Presentation after presentation, pitch after pitch, cofounder after cofounder, Dani Grant, an analyst at Union Square Ventures in Manhattan kept hearing the same concern from clients working on blockchain infrastructure: "We can’t get developers to build apps.”

This was a problem. You probably know that Union Square Ventures is one of the preeminent venture firms in technology. Its track record rivals that of any of the top VCs in Silicon Valley, with multi-billion-dollar hits that include Twitter, Zynga and even Twilio. More to the point, it, along with Silicon Valley darling Andreessen Horowitz, have been at the forefront of investment in the decentralized web, with bets already paying off on the likes of CryptoKitties, Coinbase and Polychain Capital.

So Grant & co had become increasingly concerned as they heard mounting confusion among the potential builders of Web3. “As a VC firm, you investigate a lot of ideas to try and determine what is the right thing to build,” she said. “We wanted to know why there was this mismatch between those building apps and those working on infrastructure.”

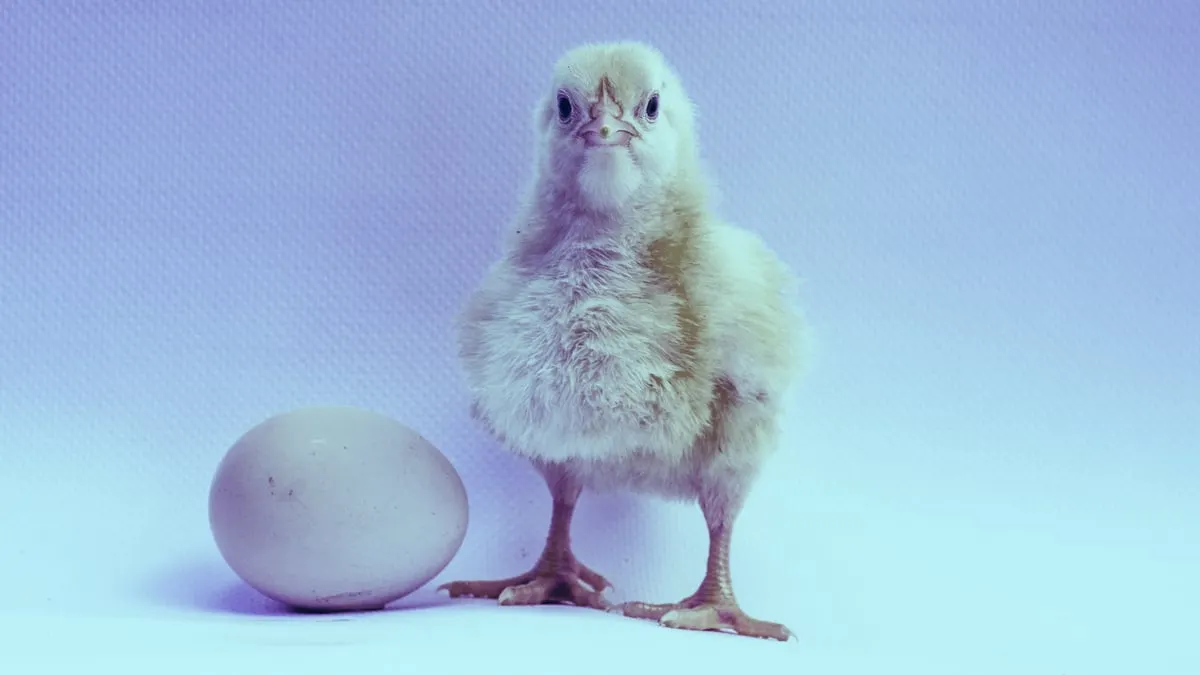

It seemed to boil down to a chicken vs. egg debate in the dApp community: Were we in a phase where companies needed to be building the tools and infrastructure to create the scaffolding of the new web? Or was the smart money funding new apps that would not only run on that new infrastructure, but bring in users?

The infrastructure people said that without a resilient foundation, decentralized apps wouldn’t work well.

But the apps people asked, why invest any more time in increasing network capacity when there are only a few people using the decentralized web?

So Grant, and her colleague, Nick Grossman, set to work studying the problem, creating spreadsheets that compared the evolution of world-changing technologies over time. Their findings, which were published earlier this week, might come as a surprise to anyone studying the history of chickens and eggs:

The question turns out to be a false dichotomy. The answer is neither of the above.

“It’s a trite cliché. There is no chicken or egg phase just like there is no infrastructure or app phase,” Grant said, in a recent interview. Phases, she said, would indicate that tech development is in one state or another, in a kind of dialectic, with one thing giving way to another. But in fact, tech development, in this case, is a dynamic process, more akin to evolution than revolution. “It’s all a myth,” she said. “We don’t work in phases.”

Grant’s and Grossman’s report, “The Myth of the Infrastructure Phase, which gets into the nitty gritty of how the process works, was the talk of techland this week and the toast of Twitter, where it is being endlessly discussed. (Union Square, which published the report on its blog, declined to say how many views it’s gotten.)

The report showed pretty conclusively that the chicken and the egg question made as much sense as the light bulb versus the electric grid and the plane versus the airport. “The crux of all this is that you don’t need one or the other to come first,” Grant says. “It’s all iterative.”

Grant and Grossman found that there is a continuous cycle where apps beget improvements in infrastructure. And sturdier, more capacious infrastructure encourages more and better apps to come online, which leads to the build out of ever-improved infrastructure.

“We also see this pattern with our most recent iteration of mobile apps: first we had a suite of popular mobile apps that relied heavily on streaming video: Snapchat (2011), Periscope (2014), Meerkat (2015), and Instagram Stories (2016),” they write in the paper. “And now, we are seeing companies building infrastructure that makes it easy for mobile apps to add video: Ziggeo (2014), Agora.io (2014), Mux (2017), Twilio Video API (2017), Cloudflare Stream (2018).”"The Myth of the Infrastructure Phase," Union Square Ventures

Grant cited the work of the British-Venezuelan scholar Carlota Perez, who specializes in technology and socio-economic development, and who noticed that this iterative cycle only starts when an “irruption” occurs—a big-bang-like explosion of interest and excitement.

Bitcoin was an irruption, said Grant: “It got people excited. And it inspired possibilities.” It inspired consumer-facing companies, such as Coinbase, and new tools and infrastructures, such as ERC 20 and smart contracts.

But what about the Great Crypto Crash of 2018, which has seen currencies fall by 80 percent? Does the bubble bursting put a damper on the iterative cycle? Grant is bullish and said developers should ignore all that and stick to their knitting. This is all part of Perez’s cycle—now is actually the right time to be building—both infrastructure and applications.

“We are now looking for the next hit app that will spur the next set of tools that help inspire the future set of apps,” Grant said. “And it’s very likely it’ll be in one of two things: finance and games.”

Right now, according to Grant, there are some 20-plus exchanges that do more than $50 million of trading volume daily. “There’s potential money to be made,” Grant said. “Speculative investors are craving tools to interact with the platform.”

Games, on the other hand, are more fun and early adopters are willing to jump through hoops and give developers a chance. Plus, gamers are just more tech savvy. “People were playing Counter Strike during the early days of the web.” The same dynamic is apparent on Web3 today.

The main thing that builders and entrepreneurs need to do today is keep their heads down and believe in the future of trustless, decentralized systems. “The best founders are ignoring the media hype and focusing on progress,” she said.

Now that she’s solved the riddle of the chicken and the egg, perhaps she can tell us why the chicken wanted to cross the road.