In brief

- Former Ripple CTO Jed McCaleb received 266 million XRP this morning and has already sold a chunk of it.

- McCaleb, now the co-founder of Stellar, has been dumping XRP on the open market ever since leaving Ripple in 2014.

- His public wallet holds over 251 million XRP (worth $138 million) as of today.

Stellar co-founder Jed McCaleb is taking advantage of high XRP prices while he still can. The former Ripple CTO received over 266 million XRP earlier this week and immediately proceeded to sell the tokens, on-chain data shows.

🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 266,305,309 #XRP (148,031,671 USD) transferred from Jed McCaleb Settlement to Jed McCaleb wallet

— Whale Alert (@whale_alert) December 9, 2020

McCaleb was part of Ripple’s founding team until 2013, trying to build a crypto payments network to rival Bitcoin’s. He left the firm in 2014 to develop Stellar.

But the break up came with generous alimony. McCaleb was awarded over 9 billion XRP for his role in founding OpenCoin (which later rebranded to Ripple) on a fixed schedule with no strings attached—except for not dumping the 9 billion tokens in one go—meaning he was free to sell, store, trade, or donate his XRP with no consequences or prior permission.

And sell he did. McCaleb announced his intentions to sell his XRP on XRP Talk, a Ripple community forum, back in 2014 and has yet to put the brakes on his sales.

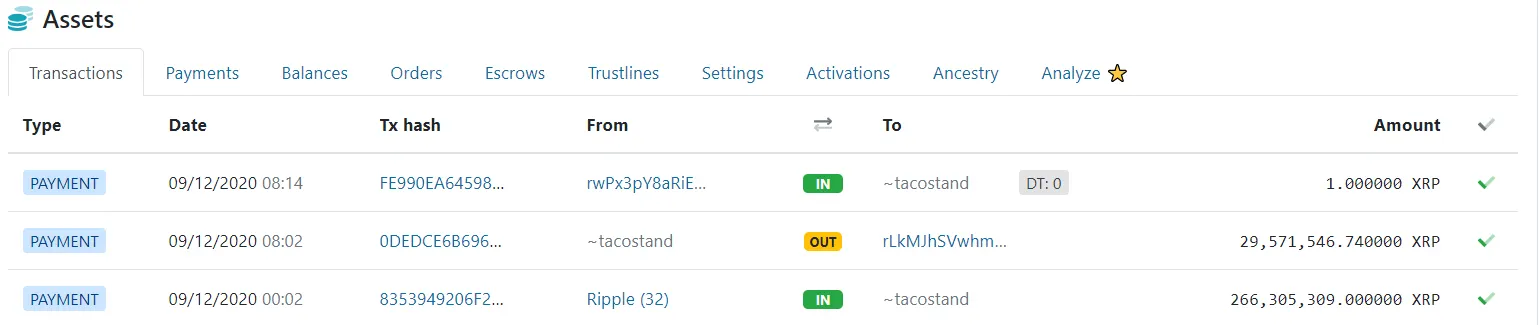

The latest of those came in earlier today, as the image below shows. McCaleb received 266, 305, 309 XRP this morning, and dumped more than 10% of that stash eight hours later.

The amount he received was worth a staggering $148 million, as per analytics site CoinGecko, with McCaleb banking $16.2 million on his sale (considering an average price of $0.56). XRP itself fell -6.2% in the hours after and now currently trades at $0.54.

He has also made other sales this month. On-chain data shows McCaleb’s public wallets received 113.3 million XRP on December 1, with McCaleb sending (and selling) the funds out in batches of approximately 10 million XRP in the days after.

At press time, his so-called “~tacostand” wallet holds over 251 million XRP ($138 million at current prices), or about 0.5% of the token’s entire circulating supply.

But McCaleb isn’t the only en masse XRP seller. Ripple, which has backed off from its ties to XRP in the past few years, also holds about 50 billion XRP in an escrow wallet and regularly sells the token to fund its own operations (although they have recently started to buy XRP to support its price as well).

This has, understandably, created massive controversy and criticism for the company among crypto circles, but it has still not stopped XRP from maintaining its position as the world’s third-largest cryptocurrency by market cap.

However, McCaleb did pledge to donate the proceeds of selling 2 billion XRP to charitable causes in 2014, so not all the money is flowing into his pockets.