In brief:

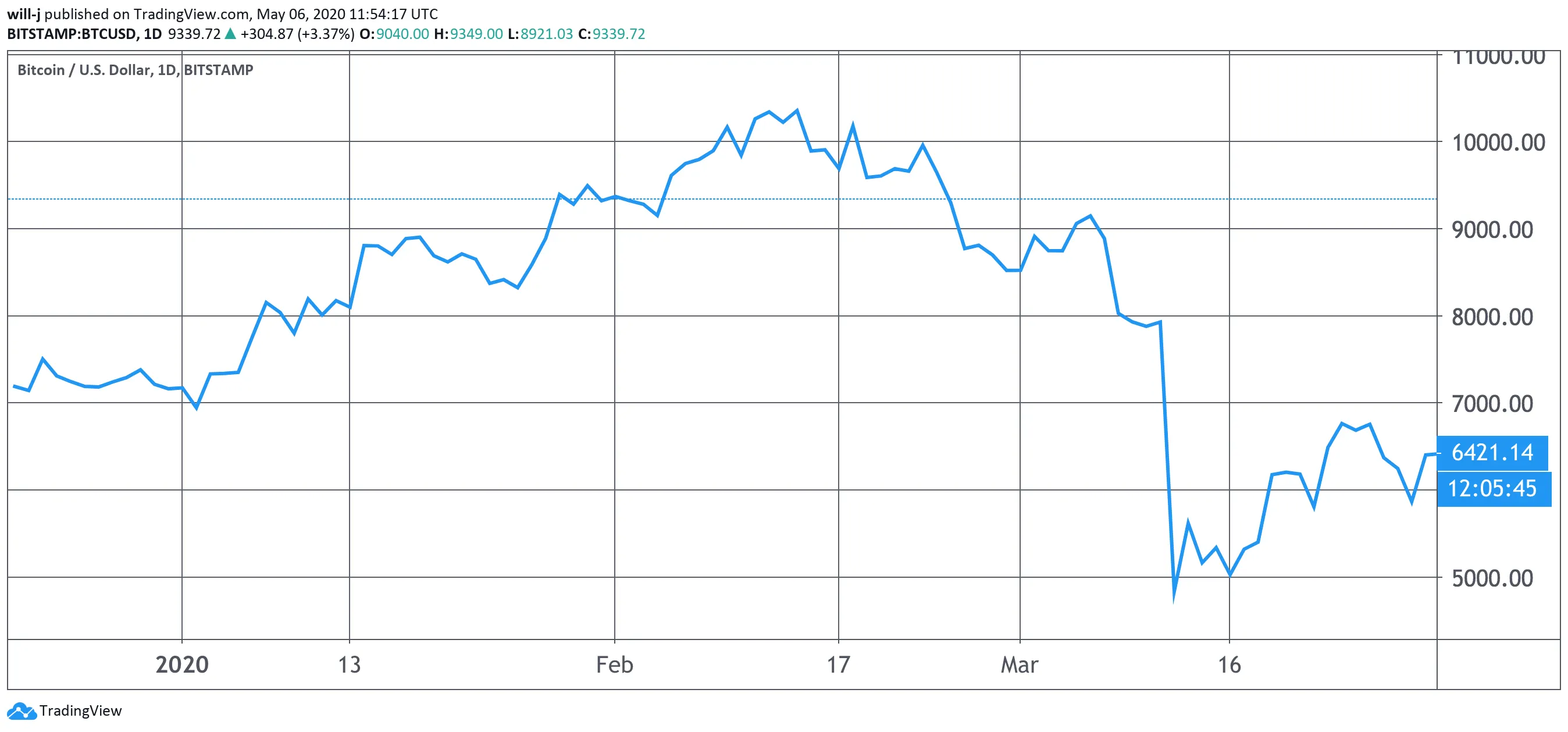

