In brief

- Bitcoin, Ethereum and other projects are all down in the last 24 hours.

- DeFi projects however continue their strong growth.

- Stock Markets are in the red amidst rumours the Fed will reduce its quantitative easing.

While the incumbents in the top 20 cryptocurrencies by global market cap have continued their slide, DeFi projects are defying the trend.

Bitcoin, Ethereum, Tether, Polkadot, Ripple, Cardano and almost all projects had a second day of straight losses. The biggest movements came from Polkadot - down 5.5%, Bitcoin Cash - down 4.5% and Chainlink down 3.6%.

For DeFi projects however, it was a very different story. Uniswap hasn’t stopped growing all week, gaining 10.1% in the last 24 hours and taking the project to the 14th largest overall.

AAVE too has been on a tear recently, adding 5.3% in the last day, taking it to 16th overall. Lastly, but no means leastly, Synthetix, a decentralized payment network, is up 9.5%, helping it break into the top 20 cryptocurrencies.

As we reported earlier in the week, the performance of DeFi projects had helped push Ethereum’s value to all time highs. But while this wasn’t the case today, these projects are still having a positive effect, with Ethereum only down 0.8% according to data company Nomics. Another positive effect on Ethereum’s price is the continued boom in NFTs.

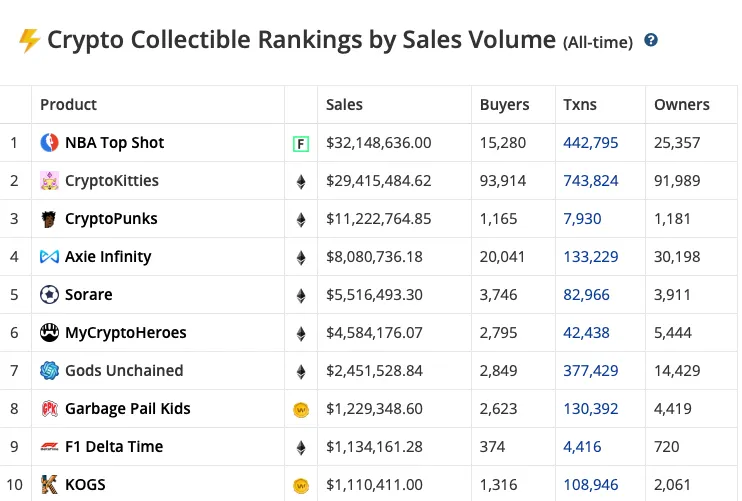

Yesterday Dapper Labs’ NBA Top Shot collectibles hit the number 1 spot in sales volume for the first time. The company that also makes CryptoKitties surpassed $32 million in sales, overtaking the collectible cats.

The NFT collectible market has sold nearly $100 million worth of collectibles thus far, with the top 5 collectibles all seeing 50% or more growth in the past seven days. For investors who are waiting for the next Bitcoin bull run, collectors of digital artwork are having their time in the sun.

Markets turn red amid fears Fed will pull back on quantitative easing

The Dow, S&P 500 and the Nasdaq all closed trading yesterday in the red over concerns the Fed may decide that it will pull back on its aggressive asset buying programme.

The Federal Reserve is due to give a statement this week which investors are watching with a keen eye as any reduction in federal support may cause a chain reaction that could see the markets plunge as the effects of COVID continue to linger.

But there were bright spots for investors yesterday. Apple, Google, Tesla, Netflix, Amazon and Facebook were all up in the day’s trading. The biggest mover was Microsoft, which gained 1.28% thanks to strong earnings reports.

Brought to you by AAX

Learn More about partnering with Decrypt.