In brief

If you are a company CEO and thinking about adding #Bitcoin to your balance sheet you still have the opportunity to be an early adopter. But not for long.

— Cameron Winklevoss (@cameron) February 8, 2021

$67,104.00

3.27%$2,017.26

6.19%$628.04

4.21%$1.40

5.02%$1.00

0.00%$86.45

7.19%$0.282055

0.75%$0.094957

4.32%$1.029

-0.92%$49.82

2.37%$0.282288

5.19%$0.999962

0.03%$451.40

0.52%$8.99

1.94%$30.88

12.16%$345.50

2.89%$9.03

6.81%$0.166463

1.44%$0.999342

0.02%$0.159638

4.99%$0.999605

0.01%$0.00939447

0.22%$0.09967

2.78%$1.00

0.01%$54.53

3.38%$9.20

5.98%$223.97

5.57%$0.920387

7.18%$0.00000572

2.26%$0.076221

3.46%$0.111218

2.00%$1.24

-1.31%$5,336.93

0.50%$1.50

1.11%$1.57

3.51%$5,401.99

0.10%$3.81

4.37%$0.642003

2.68%$1.00

0.00%$1.12

0.01%$1.00

0.00%$0.713632

2.12%$115.61

6.63%$182.02

4.62%$0.995831

-0.04%$76.89

2.86%$0.170591

2.59%$0.068119

2.79%$0.00000359

1.15%$1.18

10.44%$2.16

-0.41%$0.999911

-0.04%$0.00000152

-2.72%$8.72

4.60%$2.45

4.51%$0.999205

-0.02%$0.2623

6.29%$0.00196124

9.91%$11.00

0.00%$0.107529

3.06%$6.99

2.81%$0.393132

3.77%$7.73

2.31%$0.01790087

-0.19%$0.058642

4.77%$1.73

-1.78%$63.35

1.21%$1.83

1.42%$0.106229

7.67%$0.856772

2.32%$0.998723

-0.22%$3.51

6.14%$0.00949078

4.07%$0.02989642

2.33%$1.24

0.01%$0.087877

4.26%$114.44

0.00%$0.988338

4.43%$0.949765

6.59%$1.028

0.00%$1.00

0.01%$1.39

3.73%$1.11

0.21%$0.03326875

7.74%$0.03279496

-0.49%$0.00728666

3.82%$0.081325

1.14%$0.102628

9.36%$0.609115

1.11%$0.16998

13.61%$1.096

0.00%$0.993529

-0.39%$31.09

4.45%$0.00000603

5.70%$1.00

-0.03%$0.01285067

-0.23%$0.99852

-0.07%$0.271225

6.48%$0.260175

3.41%$1.089

-0.08%$0.069517

7.05%$0.709399

7.71%$1.18

0.06%$0.999991

0.01%$1.32

4.01%$0.00695501

5.92%$178.28

1.43%$33.33

4.13%$0.04751818

-0.24%$0.383347

4.69%$1.83

-17.49%$1.00

-0.00%$0.506722

5.09%$0.24877

5.77%$1.81

15.40%$0.083151

5.75%$0.999717

-0.01%$0.15665

5.43%$1.40

5.64%$0.03412585

5.06%$129.26

5.14%$1.018

-0.07%$0.00000034

2.05%$0.00000033

0.17%$3.39

0.79%$0.355838

7.84%$0.055808

3.92%$0.912856

1.99%$0.336917

17.18%$15.63

2.16%$3.09

3.86%$0.01523741

-2.73%$0.067737

3.87%$0.995108

0.54%$0.325301

6.14%$0.04954107

5.94%$0.02626373

4.60%$0.242006

11.84%$17.55

0.88%$0.00556594

2.77%$0.990273

-0.92%$0.00002834

3.22%$13.60

8.12%$0.124121

9.25%$0.075088

2.89%$0.306875

6.41%$5.82

15.25%$0.04860688

3.78%$1.54

-0.68%$0.00261734

4.25%$0.00004544

11.34%$1.31

0.42%$0.00244211

1.14%$0.02178228

7.44%$6.15

4.73%$0.126435

9.34%$1.82

-0.47%$0.999308

-0.08%$0.0413766

4.80%$0.101216

9.42%$0.084956

6.27%$0.993049

-5.07%$1.32

4.52%$0.999948

-0.01%$0.984022

0.00%$1.00

0.02%$1.30

6.69%$1.076

0.00%$0.000001

1.07%$0.49948

3.11%$22.79

0.00%$0.099263

1.20%$0.00204075