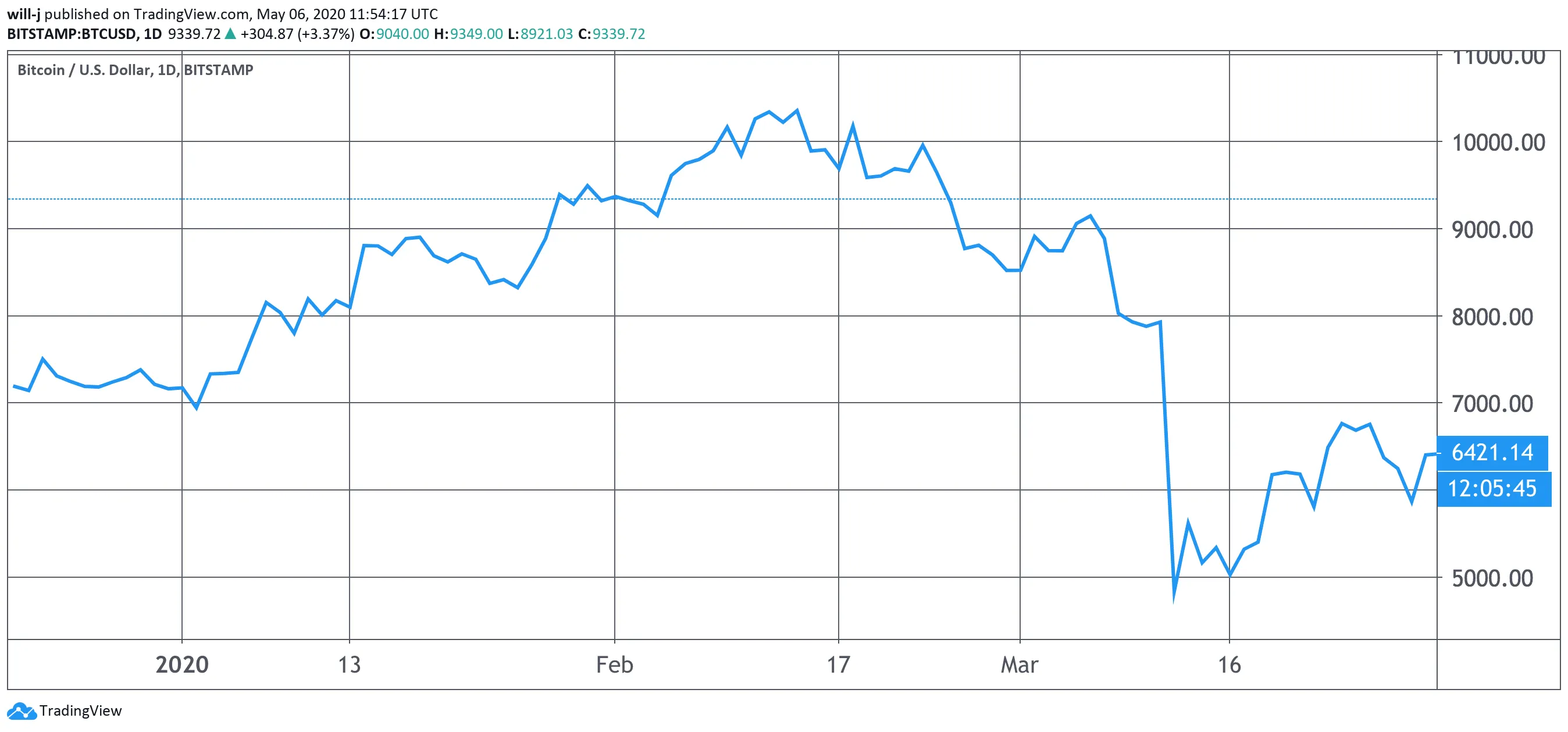

Bitcoin (BTC): -10%

