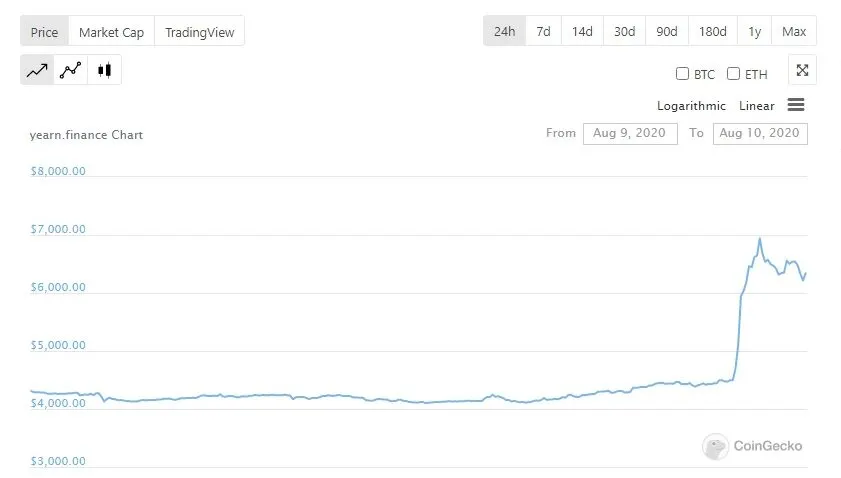

Crypto exchange Binance has announced the listing of the latest decentralized finance (DeFi) “darling”—yearn.finance’s (yEarn) token YFI. On the news, its price surged by over 50%, according to crypto analytics platform CoinGecko.

When the announcement was made, the price of YFI rose to $6,941, before coming to rest at its current price of $6,340.

What is YFI?

YFI is the governance token of yEarn, a DeFi protocol developed by Andre Cronje that helps users to move their assets between various liquidity pools. Those who hold the token are able to vote on how the network works.

As Decrypt reported, YFI exploded in July, with its price increasing more than seventy fold in just one week since its launch. But it was never meant to be that way.

Cronje stressed that it was supposed to be “a completely valueless 0 supply token” that “has 0 financial value.” The goal was for the tokens to be used for voting—but not as a means of exchange themselves.

By letting the community run the network, Cronje was able to distance himself from yEarn protocol, leaving the token holders in charge.

Yet, not only is this “useless” token worth well over $6,000 today, has a market capitalization of more than $190 million and a current daily trading volume of roughly $35.1 million, but it has also spawned a number of knockoffs such as YFII, C.R.E.A.M, WIFEY and even a DeFi exit scam.

But since it’s DeFi, not even the weirdest of them can be stopped.