In brief

Cryptocurrencies and the effect on the Sharpe Ratio

$64,043.00

-1.08%$1,854.25

-0.50%$1.35

-0.77%$584.35

-1.98%$0.999922

0.01%$78.49

0.17%$0.283332

0.70%$1.029

-0.25%$0.091819

-1.63%$48.07

-0.49%$1.00

-0.02%$484.99

-3.25%$0.259334

-1.67%$8.60

5.37%$27.16

2.66%$0.999237

-0.02%$0.160059

-0.85%$326.27

5.54%$8.20

-1.38%$0.149952

-1.34%$0.999781

0.07%$0.00935328

-0.18%$0.095561

0.13%$0.999374

-0.07%$244.55

2.04%$51.25

-0.94%$8.30

-1.18%$0.00000592

-1.74%$0.859431

-2.52%$1.31

-2.80%$0.110311

-0.51%$0.0741

-0.61%$5,128.09

-1.48%$1.42

1.08%$5,163.09

-1.55%$3.33

-1.08%$1.24

-2.53%$1.00

0.00%$0.58989

1.60%$0.997582

0.03%$113.19

-1.73%$0.696232

-0.59%$0.00000393

-1.36%$1.00

0.05%$168.10

-1.62%$1.12

0.00%$0.999877

0.00%$73.83

-1.01%$2.20

-1.85%$0.00000164

-0.77%$0.065239

3.47%$0.161815

1.51%$0.999803

0.08%$8.35

0.22%$0.968663

-1.27%$0.246942

-1.08%$0.112965

6.24%$11.00

0.03%$2.12

2.43%$6.81

-0.39%$8.31

0.93%$0.375301

0.61%$0.00171265

-6.09%$2.00

-5.54%$0.057053

-2.20%$62.11

-0.26%$0.01598427

-8.40%$1.00

0.14%$0.820929

-1.07%$0.098071

0.03%$0.804331

10.12%$1.23

-0.13%$0.02924

-2.75%$3.36

1.36%$0.00911157

0.09%$114.39

0.02%$0.083905

0.15%$1.00

0.01%$1.027

0.01%$1.36

-1.94%$1.11

-0.14%$0.03338341

-1.28%$0.881928

-0.84%$0.82274

0.87%$0.00712639

-2.43%$0.080152

-0.19%$1.68

5.29%$1.095

0.01%$0.998232

0.17%$0.092374

-1.43%$0.999921

0.01%$0.02865591

1.22%$0.00000575

-2.41%$0.999074

0.02%$0.01253852

-3.14%$28.17

8.73%$1.086

-0.03%$0.14424

-1.26%$0.999758

0.02%$0.255738

10.70%$1.18

-0.13%$0.06569

-1.36%$0.238478

1.15%$32.66

0.81%$0.04598203

1.62%$0.00639522

0.95%$0.6042

1.47%$165.91

-1.27%$1.20

-1.82%$0.367727

-0.49%$1.00

0.14%$0.502233

11.48%$1.44

2.66%$1.021

-0.44%$0.152885

-0.97%$0.03337878

-1.09%$0.077941

-1.16%$1.021

0.04%$0.999861

0.02%$0.223517

0.63%$0.00000033

-0.50%$0.00000033

-1.39%$120.38

1.38%$0.01643237

-0.64%$3.13

-6.68%$0.053037

-0.57%$15.43

1.94%$3.15

0.16%$1.48

-2.10%$0.322183

8.18%$0.050459

-0.58%$0.994702

-0.87%$0.06577

-0.91%$0.00555488

-3.11%$0.02561372

-1.17%$0.991932

0.05%$1.46

4.82%$0.00002787

-1.02%$0.288991

4.60%$17.09

-0.22%$1.63

0.99%$0.297792

-0.29%$0.142097

3.76%$0.298259

-0.72%$0.117557

-2.22%$0.04821976

0.21%$0.0024875

0.27%$0.208118

0.86%$0.069059

1.60%$0.00251913

-1.26%$0.324798

12.62%$0.999516

0.09%$6.00

-1.24%$0.0417271

2.78%$1.00

0.01%$0.988577

0.47%$0.02014502

-2.01%$1.075

0.01%$0.999953

0.02%$0.00216126

7.05%$1.25

0.45%$1.69

0.25%$0.078418