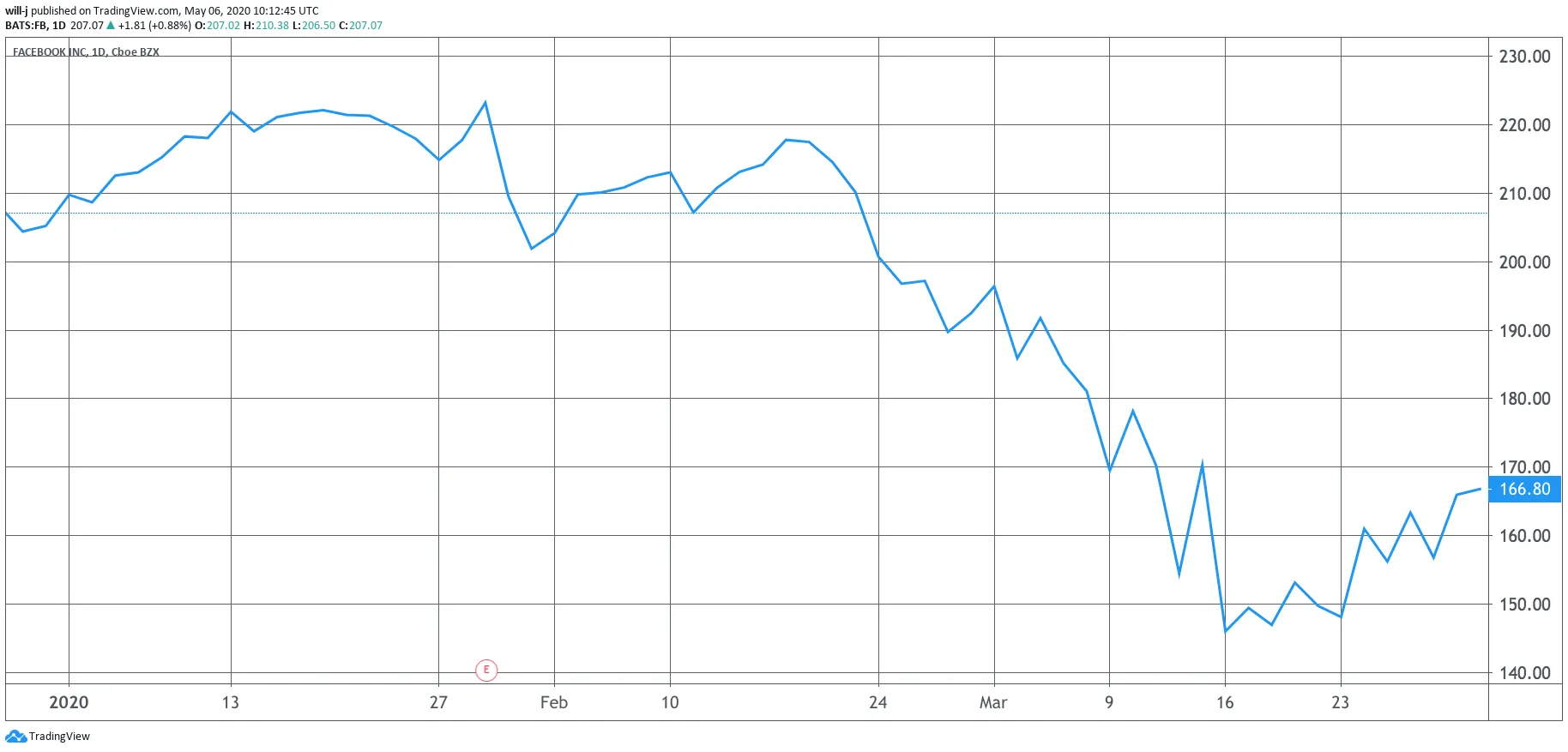

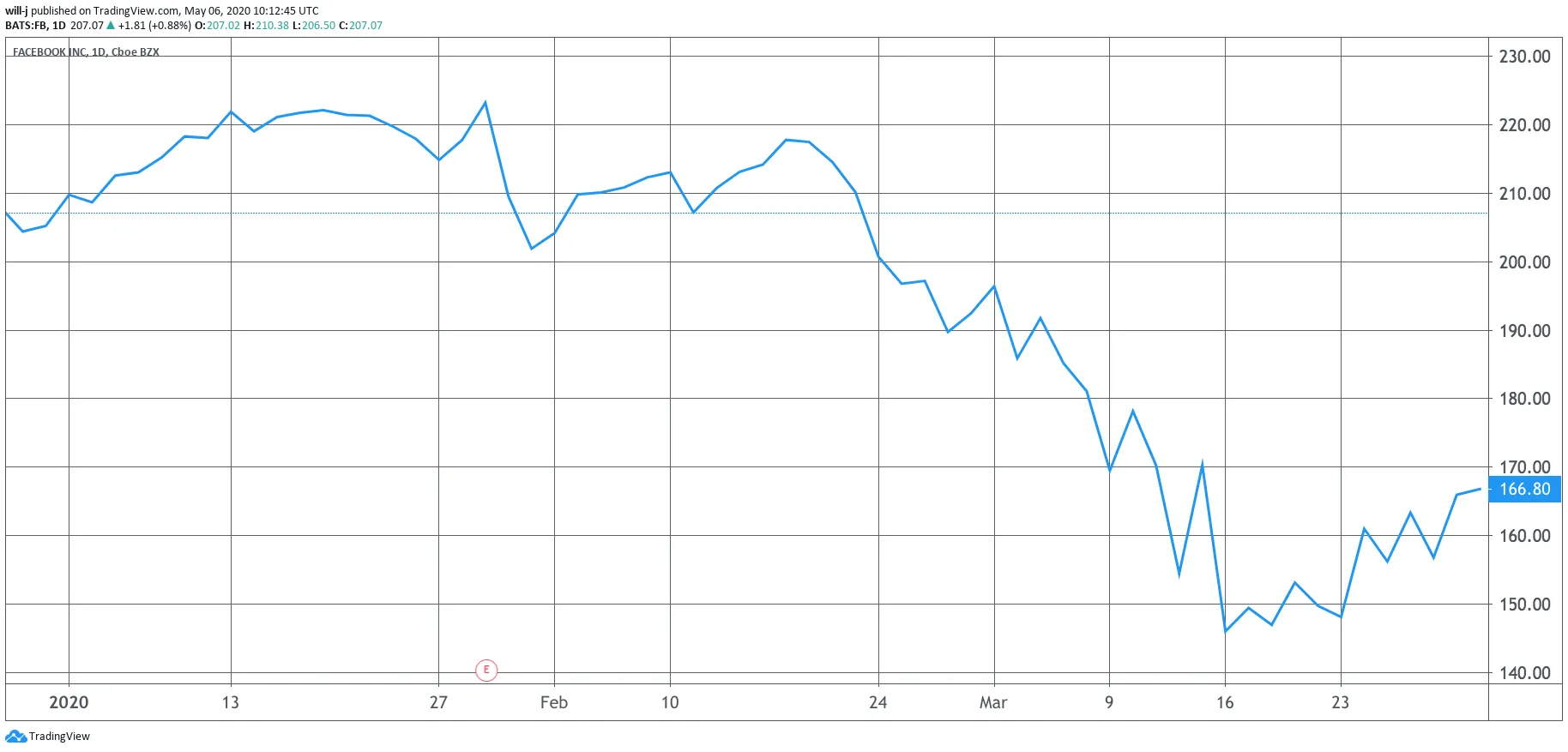

