In brief

- Executives from three large Bitcoin lending firms discuss how the industry has grown in 2020.

- BlockFi saw its assets under management (AUM) increase by 1,500%.

- Surging demand from institutional investors has led the way.

Bitcoin lending services took a firm grasp on the cryptocurrency market this year, with the top three firms growing their holdings by an average of 734%.

The availability of traditional financial services like lending and borrowing—along with more institutional-focused means of custody and ways to get exposure to cryptocurrencies—that really enabled institutions to enter the Bitcoin market this year. And unsurprisingly, such firms have seen surging demand.

“There has been a massive increase in interest across the board,” Camilla Churcher, global head of business development at Bitcoin lending service Celsius Network, told Decrypt, adding that there has been an uptick in the amount of loans the service has been offering on the retail side.

“On the institutional side, growth has been similarly exponential,” she said. “A lot of activity in crypto has been taking off, more than ever in the last two weeks. More and more corporate customers [are] coming to our platforms.”

So just what is behind the explosive growth in the Bitcoin lending market? Where do the yields come from—and how will the boom in decentralized finance (DeFi) affect the industry?

What are Bitcoin lending firms?

Many people in the crypto industry choose to hold, or HODL, their Bitcoin over the long term, either as an investing strategy or because they believe in the longevity of Bitcoin as a hedge against inflation. But some choose to lend out their Bitcoin via such services, in order to keep the same exposure—but enjoy the yield.

Current yields are 6% APY at BlockFi (below 2.5 Bitcoin), 6% APY at Nexo (8% when paid in Nexo tokens) and 4.51% APY at Celsius Network (5.97% when paid in CEL tokens on up to 1 Bitcoin).

Yields are paid in the cryptocurrency itself (or the firm’s tokens) so the US dollar value of the yields will fluctuate.

Real Vision CEO Raoul Pal, who recently invested 98% of his liquid assets into Bitcoin and Ethereum, told Decrypt that his firm invested 10% of its cash holdings into Bitcoin, via Bitcoin lending firm BlockFi.

But it’s not just the newer class of investors that are using lending services. Kraken head of growth Dan Held, who has been in the industry since 2011-2012 and is often seen as a Bitcoin OG, said he currently lends his Bitcoin out to earn yield on it.

Where the yield comes from

When receiving “free” money, it’s always good to know where it’s coming from. The simple answer is that lending firms provide loans to investors and market makers, who pay higher interest rates. The firm takes a cut between the amount it charges investors to borrow money and the yield it pays to lenders.

“The yield comes from our lending activities. On the dollar side, we lend to both retail and institutions. On the crypto side, we lend to just institutions,” BlockFi CEO Zac Prince told Decrypt.

BlockFi is active in some publicly traded products, owning 5% of the Grayscale Bitcoin Trust (GBTC)—24,235,578 GBTC shares ($683 million). It lends in the spot crypto market, it lends institutions physical Bitcoin and it’s active in the securities lending market for the GBTC.

Nexo uses lending to pay interest on stablecoins. But for cryptocurrencies, it engages in market making in order to generate the yield. “We engage in risk defined options trading strategies,” Antoni Trenchev, managing partner of Nexo, told Decrypt.

Celsius Network generates yield by charging interest on loans to institutional borrowers. It pledges to pay 80% of the interest back to its users.

A massive surge in growth

Bitcoin lending firms saw record growth in 2020 as investors handed over their Bitcoin in large numbers.

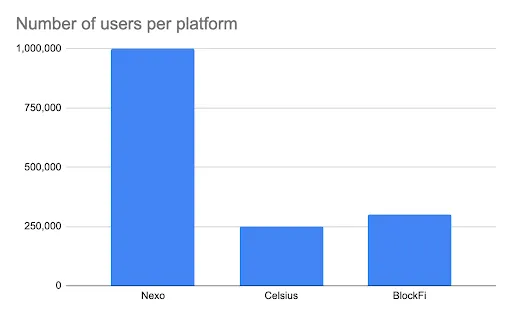

Celsius Network has seen a 467% growth in its user base, rising to 250,000 users. BlockFi edges that with 300,000 users, while Nexo now counts 1 million users.

If you’re just getting here and wondering if it’s too late, it’s not.

We’re just warming up

— Zac Prince (@BlockFiZac) December 17, 2020

That has paid dividends for each firm.

