In brief

- The Open Payments Coalition has launched PayID, a simple email-style address for sending and receiving funds.

- The industry group includes the likes of Ripple, BitPay, Blockchain.com, and Brave.

- A lack of buy-in from the traditional financial sector means that PayID is limited to crypto for now.

Sending funds to someone overseas is never an easy process. Banks require the use of an account number, routing number and SWIFT code; crypto demands that you type out a complicated alphanumeric address. Make one mistake, and the payment fails.

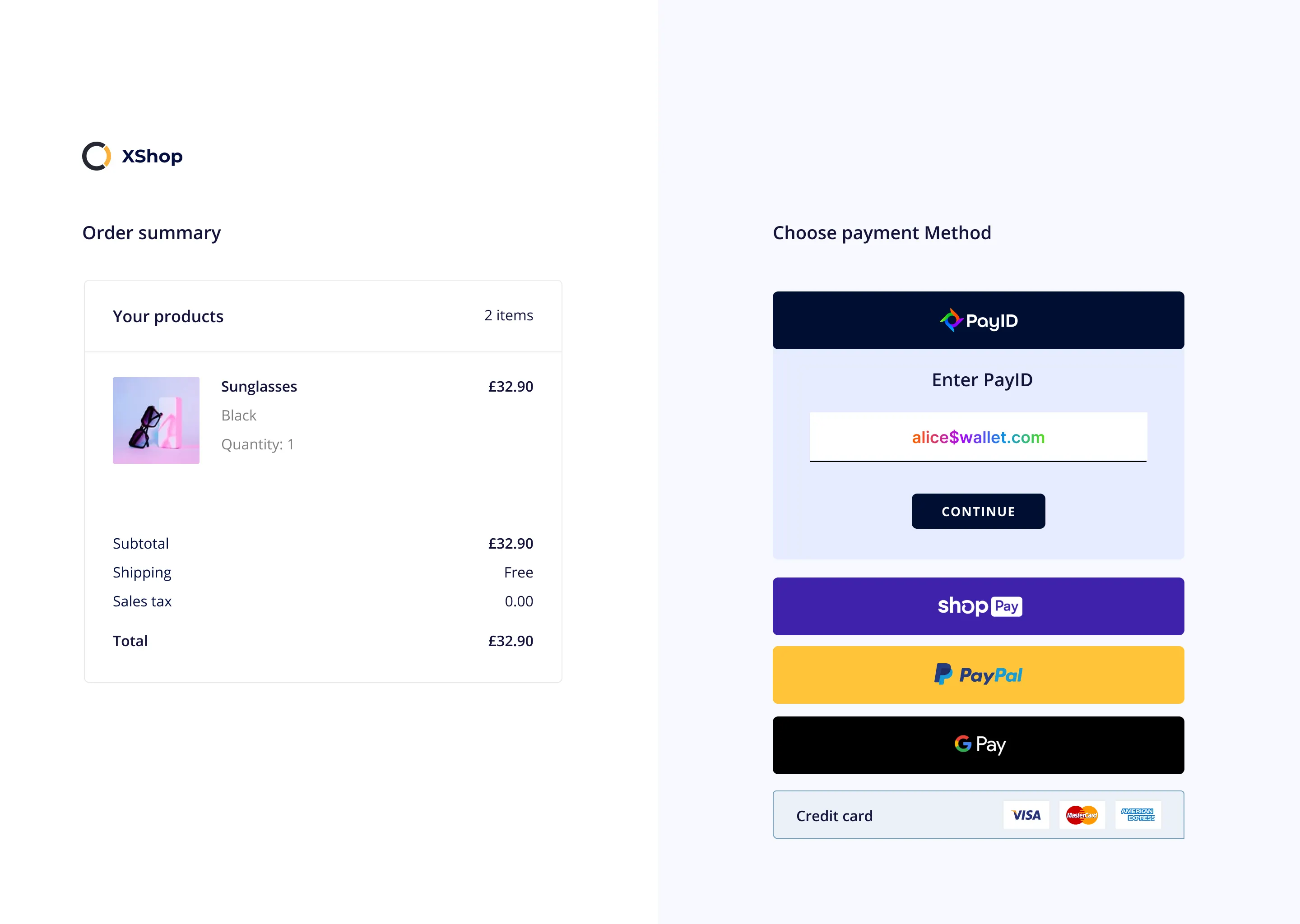

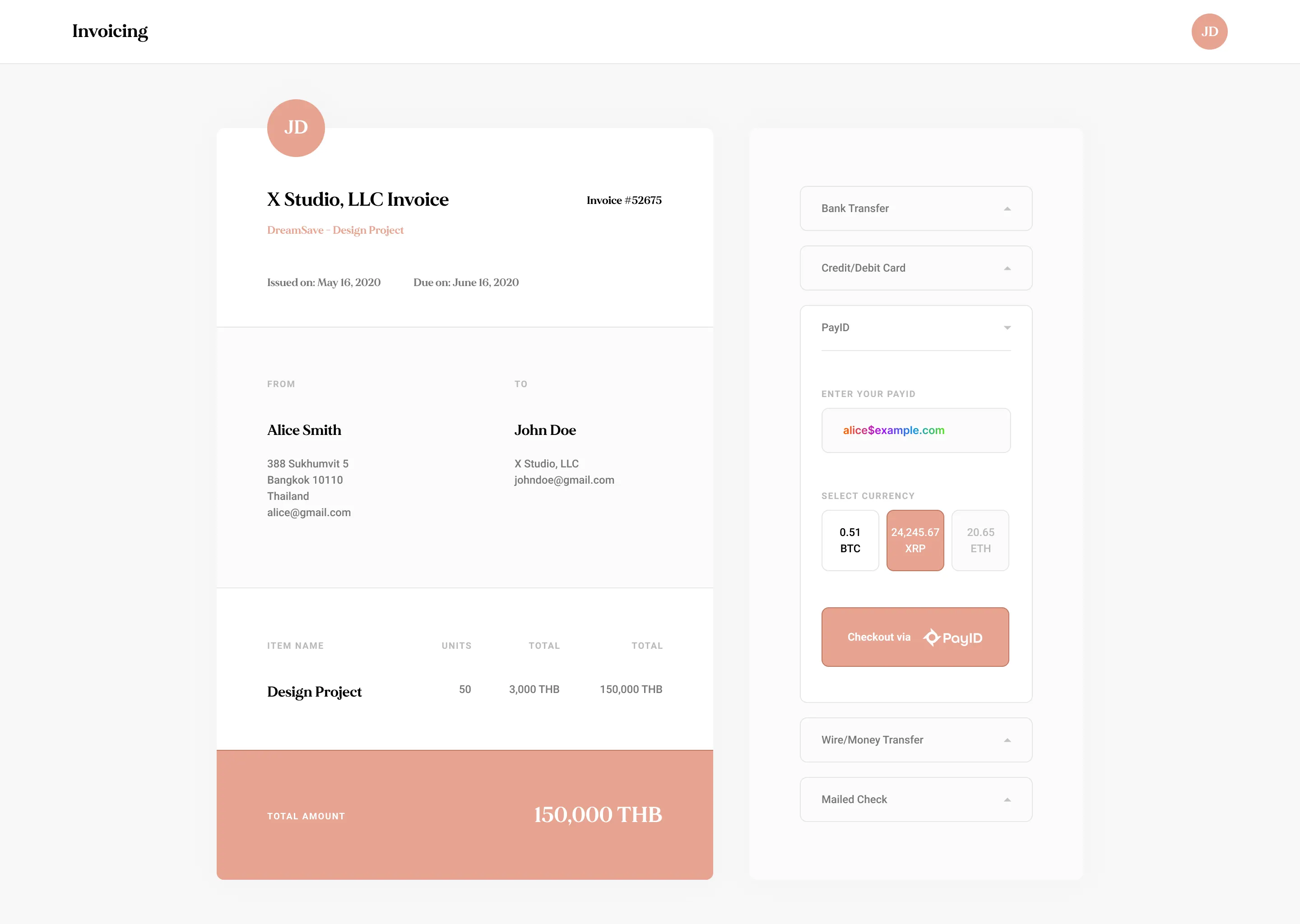

The Open Payments Coalition, an industry group including Ripple, Blockchain.com and Brave, have teamed up to create an alternative: PayID. Instead of typing in a long code, all you’d need to do is input an address that looks like an email. “363023456079” becomes “sam$ubs.com”.

"Initiatives like PayID enable a future where sending money is as easy as sending an email," Xen Baynham-Herd, COO of Blockchain.com, said in a statement. "We're supportive of initiatives like PayID that have the potential to bridge the worlds of crypto and traditional finance, opening up the opportunity for greater adoption and use."

Alongside Ripple, Brave and Blockchain.com, the Open Payments Coalition includes crypto payment gateway BitPay, Indonesian payment processor GoPay, and crypto forensics firm CipherTrace.

Within this membership consortium, Ripple says that it has a total market of 100 million people.

Ripple says the platform has Travel Rule compliance for satisfying both FinCEN requirements and FATF recommendations.

Banks have yet to join PayID

Absent, however, are any traditional financial institutions as payment partners. Although you’d still likely be able to send funds to an account holder at these institutions via an intermediary, the lack of buy-in from banks adds a layer of inefficiency to the process.

The elephant in the room is PayPal; it also allows its users to send funds to one another via an email address, but there’s still a delay when a user wants to move their funds from PayPal to their bank account.

Right now what PayID has is a way to send crypto assets to one another via an email-like address. It's certainly an improvement from having to copy-and-paste a long wallet address, and the feeling of paranoia that a character may be off, but it's not quite there yet.

Ripple is working hard to integrate itself into the traditional financial system by building out payment corridors or investing in startups that look to create application programming interfaces (APIs) that can integrate Ripple’s software stack into their online banking systems.

For PayID to be truly revolutionary, it needs to be able to work directly with banks and not further intermediaries like payment processors.

This story was produced in collaboration with our friends at

Forkast, a content platform focused on emerging technology at the intersection of business, economy, and politics, from Asia to the world.