In brief

- A new survey by Gemini challenges the existing notions of an average crypto investor.

- One such finding was that people from all age groups were buying cryptocurrencies, as opposed to just youngsters.

- The percentage of female investors was also not found to be as low as popular opinion would suggest.

Crypto exchange Gemini found that over 13.5% of the 68 million-strong UK population is either a current or previous investor in the burgeoning cryptocurrency market, as per a survey shared with Decrypt today.

The exchange said the numbers were up over 152% compared to similar studies in the past. One such survey from 2019 found only 6% of the population was invested in the crypto market at that time.

As such, results from Gemini’s survey of over 2,000 respondents challenged certain long-held stereotypes about the average crypto investor, typically seen as young, single, male, and childless. Instead, it found the average investor was married, middle-aged, likely to have children, and that there was no significant skew between the percentage of men and women investors.

The findings

Among the key findings was that more women in the UK are investing their funds into the crypto sector more than ever before, with women now making up more than 41.6% of current and previous UK crypto investors.

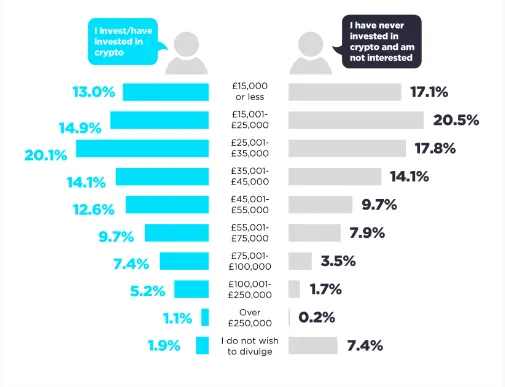

It wasn’t only the rich playing with cryptocurrencies either. The survey found that over 91.8% of current and previous cryptocurrency investors recorded a household income of under £100,000 ($136,000). As per earlier reports, 95% of UK citizens earn less than that figure.

In terms of age, youngsters and young adults unsurprisingly led the charts, as the demographic has a relatively higher disposable income and can take on more risk than older generations. Over 60.6% of UK investors were below the age of 34, the survey found.

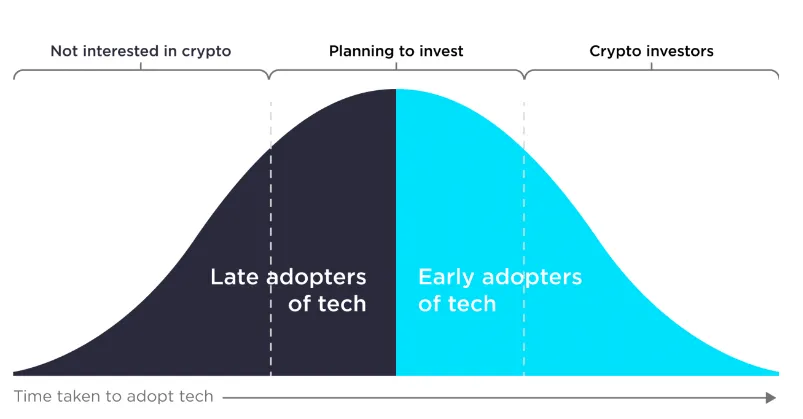

Another unsurprising finding was the average crypto investor was likely to have adopted other emerging technologies, apart from just digital currencies. As the below image shows, over half of all crypto investors had already dabbled in smart applications, sophisticated home security systems, and other smart home tech. Non-crypto investors were, however, less likely to have implemented any of the newer technologies.

As such, crypto investors are not planning to pause their purchases anytime soon. Gemini said that crypto investors were more likely to increase their investments over the next year, with nearly half (47.8%) planning to invest more, compared to one-third of overall respondents.

Blair Halliday, Gemini's head of the UK, said that such a response was made possible with the rise of safer, regulated, and more secure platforms available for trading and investing in cryptocurrencies.

“Crypto has never been more accessible,” he said in the regard, adding, “We expect the reach of crypto to widen further, particularly the 9.0% [of respondents] who are interested in crypto to enter the market,” he added.

But despite the new findings, Halliday still sees a long way for the industry to grow. He said the broader crypto sector had a huge opportunity to educate the 38.7% of respondents who either didn’t know about cryptocurrencies at all or were too scared to invest in the infamously volatile market.