In brief

$95,258.00

4.47%$3,337.85

7.68%$2.17

5.82%$949.73

5.20%$145.73

4.95%$0.99971

-0.01%$3,335.22

7.59%$0.304492

1.86%$0.147559

7.87%$0.420763

8.77%$1.033

-0.45%$4,083.58

7.56%$677.66

6.91%$617.88

-1.03%$57.17

4.28%$3,631.57

7.68%$95,197.00

4.66%$3,621.28

7.53%$14.12

7.66%$0.999537

-0.02%$0.999322

0.05%$3,335.52

7.55%$9.06

-0.38%$0.240116

8.89%$95,215.00

4.35%$1.87

5.83%$415.73

4.16%$1.00

0.07%$14.74

8.48%$25.71

6.66%$78.07

2.25%$0.144928

1.64%$0.123031

6.57%$0.00000887

5.25%$0.182223

7.23%$0.999396

0.06%$1.083

-0.10%$1.79

3.20%$0.104184

4.99%$2.27

8.84%$1.21

-0.07%$5.75

6.94%$0.999673

-0.01%$0.999231

0.00%$0.989701

4.07%$0.00901002

3.90%$296.08

5.20%$0.00000663

15.43%$1.61

-4.52%$178.79

7.76%$3.68

3.33%$117.21

5.47%$1.87

9.03%$4,609.84

0.61%$0.996833

-0.18%$182.53

4.83%$13.33

8.33%$3,337.89

7.69%$3.54

12.95%$0.242892

13.11%$4,620.37

0.54%$0.210751

2.41%$1.00

0.00%$0.729383

5.27%$0.616549

10.15%$0.158801

5.05%$145.66

4.88%$4.93

3.37%$159.30

5.17%$0.00000172

1.14%$0.00270474

9.85%$1.11

0.00%$11.59

3.70%$0.999581

-0.01%$1.95

9.45%$1.15

-0.02%$3,852.22

7.53%$0.999299

-0.04%$949.80

5.26%$0.059479

5.65%$3.81

28.93%$0.417718

7.35%$0.998824

0.04%$0.02440253

-0.29%$0.0485427

3.64%$2.64

4.98%$0.999649

0.00%$0.222935

10.04%$10.74

4.34%$2.39

1.08%$0.138967

7.16%$3,544.51

7.68%$6.12

4.27%$0.069877

5.40%$1.57

6.88%$5.69

6.07%$76.88

6.02%$0.01223023

7.83%$95,297.00

4.54%$95,564.00

4.87%$0.00001152

12.27%$95,163.00

4.47%$0.979464

2.22%$0.01163149

3.00%$0.999094

0.09%$3,531.52

7.77%$3,606.43

7.26%$0.04608946

-0.39%$0.998481

-0.06%$0.01332257

12.43%$113.96

0.01%$1.022

0.01%$0.126565

6.47%$10.96

0.03%$0.999589

-0.03%$95,112.00

4.48%$0.999609

-0.01%$1.40

8.10%$3,563.21

7.60%$96,056.00

0.09%$169.19

4.86%$0.22673

8.95%$0.39343

1.41%$2.07

6.71%$56.75

39.13%$0.363569

16.62%$1.077

10.00%$0.091376

1.21%$3,543.36

7.55%$1.11

0.07%$0.292768

3.54%$0.01161221

2.89%$1.11

0.07%$1.00

0.01%$3,337.13

7.62%$0.435949

9.95%$0.593984

6.33%$0.999762

-0.03%$1.22

-0.17%$25.99

6.76%$0.134242

68.00%$0.623062

8.00%$95,051.00

4.28%$5.65

11.45%$0.66608

8.79%$0.054835

5.38%$3,335.19

7.52%$0.603969

7.50%$0.989739

0.32%$3,333.43

7.42%$2.12

-1.02%$0.0000548

7.86%$0.607621

13.68%$0.801063

9.72%$196.87

4.91%$0.999879

0.15%$0.998809

-0.17%$0.998891

0.02%$3,575.84

6.88%$3,596.39

7.59%$1.087

-0.20%$0.093062

14.65%$3,734.63

7.52%$0.04332208

6.02%$0.229987

12.81%$0.396078

1.16%$0.106127

11.15%$0.00891936

3.54%$22.38

12.79%$177.20

7.73%$1.11

0.02%$95,414.00

4.38%$0.00000044

5.42%$0.00447784

0.38%$0.123354

