In brief

#Bitcoin miner revenue is back at pre-halving levels.

Chart: https://t.co/Ao9DodRwqi pic.twitter.com/PwUHPaKz8L

— glassnode (@glassnode) November 18, 2020

$66,629.00

-0.05%$1,970.48

0.08%$622.53

0.54%$1.37

-1.33%$0.999998

0.00%$84.89

-0.46%$0.281847

0.05%$1.029

0.00%$0.093562

-0.98%$49.00

-1.33%$0.277669

-1.32%$0.999988

0.04%$449.25

-1.21%$9.25

2.84%$32.19

5.84%$343.94

1.06%$8.81

-0.63%$0.162721

-3.01%$0.999396

-0.01%$0.156337

-1.88%$0.999493

0.00%$0.0092475

-0.04%$0.098589

-1.53%$1.00

0.00%$54.03

-0.45%$9.12

-0.70%$219.78

-0.66%$0.906575

0.27%$0.00000565

-2.02%$0.075459

-0.93%$0.109635

-3.05%$5,306.45

-0.17%$1.22

-3.72%$1.58

-2.83%$1.50

3.29%$5,379.01

-0.10%$3.83

-0.12%$0.640645

0.48%$1.00

0.00%$1.12

0.00%$0.999925

-0.01%$0.713192

-0.49%$115.21

2.30%$0.996731

0.05%$178.67

-1.36%$76.54

-0.16%$0.168767

-1.13%$0.067779

-0.45%$1.18

2.53%$1.00

-0.00%$2.13

-0.88%$0.00000349

-4.56%$0.00000152

-2.77%$8.63

-0.16%$2.40

-2.52%$0.999214

-0.02%$0.255989

-2.19%$11.00

0.00%$0.00196279

2.63%$0.107579

-0.52%$6.95

-1.19%$0.390083

-0.96%$7.66

-2.78%$1.76

0.23%$0.05794

-0.24%$0.01677319

-4.35%$62.33

-1.88%$1.81

-1.43%$0.105702

1.29%$0.85068

-1.71%$0.99968

-0.05%$3.46

-0.20%$0.00942083

-0.45%$0.02971348

0.09%$1.24

-0.22%$0.087053

-0.54%$114.44

0.00%$0.957792

0.26%$0.984033

-1.74%$1.028

0.00%$1.00

-0.01%$1.37

-1.92%$1.084

-2.82%$0.03268481

-0.55%$0.03261921

-2.47%$0.00724644

-0.28%$0.080583

0.99%$0.102303

2.05%$0.170777

5.78%$0.57753

-0.36%$1.096

0.00%$0.994862

-0.39%$30.87

-6.84%$1.00

-0.00%$0.00000594

-0.79%$0.01285794

-0.67%$0.999087

-0.03%$1.088

-0.15%$0.25675

-1.66%$0.06921

1.25%$1.18

-0.21%$0.999827

-0.02%$0.254554

-3.39%$0.700738

-2.40%$1.32

-0.08%$0.00684812

-2.09%$0.04797431

0.57%$32.65

-1.23%$171.98

2.09%$0.374224

-3.74%$1.001

0.02%$0.509849

1.18%$1.82

4.13%$1.75

-12.32%$0.244461

-2.10%$0.081534

0.71%$0.999798

0.01%$0.03361178

-1.87%$0.152568

-1.99%$1.38

