In brief

- In 2021, banks now own crypto, and crypto has its own banks.

- Switzerland and Gibraltar have launched crypto banks, and last week the US issued Anchorage with the first federal charter.

- Traditional banks are also moving into cryptocurrencies and a new, hybrid landscape is emerging.

If you take a walk in Gibraltar’s main square, past the city vault and the smart—but still shuttered—premises of the territory’s newest bank, you won’t notice anything remarkable.

Yet the building, a former crystal factory, is now the home of Xapo Bank Gibraltar Ltd, Europe’s first physical cryptocurrency bank, and one of the forerunners of a quiet revolution in banking.

That regulators in Gibraltar and Switzerland are licensing crypto firms as fully-fledged banks, authorized to custody funds, trade, and lend on behalf of their clients, may not be so surprising. But, last week, the US banking regulator, the Office of the Comptroller of the Currency (OCC), joined the fray and cleared Visa-backed digital asset platform Anchorage as the first federally chartered crypto bank—paving the way for the integration of crypto assets into the mainstream economy.

The action signals a new legitimacy for cryptocurrency and accompanies growing pressure on mainstream banks, whose institutional clients are hungry to safely access the trillion-dollar crypto market. The OCC has even provided explicit reassurance that banks can hold cryptocurrencies—a service many have been none too keen to perform.

As the new crypto banks prepare to build out a brave, new banking landscape, Decrypt spoke to Anchorage, crypto exchange Kraken, and others embarking on this venture.

The first federally chartered crypto bank

The federal trust charter Anchorage has received covers all the services it currently offers to its institutional clients: custody, trading, financing, lending, borrowing, and governance of crypto assets.

But it also gives the firm the flexibility to operate under just one regulator, the OCC, rather than the differing laws governing cryptocurrencies that exist at state level. No longer is the startup at a disadvantage compared to their clients, who are often other banks.

“There’s never been a higher watermark than a federally chartered bank,” Anchorage cofounder and president Diogo Monica told Decrypt. “There are other regulatory regimes in which crypto has been either condoned or crystallized in the form of a specific charter. But in the US, that had not been the case. And, given that it's the world's largest economy, this is a huge step for everyone.”

"Crypto deserves a bank, and we are immensely proud of being approved as the one to set the standard." -@diogomonica and @nathanmccauley

Read the full announcement 👇👇https://t.co/0bvQHtCbCj

— Anchorage (@Anchorage) January 13, 2021

Monica is a veteran of payments giant Square—one of the first major companies to champion Bitcoin. He said that the interest in cryptocurrencies shown by Square and, more recently, PayPal, has inspired a great deal of interest among potential Anchorage clients, some of them major banks.

"After PayPal, all these neo banks and challenger banks want to offer Bitcoin to buy and sell."

"After PayPal, all these neo banks and challenger banks want to offer Bitcoin to buy and sell, and they're all coming to Anchorage to provide them those services,” he said. “We're going to see quite a few of these coming up with crypto products. That's going to be something that is going to take the fintech world by storm."

From Wall St. to Wyoming

Kraken, a brokerage, cryptocurrency exchange, and custodian founded in 2011, has taken a different approach to Anchorage, and looked to Wyoming for regulation, and permission to become its own bank.

The sparsely-populated state is a far cry from Wall Street, but it’s now the birthplace of the first US-based crypto bank, Kraken Financial, which is set to launch before the end of June 2021.

Kraken was the first recipient of a Wyoming Special Purpose Depository Institution (SPDI) license, enabling it to take deposits, operate payments systems and custody cryptocurrency on behalf of its customers—individuals, businesses and also regulated entities bound by law to use only chartered banks for custodial services.

“Kraken is, at its heart, a technology company, and so being able to build the architecture and integrating the API the way we want to is going to have a pretty profound operational and customer experience effect,” David Kinitsky, CEO of Kraken Financial, told Decrypt.

Kinitsky, who has worked for Fidelity Investments and Grayscale Bitcoin Trust—two of the biggest companies involved in the digital asset industry—moved out to Wyoming with his family from New York City to live “among the bison” while setting up Kraken Financial.

