In brief

- Investors set to continue the boom in emerging markets in 2021.

- Ethereum surges past $1,000 as investors eye up new assets.

- Georgia State Runoff set to influence market sentiment in 2021.

Welcome back to Market Watch, readers. What a Christmas break it has been. While we’re sure you’ve been following events over the festive period, we’ll be looking at what lies ahead--and it appears it will be more of the same.

While investors saw in the new year by pushing Bitcoin’s price to eye-watering levels, there appears to be no sating the appetite of American investors looking to continue the “everything rally” of 2020.

Bitcoin and cryptocurrencies more broadly were swept up in an investor fever that saw 90% of 70 different financial asset classes surge since the collapse in April 2020. This was only the third time in five decades that such a rally has ever been recorded.

“Investors can’t get enough risk—whatever it is,” Emily Roland, co-chief investment strategist at John Hancock Investment Management told the Wall Street Journal. “Momentum is a powerful force, and we don’t want to fight it.”

That sentiment is echoed by the American Association of Individual Investors, which reports that bullish sentiment is at its highest in several years. Fund managers are also feeling optimistic that 2021 will be a bountiful year, according to a Bank of America survey. The amount of cash being held in reserves is at its lowest level since May 2013, indicating they’re searching for opportunities to increase profits.

All of which points to increased investor appetite in cryptocurrencies. While at the time of writing, Bitcoin has pulled back from its $34,000 high, Ethereum sailed past $1,000, bringing it ever closer to its all time high of $1,432 set in January 2018.

Traders are “looking for ‘the next BTC’,” said Nimrod Lehavi, CEO and founder of crypto payments company Simplex.

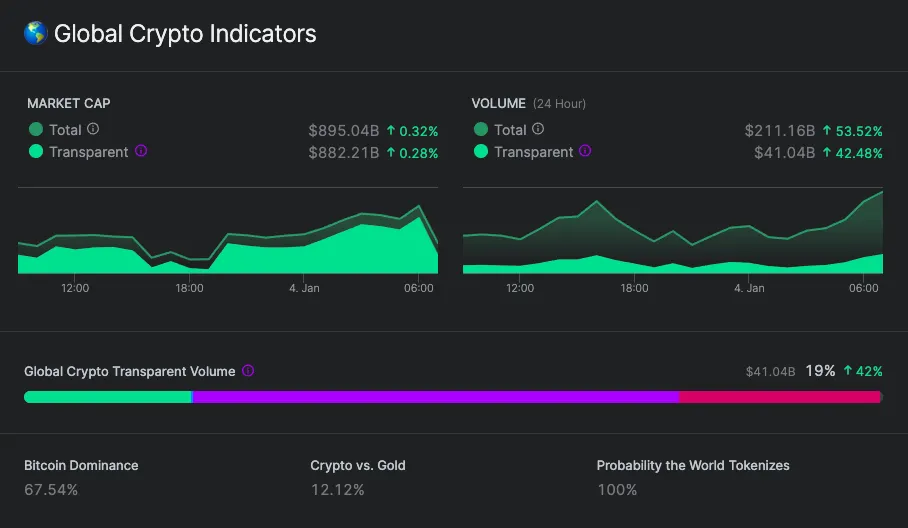

It’s not difficult to see why that’s the case. When we left you in the doldrums of 2020, the global market cap of cryptocurrencies was hovering just above the $500 billion mark. Earlier today it was at $922 billion, according to data provider Nomics.

Investors Eye Georgia Senate Runoff As Indicator For Biden Presidency

Futures Markets were all up strongly over the weekend, with the S&P, Dow, Nasdaq and Russell 2000 indices all reporting upturns.

The performance appears to be connected to the Senate runoff in Georgia. A neck and neck race between Democrat Raphael Warnock and Republican incumbent Kelly Loeffler has become a key indicator of what sort of Presidency Joe Biden will have.

If the Republicans hold onto the seat, they retain a majority in the Senate, making Biden’s plans for increased financial stimulus and tax increases unlikely.

If the Democrats take both seats, giving both parties an even 50 seats in the Senate, vice President Kamala Harris could tip decisions in Democrat’s favour thanks to her ability to cast tie-breaking votes.

The markets want the Republicans to retain the seat, as a ‘light blue sweep’ “could pose some downside for equities and reintroduce risk of anti-growth policy changes (i.e. tax increases),” JPMorgan strategist Dubravko Lakos-Bujas said in a recent note.

At the time of writing, it appears the market may have its wishes granted, but we won’t know for sure until tomorrow.

Brought to you by AAX

Learn More about partnering with Decrypt.