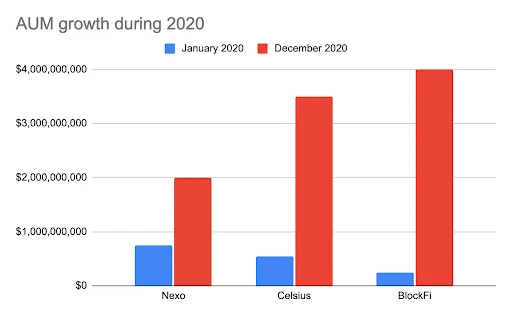

BlockFi saw the greatest growth, rising from $250 million in assets under management (AUM)—which represents how much cryptocurrency the firm is looking after—to more than $4 billion. That’s up 1,500%.

Celsius Network saw similar growth, increasing from $550 million to $3.5 billion AUM. Nexo, which had a head start, saw moderate growth from $750 million to $2 billion.

The factors driving growth in Bitcoin lending services

Bitcoin lending services have grown so much because they are a relatively new product in the market and they’re meeting a demand that’s also growing—and becoming more institutional.

“For a while these things didn’t exist. There are options. These things are needed in this market, as they’re needed in every other market in the world. It’s still early in the growth of the lending functionality within the cryptocurrency market,” said Prince.

Another aspect is tax. Trenchev pointed toward New York’s capital gains tax of 44%. “Half of it evaporates and goes to Uncle Sam—which is not great,” he said. “We’re pushing this narrative for borrowing against your assets rather than spending it.”

The three Bitcoin lending firms stated that the surge in demand has come from both retail and institutional investors.

“It’s a good mixture; we have a very diverse user base on the retail platform,”said Celsius Network’s Churcher. While there are some large holders, he added, “our average balance is around $27,000 over 250,000 registered users.”

BlockFi users similarly have an average balance of $25,000, but Prince noted that they range from $50 up to tens of millions. “It’s a pretty diversified depositor base and we’re seeing growth across the board, across all segments and account sizes,” he said.

How will DeFi impact Bitcoin lending services?

The DeFi industry struck a chord in 2020. There was a lot of innovation, primarily based around yield farming (providing liquidity in exchange for yields) and native DeFi tokens, such as YFI, which exploded in value. But there was also a lot of risk, with multimillion-dollar hacks occurring on a weekly basis—something that makes institutions understandably wary.

BlockFi, which is based in New York and regulated in the US, is keeping an eye on the DeFi space, but currently has no plans to enter it.

“If you are in a region where you can’t access centralized products like BlockFi, then certainly DeFi makes a ton of sense,” said Prince. “Down the road, you could see a little bit of integration. For us, it’s still way too early—and there’s way too little regulatory clarity, given our regulatory positions, for that to be viable.”

Celsius Network is exploring the industry, according to Churcher. “I think it’s a new frontier and we are supporters of offering new financial services to our customers.”

We are in the process of handing off the baton from Bitcoin speculators who dominated BTC since 2018 to long term institutional holders

This will take about two years and will involve several price changes as we try to match limited supply with growing demand.— Alex Mashinsky ©️ (@Mashinsky) December 20, 2020

Nexo, meanwhile, is more engaged with DeFi; it works with several companies in the space, including Maker and Chainlink. Trenchev said, “It’s definitely where the future is headed. It’s just there have been some high profile hacks. People should curb their enthusiasm a little bit as to how quickly everything will become decentralized and non-custodial.”

Looking ahead to 2021

The three firms are all planning on expanding next year, anticipating further growth in the Bitcoin lending industry.

BlockFi is getting underway with rolling out its Bitcoin rewards card, its foray into the payments space. It also plans to launch its first trading facility for its institutional clients early next year.

It’s here. Log in to your BlockFi account to join the waitlist for the world’s first Bitcoin Rewards Credit Card and earn 1.5% back in Bitcoin on every purchase. RT to be part of history 🚀 pic.twitter.com/DMA14hUjjB

— BlockFi (@BlockFi) December 1, 2020

Next year, Celsius Network plans to increase its number of services and expand to new jurisdictions. It is particularly focusing on regional expansion and is eyeing the Asia-Pacific and Latin American regions.

Nexo is optimistic about the inrush of institutional investment into the market and expects it to dramatically boost the Bitcoin lending space.

“You can’t have printing of trillions and trillions of dollars, and this not affecting assets that are scarce; that have proven scarcity, like gold, like Bitcoin,” Trenchev said. “There’s going to be an inflow, the whole space is going to grow. Organically, this will lead to growth in the lending space.”