NEW: Kraken Wins Bank Charter Approvalhttps://t.co/NnJTMWQJQZ

— Kraken Exchange (@krakenfx) September 16, 2020

In addition to providing more control, a banking license will enable Kraken to offer new products and services—“different types of investment accounts, things like tax advantages or retirement accounts,” said Kinitsky, and to serve new institutional or jurisdictional markets.

However, Kraken’s charter, which was designed specifically for the crypto business, does not allow it to operate on a fractional reserve basis, which is commonly how retail banks make their money. SPDIs must maintain all of their customers’ reserves at all times.

So it will be more like a custodial bank, rather than a retail lending one, which loans out customer deposits. This diminishes some of the insolvency risks, and will not stop Kraken from offering “digital asset lending that's more customer-directed,” said Kinitsky.

Coming soon to town centers worldwide

Gibraltar-registered Xapo, a crypto custodian since 2013, has adopted a more traditional approach with its customers. It’s predominantly targeting wealthy clients in emerging markets, who have the option of face-to-face interaction within its prime-real-estate perch on Grand Casemates Square.

Notably, Xapo, founded by serial entrepreneur and Bitcoin bull Wences Casares, threw in the towel with American regulators some time ago. Now, it’s been awarded a full and unrestricted banking license in Gibraltar, a spokesperson for the Territory's regulator told Decrypt, and the only thing stopping the bank from opening is the coronavirus pandemic.

In India, Unicas, a joint venture between crypto banking platform Cashaa and United Multistate Credit Co. Operative Society, has already rolled out 14 physical crypto-banking branches.

But it was Switzerland that first attempted to regulate cryptocurrency banking, and its experience is illuminating.

Zug-based Seba and Zurich and Singapore-based Sygnum were granted Swiss provisional banking and securities licenses in 2019. That has enabled them to integrate cryptocurrency into a wide range of services—including deposits, withdrawals, lending and investing.

Crypto finance pioneer Bitcoin Suisse, which has been a regulated financial intermediary since 2014, is now also in the frame for a banking licence, and plans a public listing. But one year on, the new banks have faced challenges.

Internal strife at Seba over strategy, and whether the new bank should focus on trading or take a broader approach, has reportedly led to resignations. The novice bank blew through almost £100 million in its first two years, and now needs another raise from its Asian funding base, according to Finews. The Swiss publication reports that the political and economic considerations of a Swiss bank funded by Asian investors aren’t lost on the country’s regulators.

Sygnum, meanwhile, has tokenized its shares, claiming to be the first bank to do so. It's also developing plans for a public offering. In partnership with national telecoms giant Swisscom, and SIX, owner of the Swiss Stock Exchange, Sygnum is launching an “Institutional Digital Asset Gateway,” to offer mainstream Swiss banks access to digital asset services in the first quarter of 2021.

The gatekeepers vault the gates

Major banks have been toying with cryptocurrencies for a while now, buoyed by interest in stablecoins such as Diem—the project associated with Facebook. At the end of 2020, this activity increased markedly, according to Alexandre Lemarchand, vice president of global sales at digital asset custody solutions provider Ledger Vault.

“The more traditional financial entities, they started to look at digital assets more through the angle of tokens, to simplify process, reduce cost, etc. But now, for the first time, I see true interest in Bitcoin,” he told Decrypt.

Su Zhu, CEO of investment firm Three Arrows Capital, believes that this will be the year that some central banks announce stakes in BTC, and investment and private banks launch crypto offerings.

Last September, two of America’s biggest banks launched digital currencies, to provide customers with speedier transaction times, and other benefits. Meanwhile, PNC, the eighth-largest bank in the US, and Spanish bank Santander introduced Ripple as their crypto solution for cross-border payments.

"Banks worldwide are beginning to realize that cryptocurrencies are here to stay."

“It took nearly a decade, but finally, banks worldwide are beginning to realize that cryptocurrencies are here to stay. This is primarily driven by [a] better regulatory environment; client demand; growth and demand in Bitcoin; and discussions by various governments to digitize their own currency,” Felix Shipkevich, an attorney with 10 years experience in the digital currency space, told Decrypt.

Brian Brooks, the former US Acting Comptroller of the Currency, has done much to reassure the financial services industry that digital assets can be adequately risk-managed; that banks have legal authority to custody them, and to use blockchains and stablecoins for payments.

