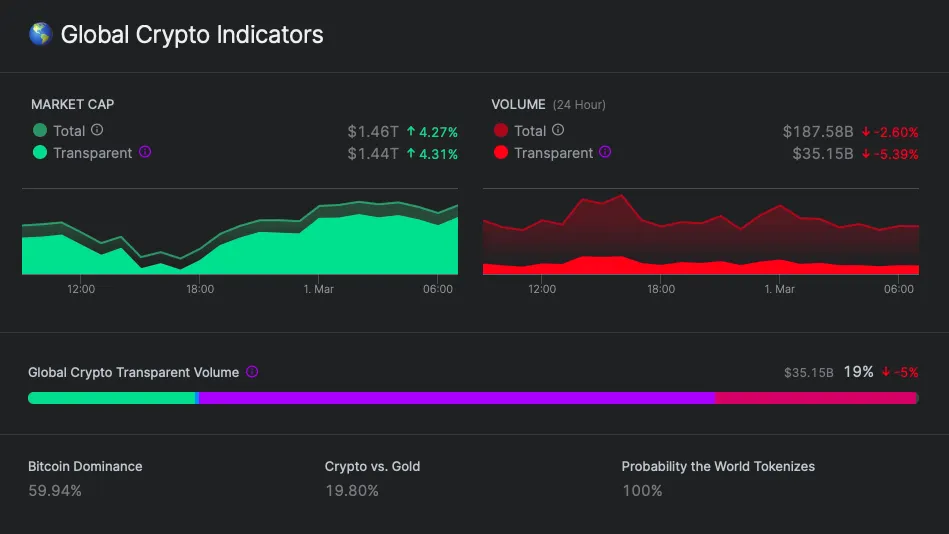

Global market cap is recovering after last week’s battering, up 4% in the last 24 hours to $1.4 trillion. During the market rout, it dipped to $1.3 trillion, having been north of $1.7 trillion a week before.

Bitcoin too appears to be on the road to recovery after dropping as low as $43,000 over the weekend. In a week, the world’s largest cryptocurrency shaved 25% off its price, its worst performance since the market collapse of March 2020.