2.01%$0.198301

4.33%$0.193809

6.97%$0.199513

5.50%$2.71

5.67%$0.052887

4.20%$1.00

0.00%$5,005.00

0.73%$0.097735

5.58%$0.079736

2.90%$0.252489

-10.42%$0.182433

2.58%$1.00

0.00%$0.00481352

3.50%$0.078668

7.98%$0.01912971

4.62%$0.999737

-0.01%$18.17

3.27%$2.18

3.13%$0.00358865

4.42%$0.02058757

0.73%$0.053471

4.90%$2.07

2.05%$1.81

0.76%$1.78

6.83%$48.00

-0.01%$0.604696

5.15%$0.162162

2.56%$0.159434

1.80%$0.994295

-0.09%$1.27

0.55%$0.105116

0.57%$3.34

-1.90%$0.02138923

0.28%$0.04045776

6.28%$1.003

-0.15%$0.325076

4.34%$0.997007

-0.18%$0.00000718

2.62%$0.401135

4.15%$0.164941

4.58%$0.610694

1.04%$0.647828

5.54%$0.137694

3.29%$1.014

0.04%$0.270565

7.45%$0.135356

3.84%$0.289615

-0.01%$0.093893

5.85%$4.48

4.89%$0.0231237

13.52%$0.080904

5.10%$1,096.46

0.00%$0.075007

1.01%$0.268819

33.44%$0.311509

5.73%$0.251596

8.58%$0.13049

-0.05%$0.00402894

5.66%$11.21

-9.18%$0.00145947

2.64%$0.217147

4.08%$1.001

0.00%$0.187814

7.01%$0.26862

3.47%$2.36

5.41%$1.48

-4.69%$1.08

-0.06%$0.994935

-0.02%$1.00

0.06%$1.00

0.05%$0.00644829

14.52%$0.998548

-0.03%$1.061

-0.26%$0.999436

-0.01%$1.001

0.92%

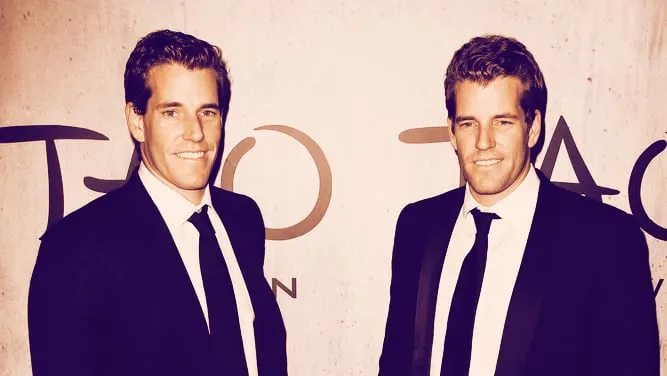

The Winklevoss twins, two of the biggest Bitcoin preachers out there, are a whole lot richer—thanks to Elon Musk.

Tyler and Cameron Winklevoss, founders of crypto exchange Gemini, are often coy about how much Bitcoin they actually own. But if a previous figure from the New York Times is anything to go by, they had $11 million-worth of the currency in 2013.

That’s when the price of Bitcoin was $141 per coin. It’s now up over 30,472%—at its new all-time high of $42,605.52 (at the time of writing). This means the twins’ fortune is now a spectacular $3.3 billion. And that’s a conservative estimate.

Last time Decrypt reported on the twins’ Bitcoin wealth, we estimated the figure to be combined at $2.8 billion.

That figure is now up half a billion.

The twins have Elon Musk to thank for their latest boost in Bitcoin wealth. That’s because his company, Tesla, has invested $1.5 billion in the cryptocurrency, according to an SEC filing revealed today.

And the price of currency has since rocketed: at the time of writing it was $42,605.52, up 13% in the past 24 hours, according to CoinMarketCap data.

If you are a company CEO and thinking about adding #Bitcoin to your balance sheet you still have the opportunity to be an early adopter. But not for long.

— Cameron Winklevoss (@cameron) February 8, 2021

Cameron Winklevoss today tweeted about Musk’s move. “If you are a company CEO and thinking about adding Bitcoin to your balance sheet you still have the opportunity to be an early adopter,” he wrote. “But not for long.”

If the twins’ prediction is right, they’ll be thanking CEOs for a long-time to come.