In brief

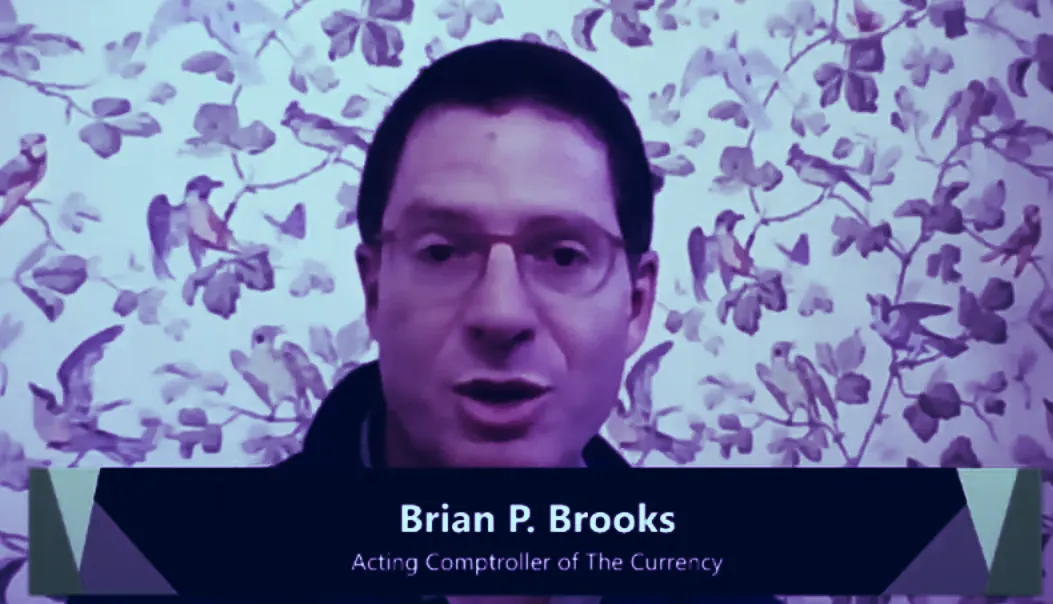

- The acting Comptroller of the Currency, Brian Brooks, spoke at the LA Blockchain Summit today.

- He said he wants to help provide regulatory clarity about cryptocurrencies.

- Since assuming the role, he's clarified that banks can hold custody over cryptocurrencies.

Brian Brooks, head of the US regulatory agency that supervises the nation’s banks, spends his days trying to calm the cryptocurrency industry’s raging seas.

“If there’s bad activity in crypto, we need to get rid of it,” said the head of the Office of the Comptroller of the Currency (OCC) in an interview at the LA Blockchain Summit today. But, “If we’re going to get the benefit of these radical new technologies that will make credit more accessible, that will help those people who have not been included in the old system, we gotta figure it out.”

Brooks, formerly the top lawyer for leading US-based cryptocurrency exchange Coinbase, has advocated for clarity about cryptocurrencies since becoming the acting Comptroller of the Currency, a role he assumed in April of this year.

In July, the OCC clarified that regular banks could custody cryptocurrencies. And last month, it clarified that banks could hold the reserves of companies that issue stablecoins.

US dollar stablecoins are pegged to the US dollar, and some, such as Tether or USDC, claim to be backed by real US dollar reserves. Tether struggled to find banks that would hold its crypto, and sister company Bitfinex claimed that one of the companies that helped it fill this gap, Crypto Capital, scammed them out of close to $1 billion. (The New York Attorney General, however, alleges that Bitfinex was “improperly commingling both client and corporate funds.”)

“Over time, these blockchains may really just be payment [systems],” said Brooks of stablecoins. “If so, we need to start providing some clarity to banks about the circumstances in which they can support those blockchains and at some time can use it in the future,” he said today. “We’re working with our other agencies to ensure that there’s clear and consistent messaging on that.”

Brooks banged similar drums while at Coinbase; there, he helped start the Crypto Ratings Council, a (toothless) industry organization whose members, mostly exchanges, worked together to figure out which assets constituted US securities and were thus safe to list.

“Simply saying [crypto’s] different so we have to throw up our hands—as you can probably tell, that’s not my style,” he said in today’s interview.

Institutions are “hostile” to crypto, he said, though that’s because regulators haven’t put forward a framework to minimize risks. “What we’re trying to do is just provide clarity,” he said. “The market can only develop organically if there’s clarity.”

Governments should stick to rule-making

Brooks also rejected the Fed’s timeline for FedNow, a public, decentralized payment platform version of the dollar. Lael Brainard, a Federal Reserve governor said that the projects could be out within three or four years.

“When the government promises you [something] four years out, what they’re sort of saying is, ‘we doubt any of you are going to remember that we said this.’” He added, “If you can’t deliver the product in six months, you’re probably not going to deliver it at all.”

“The government is really good at establishing rules,” but not products. “Why do we think that would be different in constructing a payments system?” His main focus, he said, is ensuring that the US retains its status as a leader of global finance.

And a digital dollar? “The role of governments isn’t to produce tech,” he said.