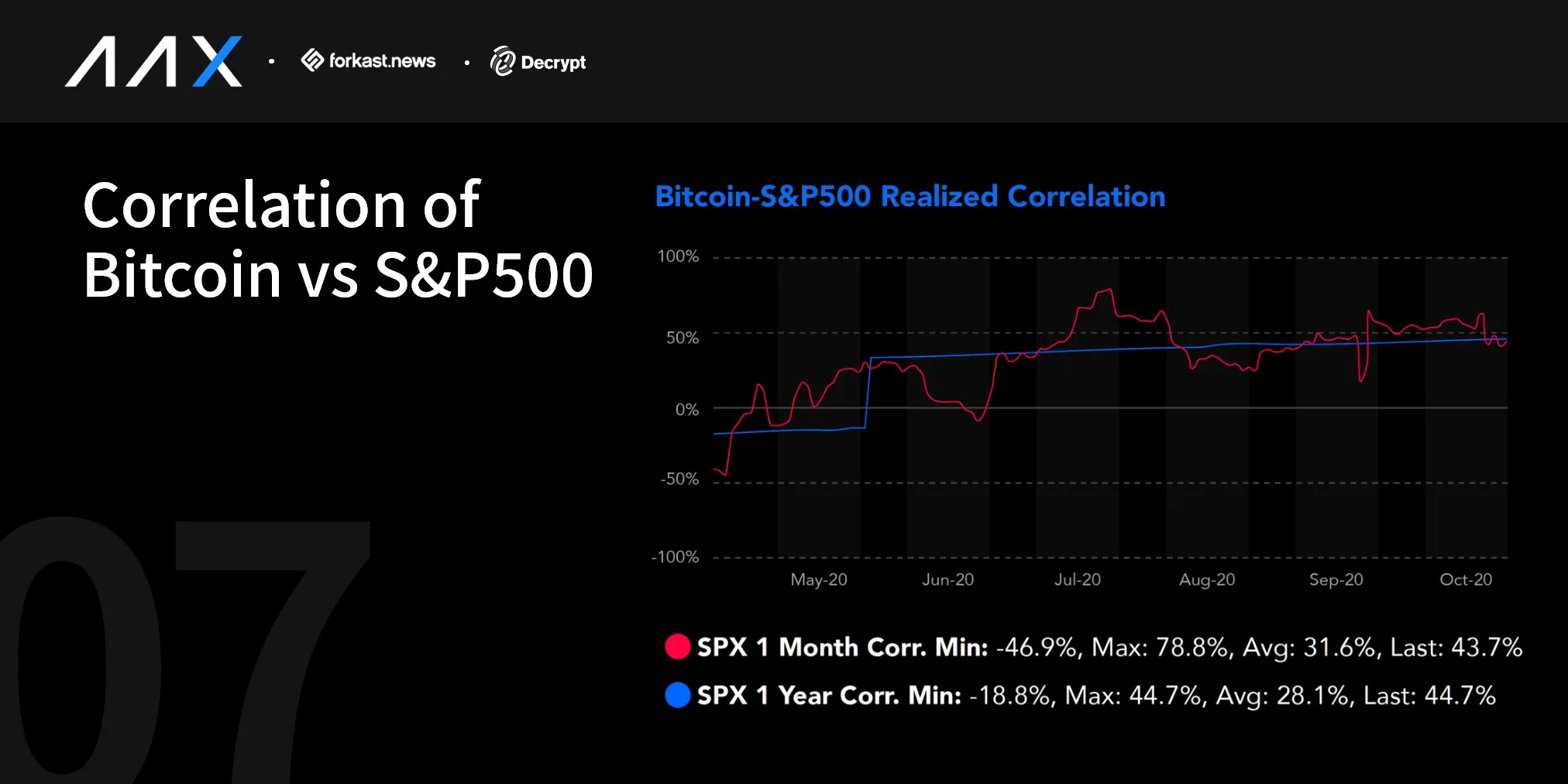

Volatility has shot above 5% for both 30 and 60-day rolling averages. By comparison, in October 2020, Bitcoin’s price swings had dropped to 1.7%, briefly making BTC a more stable store of value than some of the world’s biggest fiat currencies. But with a boom in prices comes a boom in uncertainty.

Cardano Clings On

It was a similar picture across the broader crypto markets, with almost all of the top 20 showing gains. Ethereum has recovered strongly in the last day, gaining nearly 6%, helped along by AAVE’s 18% jump bringing the project’s native token back in to world’s 20 largest.

Cardano clinged to its top three slot despite the market recovery, while Binance has slid back two places to fifth after its native token lost a third of its value since it reached an all time high of $333 on February 19.

Why are the markets back in the green? Investor confidence. US and European futures markets all rose over the weekend, on the back of the news that governments across the world would continue their bond purchases to prevent market jitters stifling the recovery.

The worry last week was that as the yields from government bonds gathered pace, inflation was sneaking back into the economy, meaning central banks might have to rein in their lavish bond buying programs that have kept markets afloat.

“With a lot of the move in yields due to the improving growth outlook and reopening prospects, risk appetite is holding up,” Esty Dwek, head of global strategy at Natixis Investment Manager Solutions told Bloomberg.

“The pace and scale of the move in yields is more important than the absolute level, suggesting that as long as the move is gradual, risk assets should be able to absorb them.”

That steady growth will be the litmus test for crypto this week. If yields spike like they did last week, we could see another sizeable slide in prices. If growth remains slow and steady, crypto could extend today’s recovery.

Another key factor in the markets to watch out for this week is Joe Biden’s $1.9 trillion aid package. It sailed through the House of Representatives on Saturday, and now faces scrutiny in the Senate this week.

If passed it could turbocharge the recovery, or it could force inflation up and throttle investor’s appetite for risk.

Brought to you by AAX

Learn More about partnering with Decrypt.