In brief

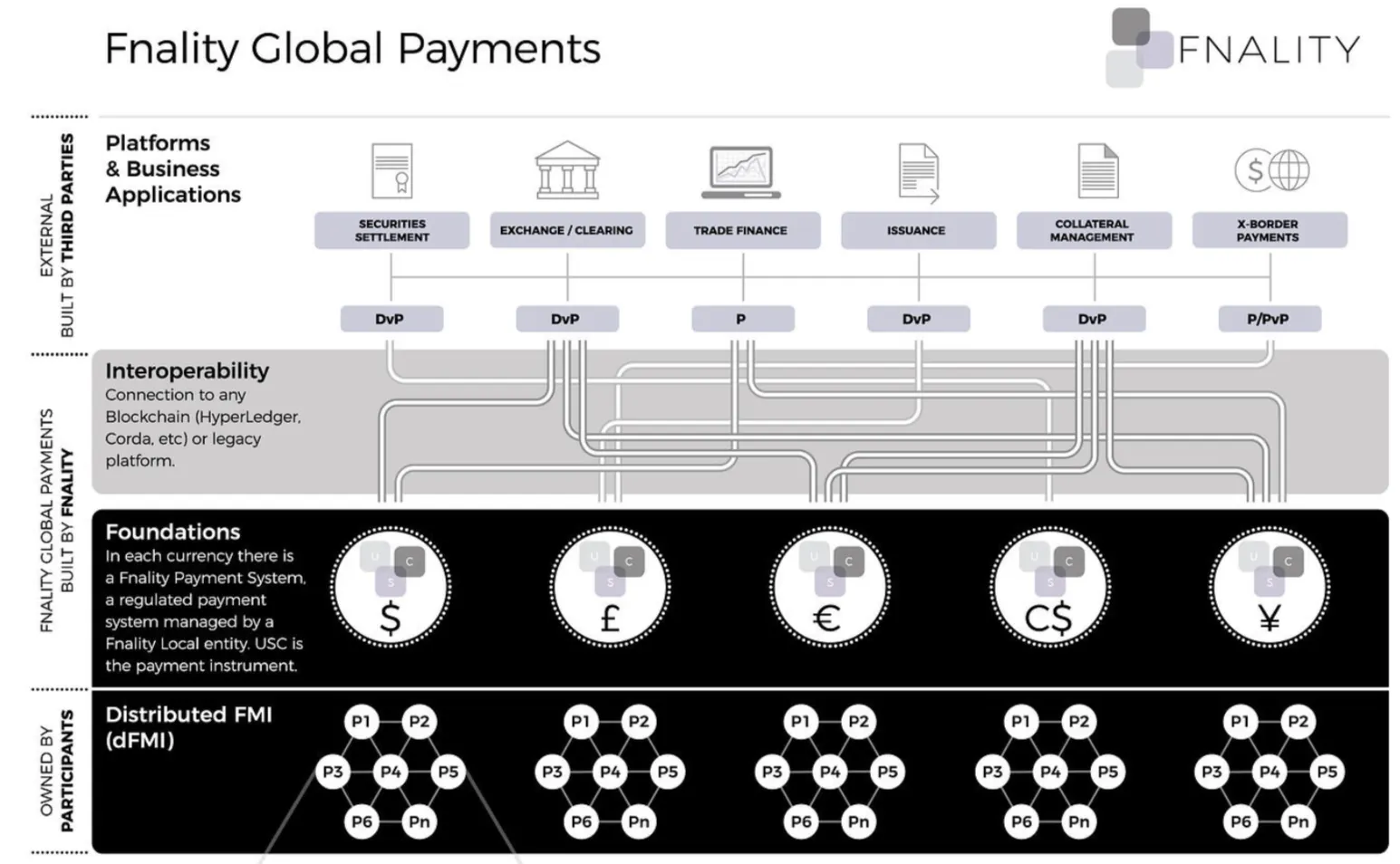

- Several major banks are part of the Fnality International project.

- Fnality is working to create digital versions of five major fiat currencies, including the dollar and yen.

- The project has been delayed until at least 2021 as it seeks regulatory approvals.

Last June, Barclays, Banco Santander, Credit Suisse Group AG and another 10 of the biggest banks in the world announced they had poured 50 million pounds into a project that would create digital versions of the US dollar, Canadian dollar, British pound, Japanese yen, and the euro.

The plan was that those digital currencies would be ready by this year. As it turns out, the project won’t be arriving until at least 2021.

The project, called Fnality, was the brainchild of UBS Group AG, a Switzerland-based investment bank. It managed to bring its erstwhile competitors aboard because they would all benefit from the project’s ultimate goal: faster and cheaper settlements.

Settlement is the often-laborious process by which financial institutions clear transactions so that everybody in the payments ecosystem gets the money they’re owed. Basically, it involves moving money from a buyer's account into the seller's account, minus fees for credit card processors and the banks that made the transaction possible.

Originally known as Utility Settlement Coin, Fnality was to make that whole process much, much simpler and speedier.

It also had a role to play in the cryptocurrency world, as people trade digital assets for cash ones. Bitcoin may settle quickly, but cash still doesn’t. That’s where the tokenized global currencies came in, hooking into enterprise blockchains and legacy systems alike.

The exact details were still being ironed out, as were the regulatory approvals. According to a report from Reuters, Fnality International head Rhomaios Ram is looking toward approval at some point at the beginning of 2021.

That means waiting for the go-ahead from a central bank, which may be interested in seeing what a bank-run digital currency looks like before rolling out a state-run version.

The US, Canada, Japan, UK, and Europe have all studied or are studying central bank digital currencies (CBDCs), which would be different from these privately created ones. In July, for instance, the Bank of Japan’s department director-general told a Japanese newspaper that the central bank was moving forward with a CBDC, though he didn’t state when it might be ready.