5.98%$0.420565

14.16%$0.419179

12.45%$0.080264

6.96%$10.81

6.45%$0.071516

9.80%$0.997615

-0.78%$1.091

0.01%$20.10

4.79%$0.02090535

1.24%$0.0400505

-0.63%$147.32

5.27%$0.00905622

3.58%$0.384001

-0.01%$0.00400465

7.66%$2.26

6.23%$0.064744

5.76%$0.909595

3.56%$0.14749

7.67%$0.99889

0.01%$95,161.00

4.39%$18.33

8.75%$0.999936

-0.04%$0.00000037

0.64%$0.00759552

9.57%$1.16

-0.15%$21.71

1.25%$148.73

0.70%$0.091531

11.16%$0.127715

11.36%$0.998547

-0.11%$0.163305

6.16%$0.336001

-1.61%$1.24

8.11%$89.64

5.83%$1.13

0.01%$18.89

16.11%$3,334.23

7.48%$0.323963

-1.99%$1.60

9.46%$0.322881

10.79%$0.090188

-0.04%$3,617.79

7.45%$1.003

0.28%$95,241.00

4.46%$0.206208

7.26%$0.03600687

8.53%$0.999371

-0.01%$3,334.25

7.72%$0.164442

-4.87%$2.40

-0.61%$0.183595

8.87%$0.0030103

8.11%$0.151521

11.63%$1,007.33

5.24%$95,562.00

4.54%$4.00

7.33%$3,327.91

7.45%$3,327.84

7.06%$0.992287

0.05%$95,252.00

5.34%$0.01531542

7.70%$0.251386

-1.33%$3,604.98

7.11%$4,082.79

7.56%$0.024917

9.49%$4.09

10.92%$164.43

4.94%$27.03

3.77%$0.264436

3.56%$23.56

1.75%$1.39

4.73%$169.79

4.86%$6,782.84

0.29%

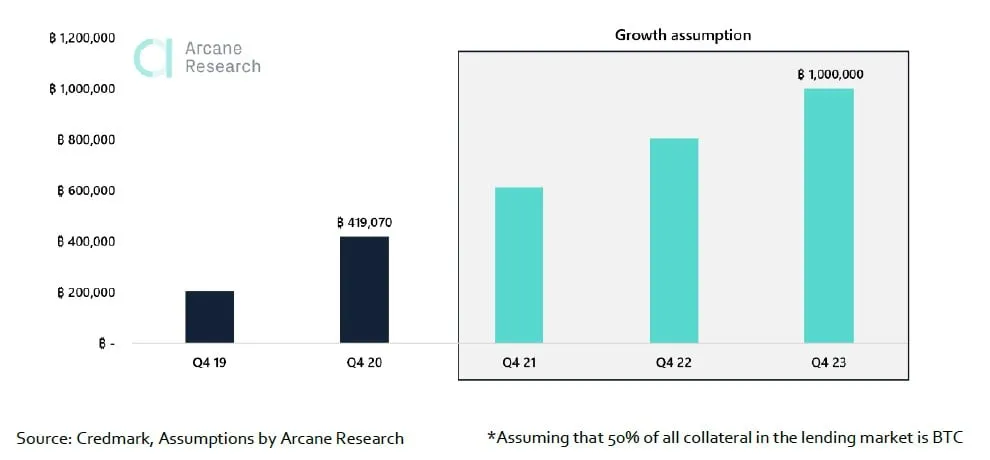

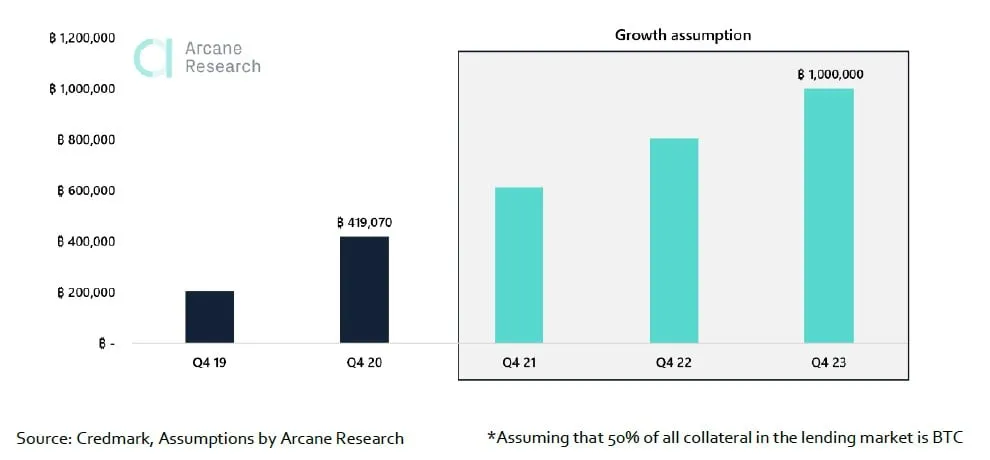

The amount of Bitcoin used as collateral in the lending markets could reach 1 million within the next three years, according to a report by Arcane Research.

Borrowing and lending are common financial tools in the traditional financial ecosystem. Recently several companies, including BlockFi, Genesis, Nexo and Celsius Network, have started providing these services but with cryptocurrencies instead. The firms, which saw remarkable growth in 2020, let investors lend out their funds and receive interest for doing so.

The amount of BTC used as collateral in the lending market is estimated to be around 420,000 BTC ($20.7 billion). Assuming that 50% of the collateral is in Bitcoin, the report speculates that it could reach 800,000 Bitcoin ($39.6 billion) in two years, up to 1 million BTC ($49.5 billion) within three years.

The report added that the growing popularity of the lending market will likely drive demand for Bitcoin and make a positive impact on the price of the largest cryptocurrency.

Currently, firms offer high rates, around 5-6% on the main cryptocurrencies and as high as 12% on stablecoins. But, the report warns that these high rates might fall as more liquidity is provided.

The report draws attention to the important role Bitcoin plays in the DeFi sector, where it is used in a number of so called “wrapped protocols,” as well as in the stablecoin space where Bitcoin is leveraged for collateralized derivatives instruments.