In brief

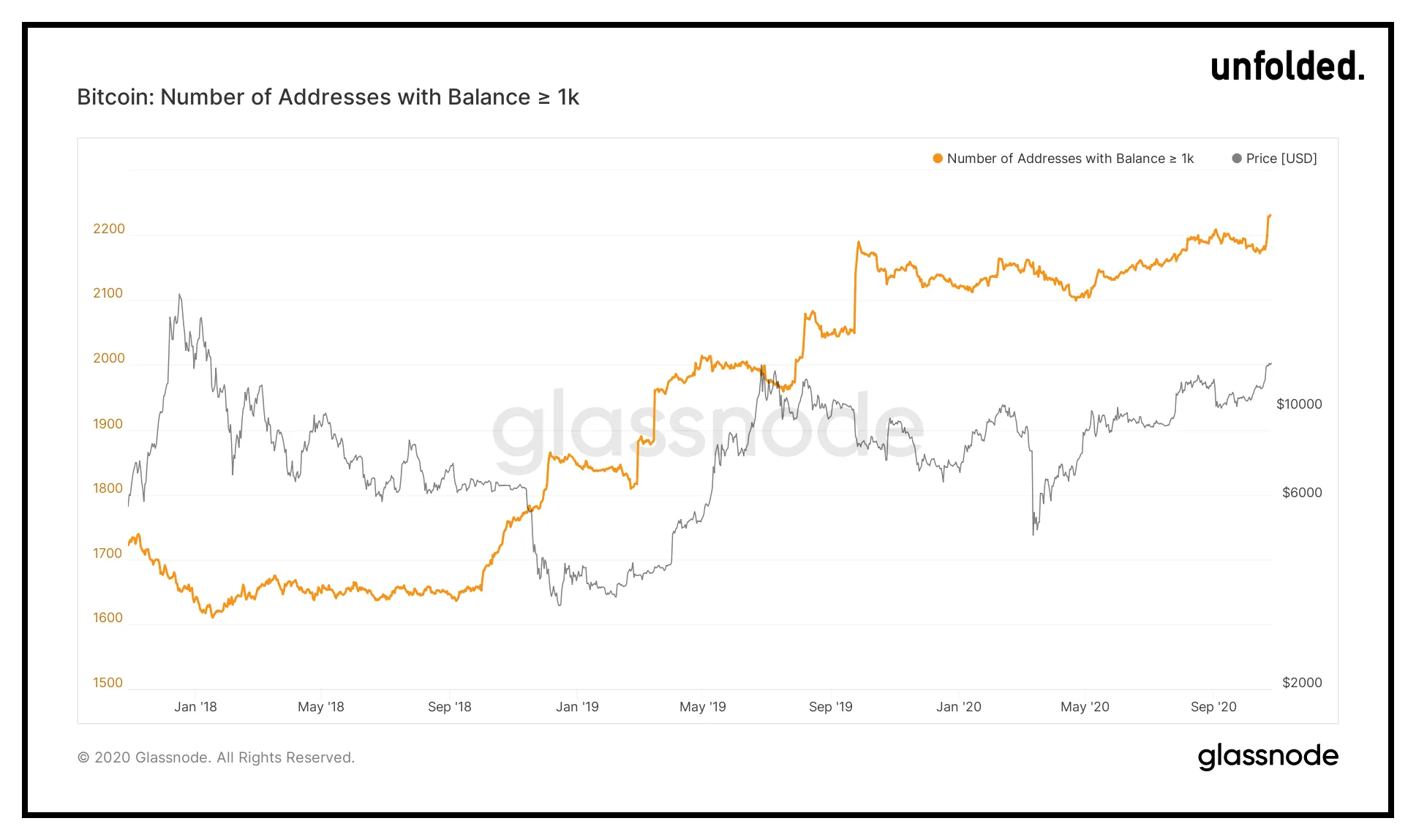

- The number of Bitcoin addresses holding over $1,000 has hit an all time high.

- The latest data shows that 2,231 Bitcoin addresses fit this category.

- Experts suggest several possible reasons: institutional investors buying Bitcoin, consolidation of addresses by HNW individuals, or exchanges becoming larger

According to data published by Glassnode, the total number of Bitcoin addresses with a balance of 1,000 Bitcoin or over has hit a new all-time high.

Yesterday, the total number of Bitcoin addresses holding over 1,000 BTC hit 2,231, with the Bitcoin price at the time given at $13,025. The previous record was set just a couple of days earlier on October 23, when the total number of Bitcoin addresses holding over 1,000 reached 2,229.

Current figures mark a short term surge in numbers, where the total number of relevant Bitcoin addresses leaped from 2,178 on October 20.

Why has the number of addresses gone up?

According to Elias Strehle, researcher at the Blockchain Research Lab, there could be multiple explanations for the increasing number of Bitcoin addresses holding 1,000 BTC or more.

“This could mean an actual concentration of wealth, or it could mean that wealthy Bitcoiners are storing their money on fewer addresses, or it could be a side effect of crypto exchanges becoming larger,” Strehle told Decrypt.

An actual concentration of wealth is a compelling argument for other Bitcoin watchers. Jason Deane, Bitcoin analyst at Quantum Economics, told Decrypt he “wouldn’t be surprised if we see this trend actually increase over time, as more and more high net worth individuals look for safe havens against fiat currencies across the globe.”

High net worth individuals and institutional investors

As well as individual high net worth investors, the trend of institutional investors taking a harder look at Bitcoin has gained momentum in recent months.

In August of this year, MicroStrategy announced a $250 million investment in Bitcoin, followed a month later by an additional $183 million. This month, MicroStrategy was followed by Square, who made a $50 million investment in Bitcoin of its own.

This trend, labeled by Deane as the “MicroStrategy effect” has essentially “kick-started corporate-level investment and those organizations are more likely to acquire larger amounts of Bitcoin, putting them immediately in the ‘whale’ category by definition,” Deane added.

Yet, there are other potential explanations, especially given the fact there has been a short term surge in Bitcoin’s price.

“If it happens all in one day, I would expect this to be an artificial effect (like a cold wallet distribution) rather than generic growth,” Ingo Fiedler, co-founder of the Blockchain Research Lab, told Decrypt.