In brief

- Per a survey from the UK financial watchdog, crypto adoption is on the up.

- Around 1.9 million people in the UK actively hold crypto, according to the report.

- Out of them, 43% keep their cryptocurrencies on the exchange they bought them.

In the UK, 1.9 million people—3.86% of its population—currently hold Bitcoin and other cryptocurrencies, according to research from the UK’s financial regulator, the Financial Conduct Authority (FCA).

Even more people have bought cryptocurrencies in total, with some having sold them. The FCA report, published Tuesday, highlighted a "significant" 2.35% increase in the number of people who have bought cryptocurrencies compared to the previous year, up from 1.5 million people to 2.6 million people in 2020.

People in the UK are hearing more about cryptocurrencies too. Per the survey, the amount of UK citizens conscious of cryptocurrencies has climbed from 42% in 2019 to 73% in 2020.

Out of the top five major cryptocurrencies, Bitcoin came out on top, with 78% of respondents recognizing it. It was followed by Facebook’s Libra—which has yet to launch—then Bitcoin Cash and Ethereum.

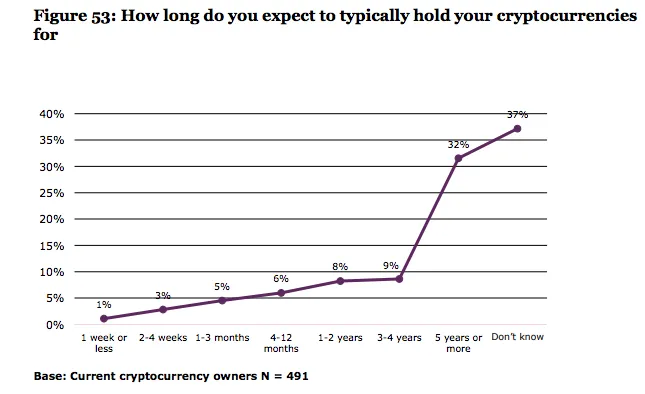

Most crypto holders reported being in it for the long term—with an aggregate 41% expecting to be invested for longer than three years.

Researchers pointed to a growing media spotlight on the sector, along with a spike in crypto advertisements, for the increased awareness.

Not your keys, not your Bitcoin

But where are hungry crypto enthusiasts buying their Bitcoin?

Coinbase topped out as the exchange of choice, with 63% of UK investors opting to buy via the San Francisco-based exchange. Meanwhile, Binance—one of the largest exchanges in the sector—took second place, citing just 15% of UK investor's patronage.

When it comes to storage, however, it seems UK crypto holders aren't adhering to best practice. A sizable 46% store their crypto haul on the exchange they bought them on. A further 34% noted that they move their funds to another crypto wallet—albeit an online one, and only 24% said they keep it offline, and more secure, in a hardware wallet.

While the UK is hearing about Bitcoin, clearly the adage "not your keys, not your Bitcoin," is falling on deaf ears.