1/ 🚨 BREAKING: US Office of the Comptroller of the Currency proposes rule prohibiting large banks from discriminating against "legal but disfavored" customers like oil & gas biz, independent ATM operators and of course...

crypto companies.

— Marco Santori (@msantoriESQ) November 20, 2020

A proposed rule that would further push banks to serve all legal businesses, including crypto businesses, is under consideration.

But the crypto industry is not so keen on another, Treasury-backed, proposal, requiring money services businesses, including banks and crypto exchanges, to record and report cryptocurrency transactions to private wallets if they meet a certain dollar threshold. They are likely to hamper broader adoption of self-hosted wallets, and potentially drive more users to regulated services.

However, on President Joe Biden's first day in office, the progress of this rule was paused (along with other pending federal rules) to allow time for his administration to review them.

The new crypto banking landscape

Of course, the banking industry is the very antithesis of the culture that early Bitcoin advocates sought to propagate. But mainstream consumers are likely to appreciate the new breed of bank springing up—one that promises instantaneous transactions, tantalizing new financial products, as well as a secure and convenient place to custody cryptocurrency.

I'm going to explain this again - you might hate regulation of BTC, you might have a MASSIVE philosophical aversion to it, and that is fine, but they are going to regulate the fiat on ramps and off ramps and it will make you RICH, as institutions now be able adopt it. #tradeoffs

