This is what radical community governance looks like.

yEarn Finance’s YFI token is one of the most interesting projects on Ethereum right now. In one week since it launched, it’s gone through a parabolic price increase, eye-popping returns for yield farmers, hundreds of millions deposited into the platform’s liquidity pools and —this is likely the most unique aspect— seven on-chain votes.

yEarn Finance is the first project on Ethereum, whose governance is entirely in the hands of token holders. While other teams like MakerDAO and Compound Finance give users the power to participate in major decisions via token-based voting, yEarn is different in that there is no foundation, early venture investors or management holding large stakes.

Earn It

YFI is distributed among those who supply liquidity for the yEarn platform and that’s the only primary market — there was no pre-sale or initial DEX offering. The system has worked out, with YFI up more than 70x in one week, climbing to almost $2,500, a record.

The “token for the people,” narrative coupled with yields of over 1,000% annually resulting from its program to incentivize liquidity (aka yield farming), have fostered an especially active community. Token holders have become so engaged in the platform, they’ve been proposing improvements and holding on-chain votes literally all week.

Proposal 0

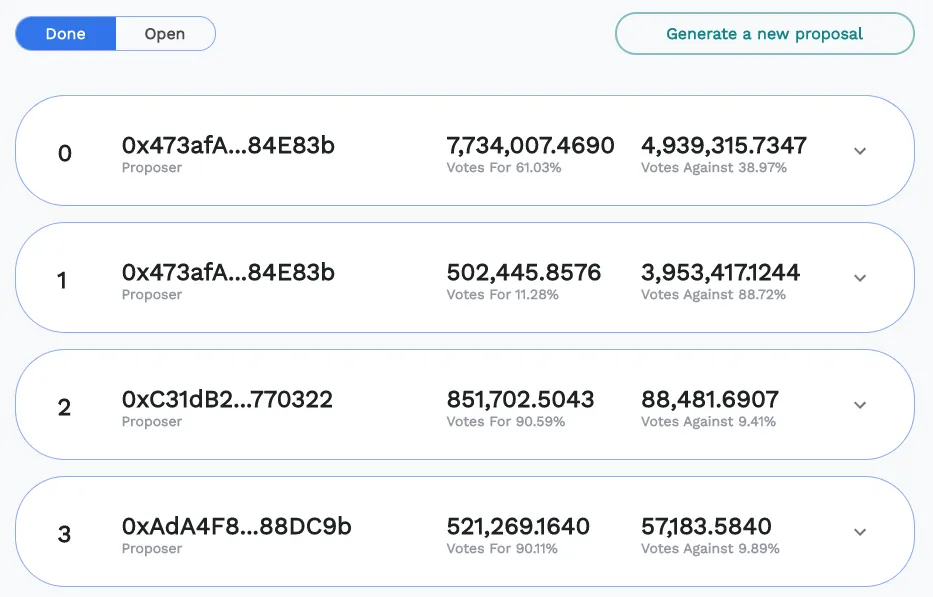

Of the seven on-chain votes held so far, the first one, called Proposal 0, passed. This proposal was to decide whether YFI supply should be capped at its current total supply of 30,000 in perpetuity or if the protocol should retain the ability to mint additional tokens in the future. 61% of participants voted to allow for YFI minting beyond the 30,000 supply.

While 63% of token holders voted in Proposal 0, the next six on-chain votes didn’t meet the required 33% quorum, so they were declined.

Ongoing Votes

There are six ongoing votes, with Proposal 10 attracting the most attention from token holders. Proposal 10 was made by Andrew Kang, an active crypto investor, who argues that only YFI token holders should be able to vote in yEarn’s governance. The current yEarn voting contract accepts BPT tokens, which are issued from depositing liquidity to yEarn’s Balancer Pool, of which YFI tokens represent just 2%. That means stablecoin holders’ are receiving a larger amount of voting shares than YFI holders.

“Governance should be dictated by those with the most vested long term interest of the protocol - YFI holders - irrespective of their portfolio composition,” Kang said in the proposal. “More importantly, the protocol is currently vulnerable to a hostile takeover of governance by stablecoin whales who could potentially pass a proposal to mint a large supply of YFI and disproportionately reward themselves (via favoring large stablecoin holders).”

The large majority of participants, or 99.6%, have voted in favor of the proposal. Still, with 21% of token voters participating, it’s below the quorum 22 hours before the vote ends.

DeFi Hero

yEarn’s governance left entirely in the hands of the community has elevated founder Andre Cronje to something close to a hero in the DeFi community. Cronje also gave up control over YFI issuance —which it solely held after launch to the concern of many— and put it in a multi-signature wallet, which requires 6 out of 9 participants to agree on changes. Cronje isn’t one of the signatories in the multisig.

It’s early to say whether this experiment works out. One question to look out for is whether YFI’s token holders’ interests will match the sustainability of yEarn platform, or will they privilege short term profits over long-term health.

[This story was written and edited by our friends at The Defiant, and also appeared in its daily email. The content platform focuses on decentralized finance and the open economy and is sharing stories we think will interest our readers. You can subscribe to it here.]