-0.71%$22.79

0.00%$5,492.56

3.86%$0.497036

0.53%$0.098401

-1.66%$0.00000095

-0.33%$0.19552

-2.68%$1.18

-0.96%$0.00003488

0.24%$1.00

0.00%$0.087396

-1.30%$0.191274

2.31%$0.079865

3.72%$0.051685

0.01%$2.60

-1.54%$9.30

16.58%$0.18177

-2.11%$1.00

0.00%$0.01921591

-3.60%$0.00473501

-0.12%$0.773267

0.77%$0.116087

-0.39%$0.08957

-1.40%$17.77

2.61%$0.999731

0.08%$0.169982

12.12%$2.08

0.84%$0.02299357

-7.41%$0.00351567

0.44%$1.79

0.02%$0.01999033

-0.35%$48.00

0.03%$3.67

-4.49%$1.74

-2.24%$0.994851

0.03%$0.05028

-0.08%$0.584195

1.38%$3.36

14.87%$1.25

-1.40%$1.95

-1.81%$0.998532

0.04%$1.001

0.01%$0.00000747

-0.88%$1.013

0.02%$0.149083

0.35%$0.03928937

-1.83%$0.146174

-4.70%$0.02479061

32.17%$0.306181

-1.23%$0.387477

0.31%$0.30313

-4.59%$0.634438

2.33%$0.157939

1.45%$0.626428

19.19%$1,097.56

-0.03%$8.63

-2.49%$0.074576

2.22%$0.316488

-0.46%$0.593839

6.66%$0.077557

-1.07%$0.36463

-5.60%$4.27

-1.18%$0.125383

-1.81%$11.40

-10.72%$0.250333

-3.90%$0.124821

-6.94%$0.130363

-0.12%$0.99532

0.03%$0.123618

-3.56%$0.087059

-1.82%$0.278609

-0.45%$0.00144877

0.75%$0.246285

0.37%$1.85

-0.41%$1.029

1.18%$0.216085

-1.78%$1.001

0.00%$0.00390386

1.96%$0.999848

-0.03%$0.072529

-1.82%$1.44

0.66%$0.189012

2.90%$2.25

2.52%$0.329264

-2.68%$1.062

-0.07%$1.00

0.03%

Holding as little as one percent in cryptocurrency can boost returns across any portfolio type, a study by crypto-asset management firm Iconic Funds suggests.

The Frankfurt-based startup is a joint venture between crypto-asset management group Iconic Holding and Cryptology Asset Group, which was founded by legendary entrepreneurs Christian Angermayer and Mike Novogratz. The research, published on Tuesday, set out to examine the impact of cryptocurrencies on traditional and alternative investment portfolios—and it’s surprisingly positive.

“Many investors and institutions are skeptical of Bitcoin and crypto because of its widely publicized volatility,” Iconic Holding CEO Patrick Lowry told Decrypt. “We wanted to present objective information showcasing how, even despite its volatility, the risk-adjusted returns of various portfolio types to crypto assets were still significantly improved by even a one percent allocation to crypto over the observed period.”

The impact of including a crypto index with weights of one percent, three percent, or five percent was examined. Bitcoin, Ethereum, XRP, Litecoin, Tether, Bitcoin Cash, EOS, Binance Coin, Bitcoin SV and Tezos were the cryptocurrencies used for the index.

