In brief

- USDC is expanding onto Algorand.

- This is because Algorand is a lot quicker than the other major blockchain that supports USDC, Ethereum.

- It's also so that Algorand developers and users can use USDC.

The second-most popular US dollar-pegged stablecoin, USDC, today found a new home on the Algorand blockchain.

This means that the stablecoin developed by Centre—a partnership between leading US crypto exchange Coinbase and payments firm Circle—has finally reduced its reliance on Ethereum, the other major blockchain network that houses USDC, since announcing its intention to migrate in June.

Stablecoins are a huge part of the cryptocurrency economy. They are a kind of foot in the door that let people store crypto without the risks of volatility. This is useful for people wanting to put money into various decentralized finance protocols or to trade between other cryptocurrencies with ease.

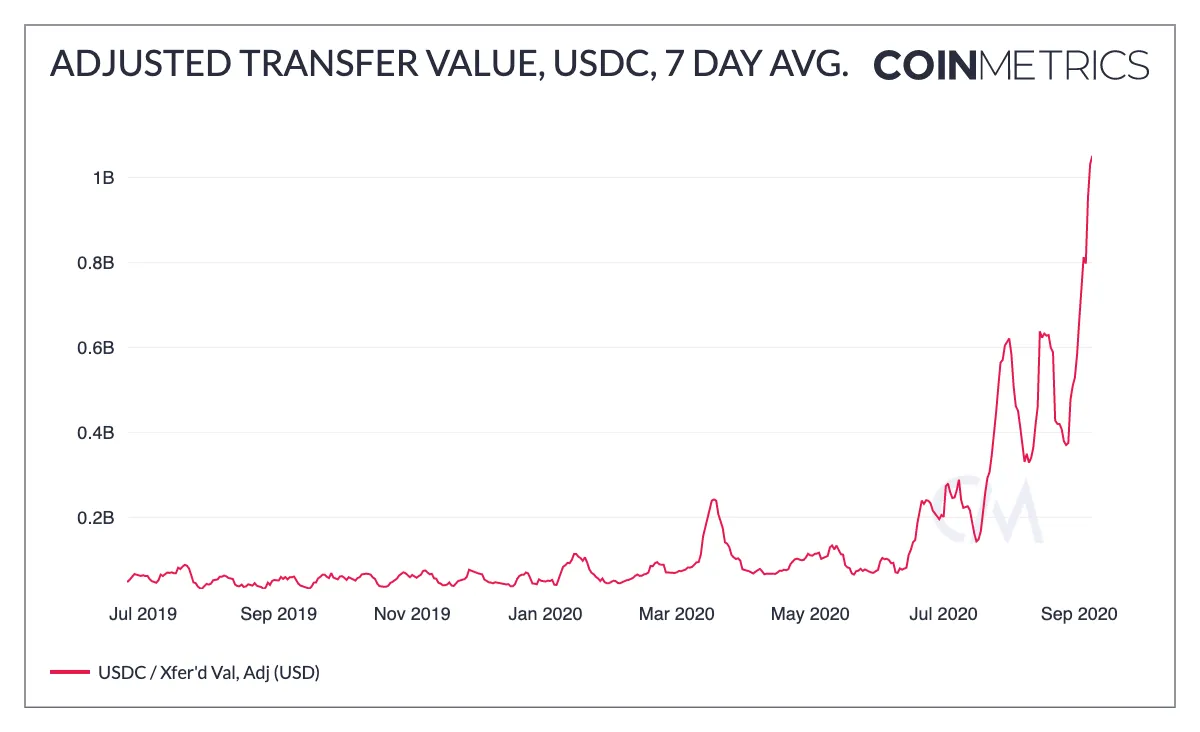

More than $1.8 billion worth of USDC is in circulation today, with almost a billion dollars minted in the past three months alone. According to Coin Metrics, the value of USDC transferred each week hit new records this past week due to the rise of DeFi, or decentralized finance—non-custodial financial services. (USDC’s prominence is dwarfed by Tether, or USDT, which has a market cap of $14.3 billion).

The migration to Algorand took place because Centre, the consortium that produces USDC, wants to reduce the coin’s reliance on Ethereum, the blockchain network that houses the vast majority of DeFi projects and whose native cryptocurrency is the second-largest by market capitalization.

This is because Ethereum is slow, fit to burst, and wildly expensive to use. “There is a tremendous need for blockchain infrastructure that can scale to support significantly higher transaction throughput and lower fees,” said Centre in a statement today.

It hopes to find happiness in Algorand, which supports over 1,000 transactions per second (to Ethereum’s 14) and transaction fees of a fraction of a penny (to Ethereum’s high average transaction cost, which last week peaked at about $14).

“Expanding USDC from Ethereum to additional blockchains like Algorand will ensure USDC has the flexibility to support everything from emerging DeFi projects to large-t scale financial institutions,” said Alesia Haas, Chief Financial Officer at Coinbase, in a statement.

To be clear, it’s not leaving Ethereum, just expanding to Algorand. The new blockchain network is the poster child of Centre's “Multichain USDC Framework,” announced in June, that represents its effort to get USDC onto new blockchains, into the hands of more developers, and sanctioned by regulators and institutional investors.

“This is a defining milestone for frictionless mainstream payments as well as sophisticated financial applications,” said Silvio Micali, founder of Algorand, Inc, in a statement. “This launch brings together the convenience of USDC and an advanced protocol for global financial exchange in which Layer-1 smart contracts are as simple and secure as ordinary payments."

Editor's note: This article has been updated with comments from Silvio Micali, founder of Algorand Inc.