— Raoul Pal (@RaoulGMI) November 30, 2020

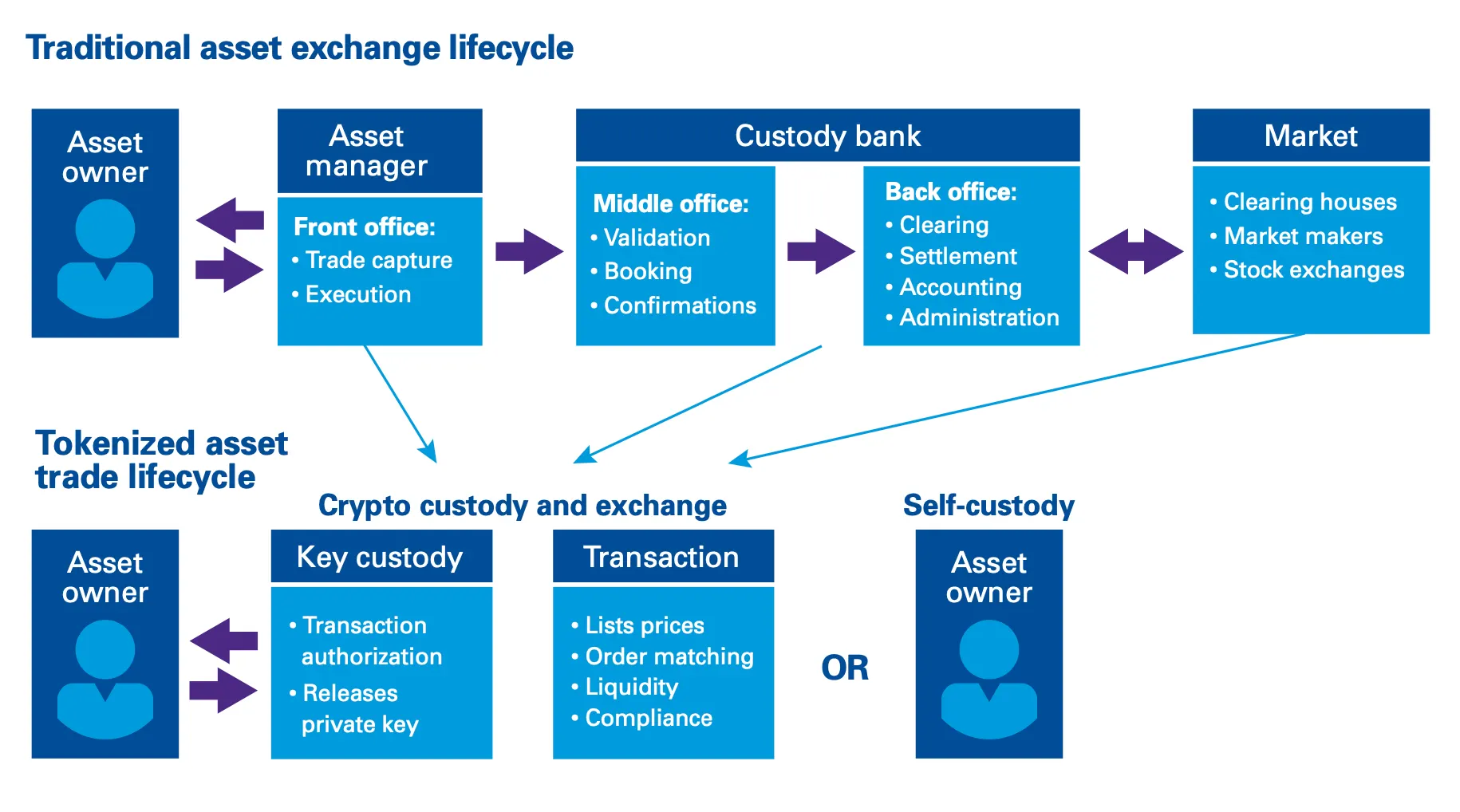

A new, regulated crypto landscape is still emerging, as are the hybrid financial services it will introduce, with banks partnering with or acquiring crypto startups, and others, such as Kraken, offering a “full stack” approach—with brokerage, exchange and banking services all under one roof.

“It's two worlds coming together, how it’s going to happen nobody can tell you right now. But for sure we see more and more interest from crypto actors becoming regulated, and embracing more standard compliance requirements to gain the trust of their customers,” said Ledger’s Lemarchand.

The venture arm of Thailand’s Siam Commercial Bank is already moving in on Decentralized Finance, and working on a suite of products that bridges the gap with traditional finance, in partnership with DeFi ecosystem Alpha Finance Lab.

In Germany, an amendment to the EU’s fourth anti-money laundering directive gives national fintechs authority to not only custody but sell cryptocurrencies, and over 60 would-be banks have applied for a license there.

The big banks are rapidly moving into crypto custody to catch up with customer demand. A report by consultancy firm KPMG earlier this year stated that the cryptocurrency custody industry had "tremendous growth potential."

In just one week in early December, Spanish bank BBVA, the UK’s Standard Chartered, and Singapore’s DBS all launched crypto custody or trading services, either through a partner or an intermediary, and Goldman Sachs’ plans to offer crypto custody are reportedly imminent.

In Italy, the most popular private bank, Banca Generali, recently acquired a $14 million stake in the crypto-to-crypto wallet provider Conio.

“This agreement strengthens both services for clients, and the technology to be leveraged with the partnership for future applications (in the wake of possible future digital currencies and so on)” Michele Seghizzi, Banca Generali’s head of marketing told Decrypt.

He added that a broader approach to technology and international best practices was behind all the bank’s partnerships: “We want to be sure to be able to offer broader services to our clients and to develop the skills to be competitive in this new environment.”

It’s a trend that’s sure to continue throughout 2021. “The crypto industry will have a record year of consolidation as the M&A market heats up and fintech / banks scoop up crypto companies,” said Kinjal Shah, a senior associate at venture firm Blockchain Capital.

New US President Joe Biden has nominated Michael Barr as Comptroller of the Currency, but both Monica and Kinitsky stressed that Brooks’ work and guidance is unlikely to be rolled back, despite the negative attitude towards cryptocurrencies displayed by Treasury nominee Janet Yellen.

In Wyoming, a second SPDI license has already been awarded—to Avanti, a crypto bank that is planning to issue its own currency. Avanti managing director, long-time crypto advocate Caitlin Long, played a major role in crafting and lobbying for the Wyoming legislation.

A clutch of other startups, including PayPal cryptocurrency partner Paxos, and payment provider BitPay, are following in the footsteps of Anchorage with applications for national charters.

Essential questions regarding custody and the use of stablecoins remain. The so-called STABLE Act would significantly tighten legal expectations for entities offering stablecoins, which provide a key fiat-crypto onramp. Should it be adopted, a banking license will effectively be a requirement.

Twelve years after the birth of Bitcoin, the hard truth is that banks can no longer ignore cryptocurrencies. Ironically, some, such as Deltec, the Bahamas-based bank that holds the reserves for the leading stablecoin issuer Tether, have even invested in Bitcoin themselves.

In 2021, more banks will own crypto, and crypto has its own banks.