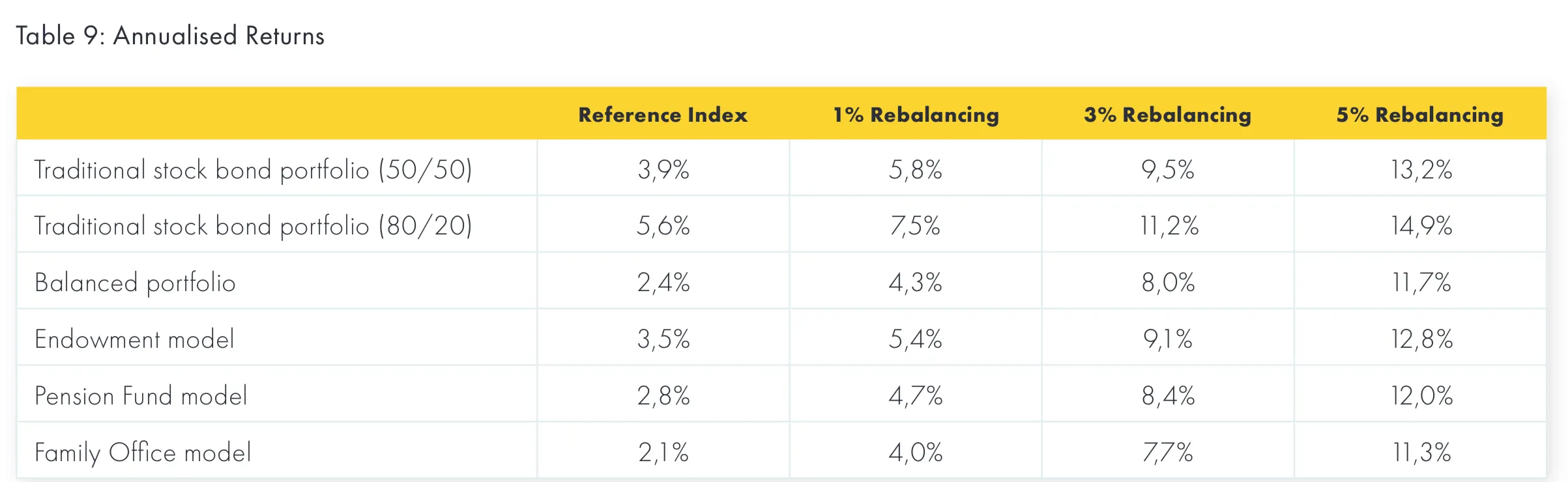

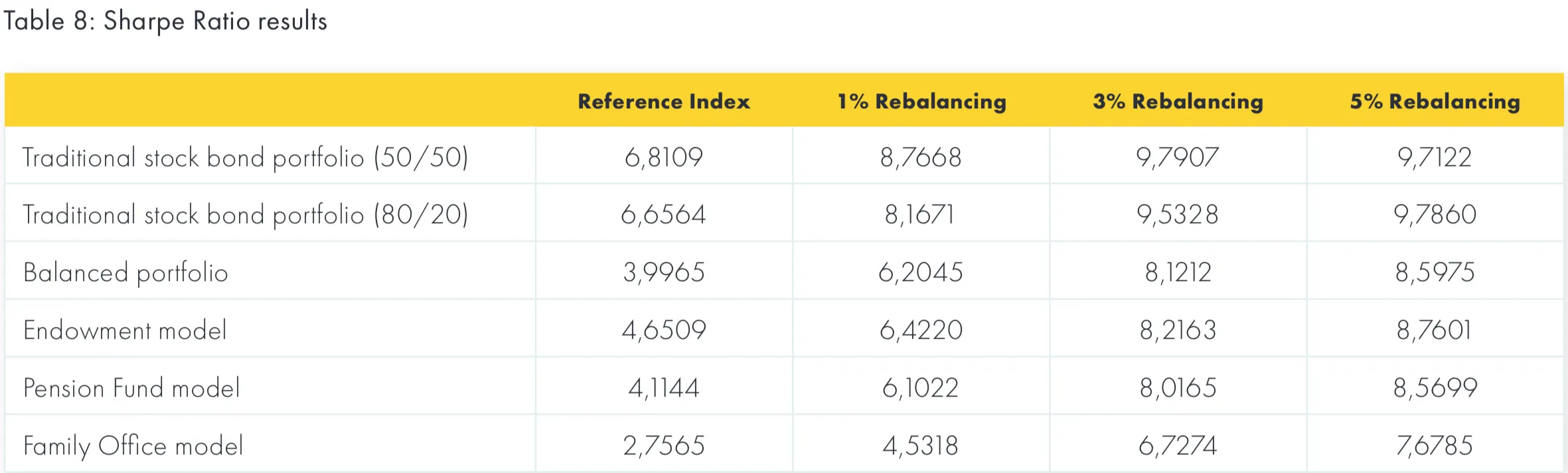

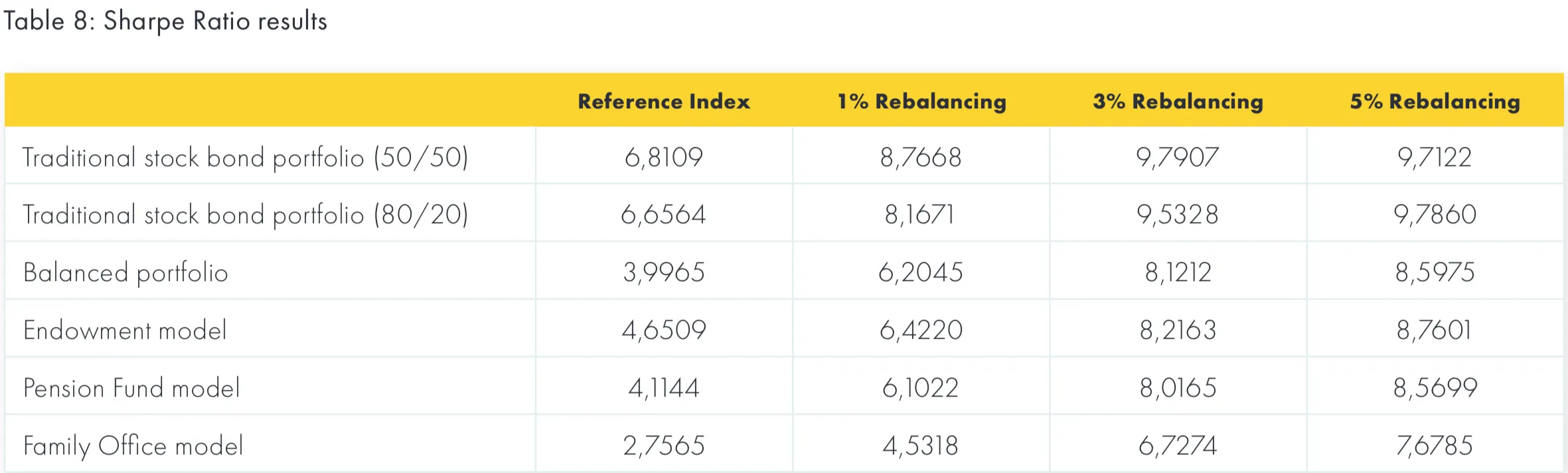

Central to the study is the so-called Sharpe Ratio. A common measure relating risk and return, it weighs the extent to which a portfolio’s return has been greater than a risk-free asset. The study found “substantial” increases in the Sharpe Ratio across all the portfolio models researchers examined—from a traditional stock and bond portfolio to a pensions fund, assuming a passive investment strategy.

“The Family Office portfolio was undoubtedly impacted the most by a crypto allocation, more than doubling its Sharpe Ratio with a three percent allocation,” said Lowry.

