Who actually uses decentralized exchanges to trade these days? The answer is, hardly anyone, according to a new report by TokenInsight, an independent blockchain research company. While decentralized exchanges account for 19 percent of all exchanges operating, says the paper, they make up just 0.8 percent of trades.

Yet, despite the minuscule figures, EOS, and its mainnet that launched last year in complete chaos, has become a hub for a slew of new decentralized exchanges. And that just might nudge those numbers up.

Historically, the biggest decentralized exchanges—IDEX and ForkDelta—sat on the Ethereum network, which launched in 2015. But the network’s speed for processing trades, dictated by the 14-second block creation times, is slow when compared to its centralized cousins. EOS, meanwhile, which launched last summer, creates blocks every 0.5 seconds, which has helped it pick up a lot of new decentralized exchanges. In fact, there are now equal numbers of EOS-based and Ethereum-based decentralized exchanges, according to the report.

The report also points to a spike in tokens listed on EOS. By the end of 2018, 2,859 projects were listed on the platform. TokenInsight suggests that surge is due to new tokens finding it difficult to be carried on centralized exchanges, which drives them to find listings on EOS's decentralized platforms.

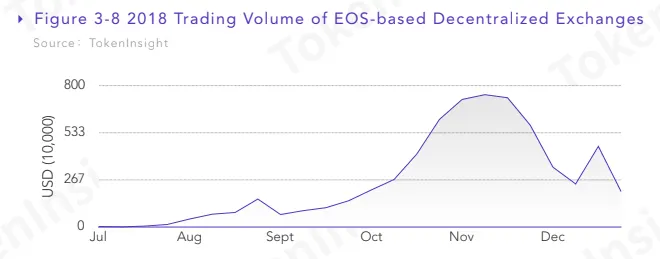

Among the biggest winners is Newdex, which accounts for 75 percent of trades made on EOS. (DEXEOS was initially popular but now accounts for just a slice of the market share.) As more platforms have been created, trading volume has grown. In the fourth quarter of 2018, trading volume was four times higher than the previous quarter, when EOS had just launched. However, daily volume peaked at around $7.5 million across all EOS-based platforms, and has since shrunk to $2.5 million at the end of December.

While they appear to be neck and neck in terms of numbers of decentralized exchanges, “Ethereum-based tokens still dominate the market in terms of trading amount and volume,” concludes the report. While it seems Ethereum’s first mover advantage is unlikely to be upended any time soon, EOS is the new kid on the block that could help make decentralized exchanges fulfill their trustless—and less hackable—promise.