In brief

- Nomics and crypto-backed lender Nexo have developed a reputation algorithm for crypto products.

- They plan to rank products in more than 20 categories based on reputation scores.

- A high score doesn’t always mean a product is the best, however.

You aren’t sure about what crypto wallet to use? Trouble finding an OTC trading desk? Nomics wants to help. The Minnesota-based cryptocurrency data aggregator has joined forces with Nexo, a provider of crypto-backed loans, to create an algorithm that calculates a reputation score for crypto products.

In other words, you don’t have to comb through all the nonsense on the internet yourself. Nomic’s algorithm crawls the web for product mentions. The startup then gives products a reputation score of 0-1,000 and ranks them accordingly. Starting today, Nomics is making those rankings available in a beta launch on its website.

“This is a space that really likes its rankings,” Nomics CEO Clay Collins told Decrypt. He should know: cryptocurrency exchange and token-market rankings are what his company is known for.

While Nomics, which makes its money from its data feeds and selling ads, has done the coding for the ranking algorithm, Switzerland-based Nexo has helped to fund the venture. “This is a very expensive project,” Collins said.

How it works

Nomics ranks crypto products within categories. Currently, it provides rankings for five crypto categories: wallets, credit lines, tax services, custody solutions, and OTC trading desks. The startup uses an algorithm to approximate reputation by sorting through referral links, tweets, Reddit mentions, blogs, and other online sources.

Collins sees reputation scoring as a better way to organize crypto products.

“There's a lot of blog posts from less-than-proficient writers saying, ‘Here are the top 20 crypto wallets,’ and it's just a bunch of random crap,” he said. “We want to provide some guidance for the space that goes above and beyond all these content farm blog posts that really didn't have the user's best interest in mind.”

Important to note: The rankings do not necessarily tell you which product is best. “We crawl the web, which is kind of an undertaking,” Collins said. “It’s basically driven by many of the same papers that Google has published about how to gauge reputation. So the purpose of the algorithm is not to say who's the best. What we're looking at, primarily, is how does the market see these?”

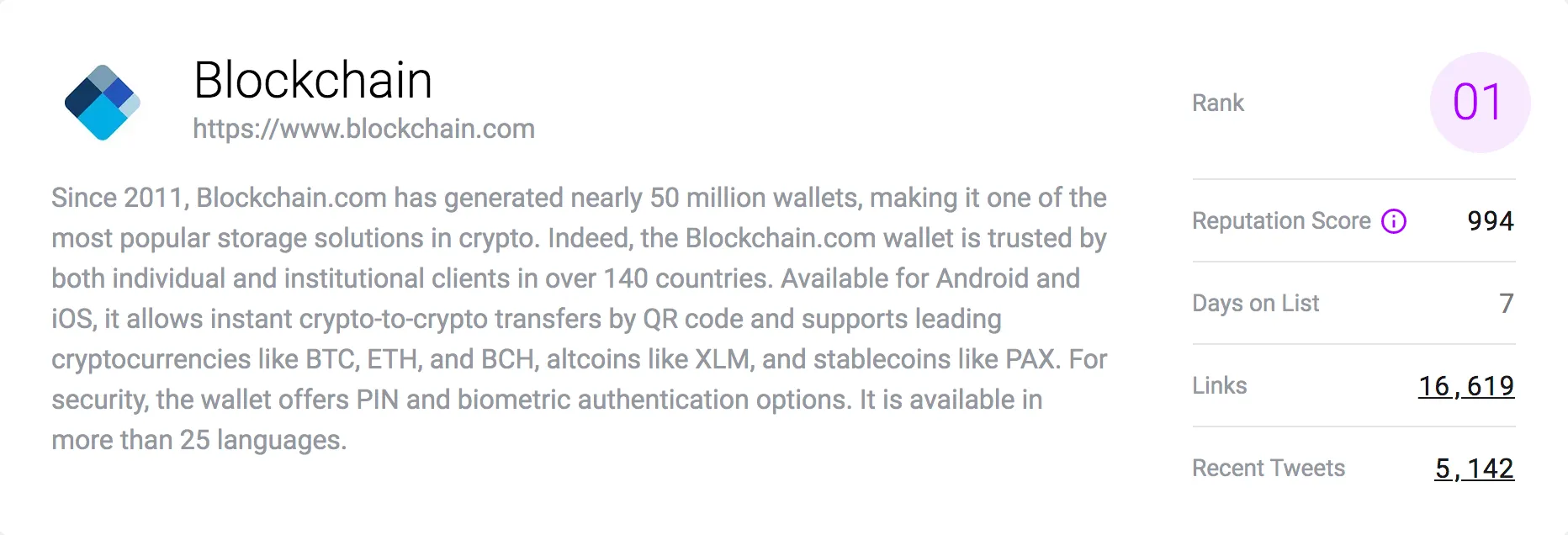

As an example, Nomics currently ranks 63 crypto wallets. Blockchain.com sits at the top of that ranking with a reputation score of 994. (A rating score of 0-1,000 is more granular than, say, 0-10, and allows Nomics to rank dozens of products within a single category more accurately.) To come up with a reputation score for Blockchain.com, Nomics pulls from more than 16,000 links and more than 5,000 tweets.

“We're drawing inferences from Twitter mentions, from Reddit mentions, from mentions on even random web pages. We look at each link to the product page or homepage, whatever we have, and try to gauge the reputation of those inbound links. Then we try and figure out which of these products the market deems to be most important. That's fundamentally what drives the algorithm,” said Collins.

Inputs are not weighted equally, however. Instead, Nomics says that its ranking algorithm considers the “perceived authoritativeness” of each tweet and link. A link on the homepage of Google, for instance, is worth a lot more than one on the homepage of some random blog written by a guy nobody has ever heard of. Nomics updates its rankings every 24 hours.

To prevent gaming, Collins said that Nomics plans to remain hush-hush about how pages are weighted until the project is out of beta. The company may also continue to fiddle with the algorithm during and after the testing period.

Nomics likes to point out that its ratings are “impartial.” That is not to be confused with bias. (Many experts believe that all algorithms carry some type of bias.) It simply means that the company applies the same algorithm to all categories.

One example of “possible impartialness” we noticed is that Nexo is the top-ranked crypto credit line product with a reputation score of 969. Collins assured us Nomics approached Nexo after the firm was ranking number one.

“We invite the market to continue to watch the rankings and hold us accountable,” he said. “But I don't think there is anyone who watches the crypto lending space who would say it's absurd that they are the leader.”

Moving out of beta

Once Nomics has populated the five initial categories, it will launch two additional categories per week until it reaches 23 product categories in total. After that, the company plans to hold an annual virtual award ceremony to celebrate each year’s best-in-class products. The first ceremony? “We’re aiming for mid-September,” Collins said.

Nomics, which launched in late 2018, is backed by notable investors such as Coinbase Ventures and Digital Currency Group. It has $3 million in funding to date.