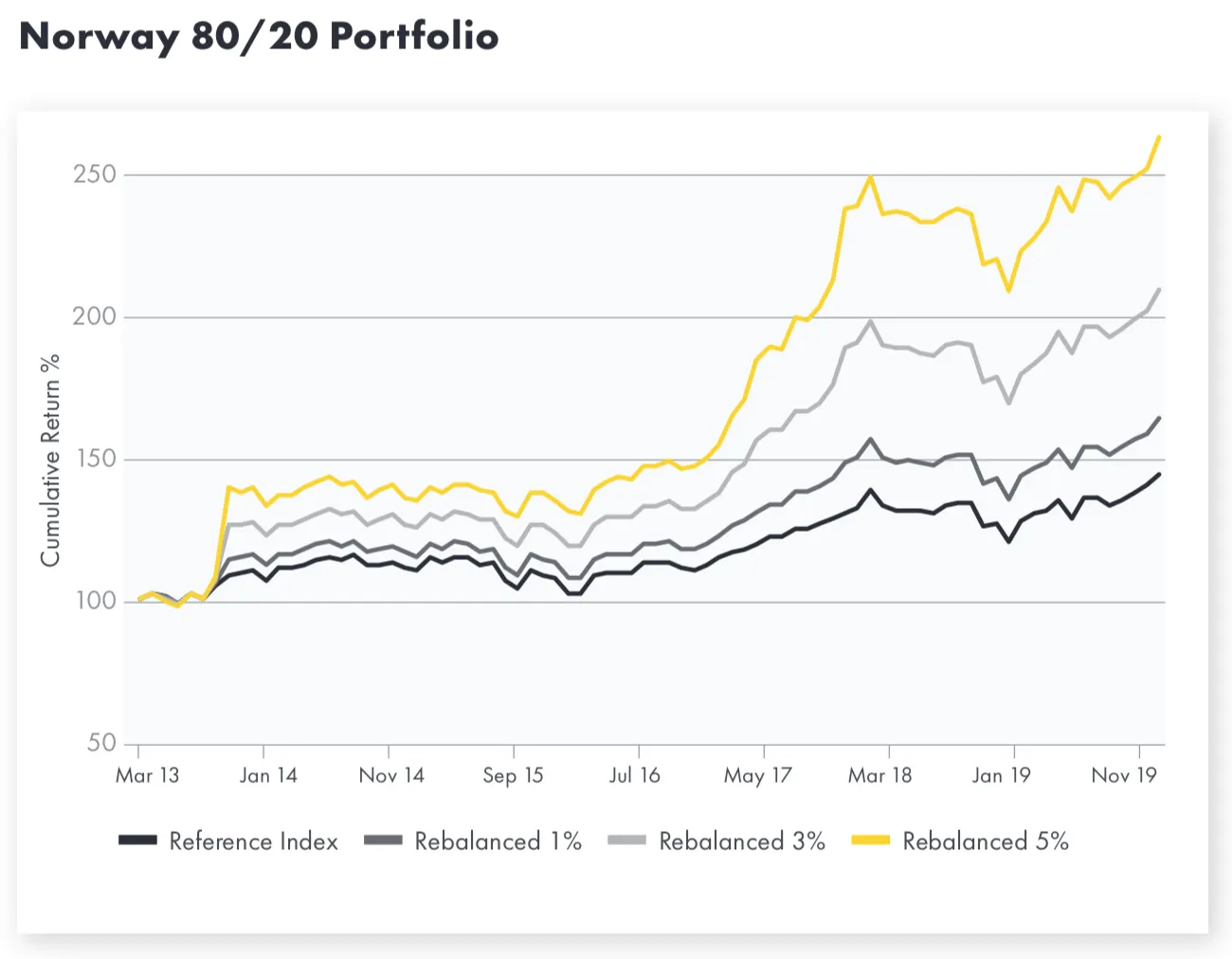

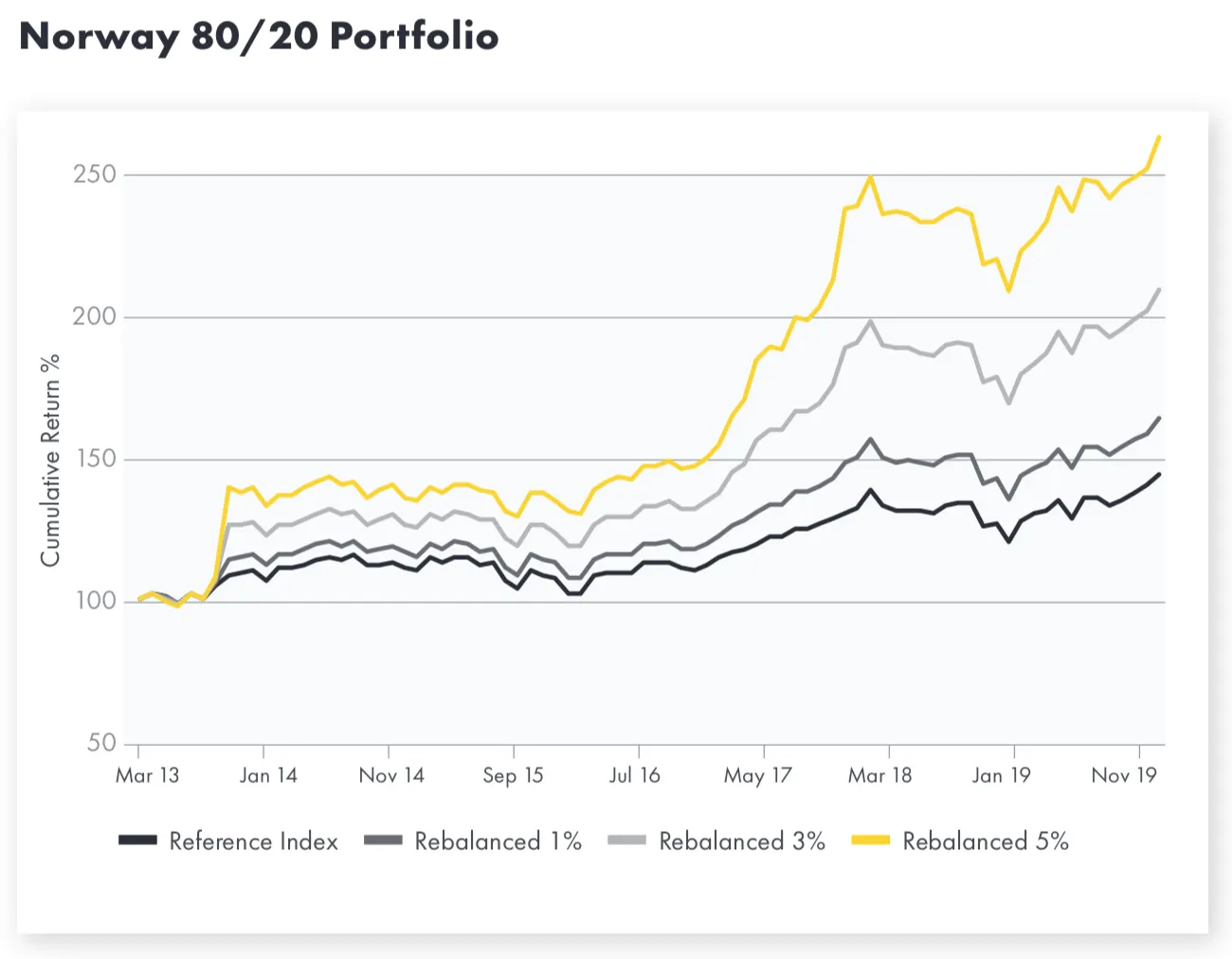

Measured in cumulative returns, the portfolios including cryptocurrencies significantly outperformed the (non-crypto) reference index, in some cases by more than 100%, over the observed time frame (between 2013 and 2019) according to the research.

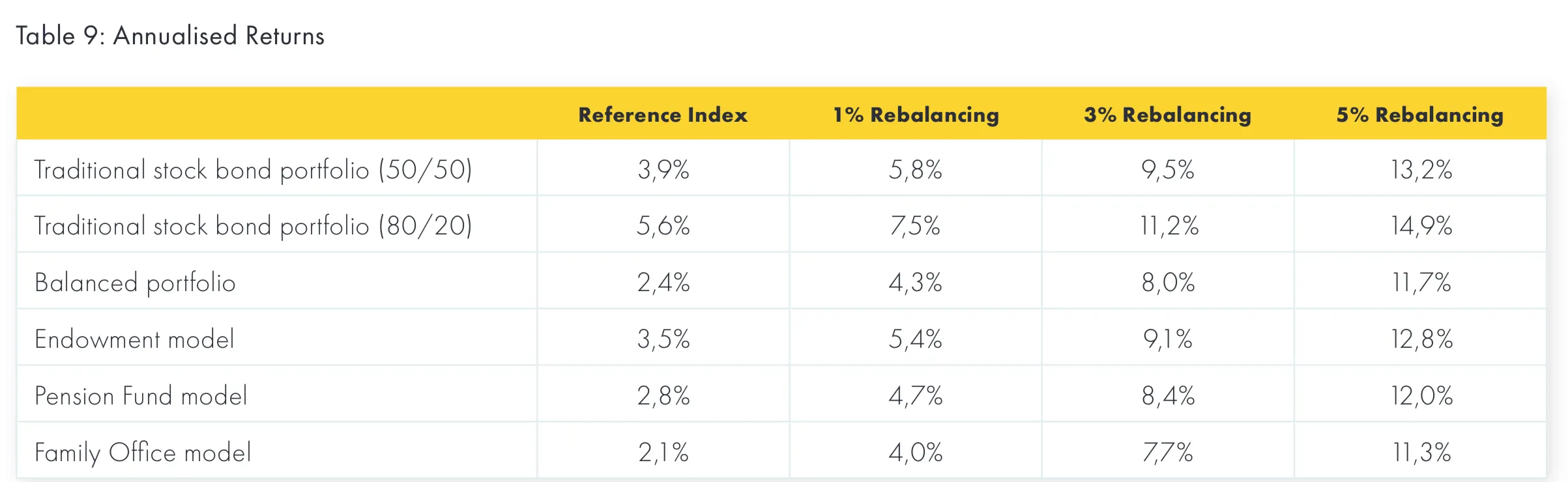

The annual returns of indexes with five percent held in cryptocurrencies reached double figures, with the highest at almost 15% for a balanced portfolio, comprising stocks, bonds, real estate, gold and commodities.

A future Iconic Funds’ study is planned to examine the correlation of crypto-assets with traditional asset classes.

“We want to put truth to the narrative of Bitcoin/crypto being a ‘non-correlated asset class’ with factual data,” said Lowry. “I suspect the results will not be what people are expecting.”