-1.00%$1.018

-0.03%$127.43

0.63%$0.00000034

0.24%$0.00000033

-0.32%$3.33

-2.68%$0.054911

-1.48%$0.345375

-2.98%$0.880158

-4.72%$15.37

-2.25%$3.05

-1.43%$0.323436

3.07%$6.64

23.29%$0.01516921

-2.80%$0.325841

0.02%$0.997305

-0.04%$0.066759

-2.04%$0.04892596

-0.11%$0.02606096

-0.69%$0.992209

-0.71%$17.44

-1.55%$13.82

9.97%$0.233529

2.61%$0.00546183

-2.46%$0.00002772

0.04%$0.123856

1.34%$0.305685

0.01%$0.073813

-3.92%$1.57

2.18%$0.04784446

-2.02%$0.00253776

-1.80%$0.00242232

-0.72%$1.28

-1.16%$0.00004309

-6.03%$6.05

-0.67%$0.126356

1.27%$0.02107261

0.71%$1.82

0.32%$0.998348

0.06%$0.084282

0.34%$0.99535

-1.04%$0.0406784

-2.50%$0.098935

-2.51%$0.999998

0.00%$0.984022

0.00%$0.999937

0.02%$1.28

-2.50%$1.076

0.00%$1.28

-1.33%$0.000001

0.38%$0.500707

0.88%$22.79

0.00%$0.00201384

-3.19%$0.199804

1.52%$0.098127

-0.78%$0.194684

-0.04%$1.00

0.00%$0.188927

-1.65%$4,989.17

0.52%$0.097195

0.52%$0.052224

0.52%$0.188042

9.30%$0.079342

-1.11%$2.63

-4.02%$0.250835

-14.01%$1.00

0.00%$0.999562

0.05%$0.00465872

-3.11%$17.93

-0.99%$0.01876203

-1.86%$0.077065

-1.67%$2.15

-2.48%$0.00355201

-0.78%$2.08

1.34%$0.02035751

-0.26%$0.052931

0.22%$1.80

-0.33%$48.00

-0.01%$0.598063

-1.51%$1.74

-0.55%$0.995899

0.09%$1.27

0.87%$0.156132

-4.98%$0.156501

-12.72%$0.102783

-2.94%$3.28

-4.83%$0.02099117

-3.68%$0.04010328

0.89%$0.998483

-0.45%$0.268599

-3.91%$0.998335

0.03%$0.169544

3.28%$0.00000716

-0.17%$0.316029

-4.11%$0.39784

-0.43%$0.602978

-2.33%$0.136924

1.46%$1.014

-0.02%$0.134509

-3.17%$0.623807

-4.27%$0.286404

-3.37%$0.264481

0.27%$1,096.62

0.02%$0.093174

-0.11%$0.074415

-2.35%$4.39

-2.61%$0.07947

-1.13%$0.02198869

-2.56%$11.23

-0.70%$0.130566

0.02%$0.302256

1.03%$0.24596

-0.40%$0.00143973

-0.08%$0.00393884

2.40%$1.001

0.00%$0.212499

-0.36%$0.268428

-0.21%$1.08

0.06%$1.47

-6.47%$0.181296

-1.88%$2.31

-0.76%$0.999976

-0.03%$0.999211

-0.05%$1.063

-0.01%$0.999668

-0.00%$0.999034

-0.06%$0.994442

-0.06%$0.111414

1.05%$0.00631035

5.99%

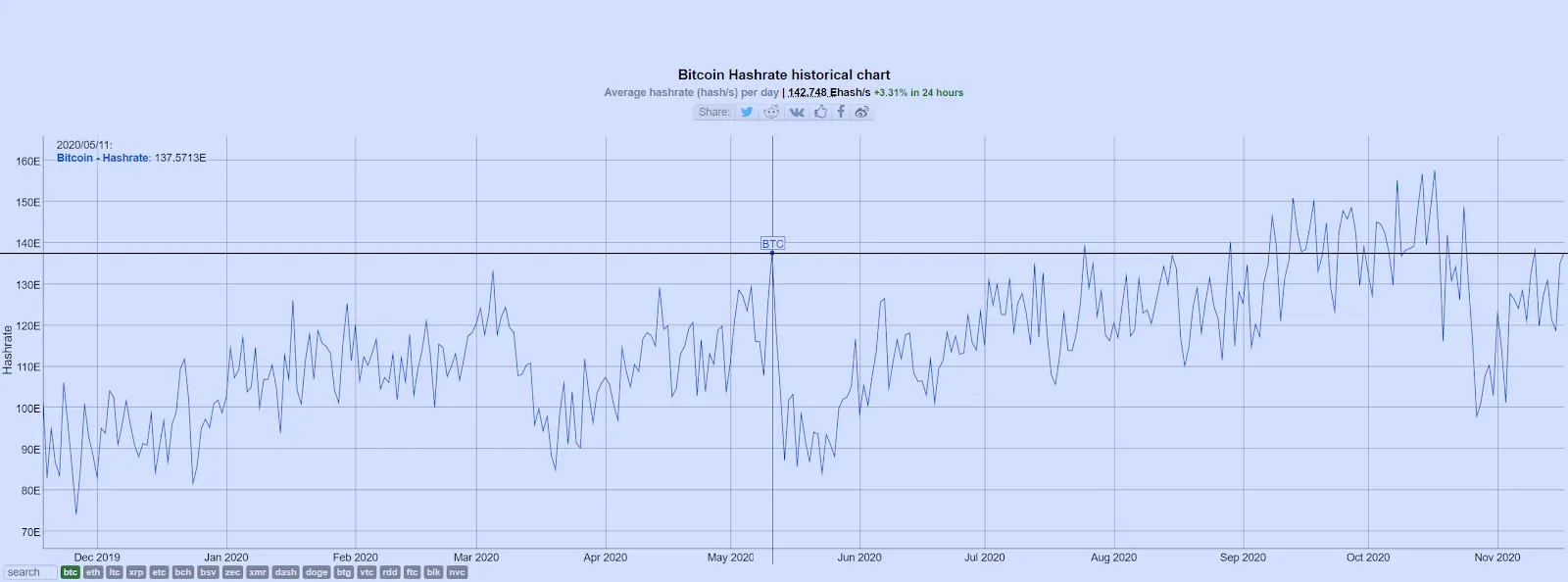

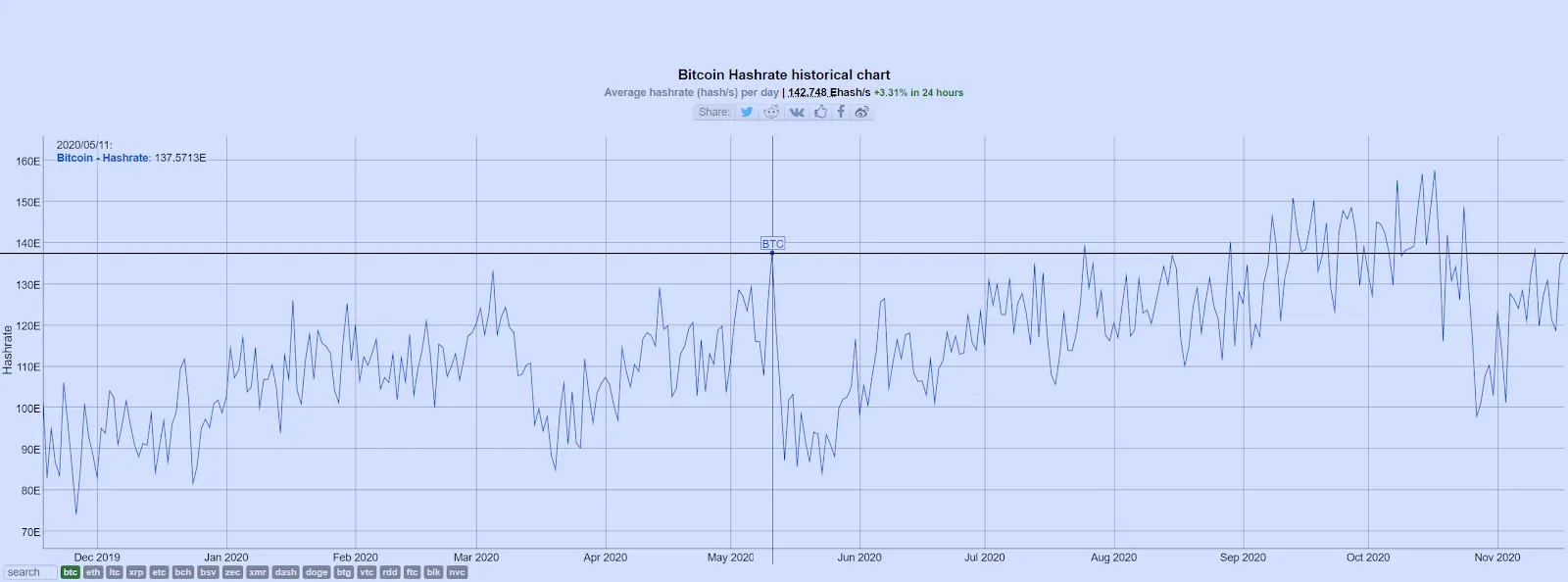

Back in May, the reward for mining new Bitcoin was cut in half. But so popular is Bitcoin, that miners have ramped revenues right back up to pre-May levels, data from market analytics firm Glassnode shows.

Due to a feature baked into the Bitcoin protocol, the reward the network provides to miners for processing transactions cuts in half approximately every four years. This event, known as the Bitcoin Halving, effectively means that miners have to work twice as hard to make the same profits.

The logic is that, as more Bitcoin gets mined and more people use the network, it becomes harder to mine Bitcoin and thus its value increases.

And so it was, that on May 11 the total mining revenue for Bitcoin miners fell from $19 million to $7.9 million. Then, almost on cue, mining revenue started to pick back up as more powerful miners went online and the price of Bitcoin increased.

But things didn’t get too crazy until this month, when prices hit highs unseen since the December 2017 bull run. On November 1, mining revenue was up to $13 million per day.

And then on November 9, it happened: Bitcoin mining revenue rivaled that of pre-Bitcoin halving days, at $19.9 million, almost a million dollars higher than in May.

#Bitcoin miner revenue is back at pre-halving levels.

Chart: https://t.co/Ao9DodRwqi pic.twitter.com/PwUHPaKz8L

— glassnode (@glassnode) November 18, 2020

The subsequent days haven’t observed a massive dip, either. As of yesterday, the most recent day for which Glassnode shows data, the Bitcoin mining revenue of all miners hit $18.3 million.

Part of the fluctuation has to do with the price of Bitcoin. Mining hash rate—the combined computational power of Bitcoin miners—had hit pre-halving highs as early as July, according to data from BitInfoCharts.

But while Bitcoin’s price stagnated over the summer, its bull run this month lined miners’ wallets.