Facebook (FB): -20%

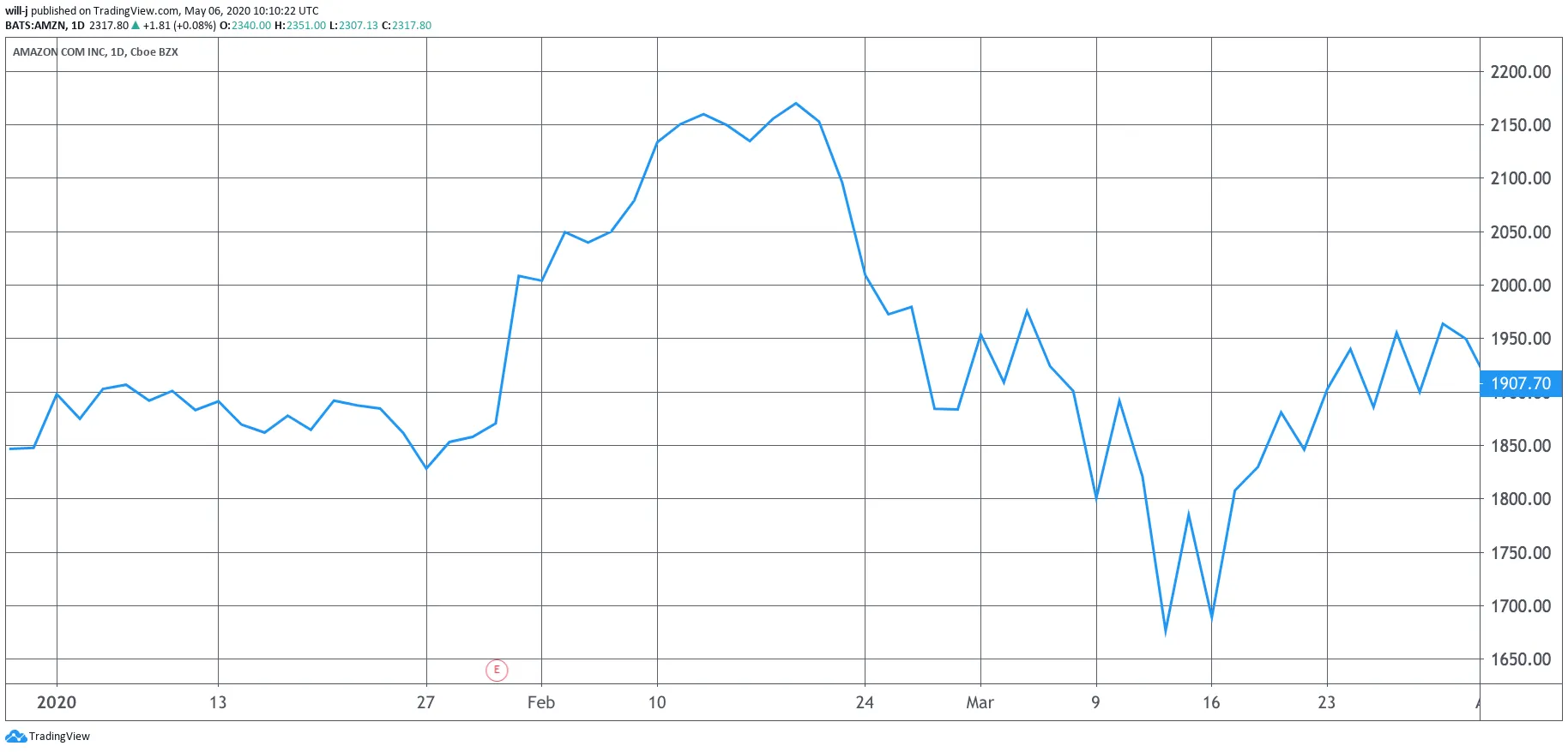

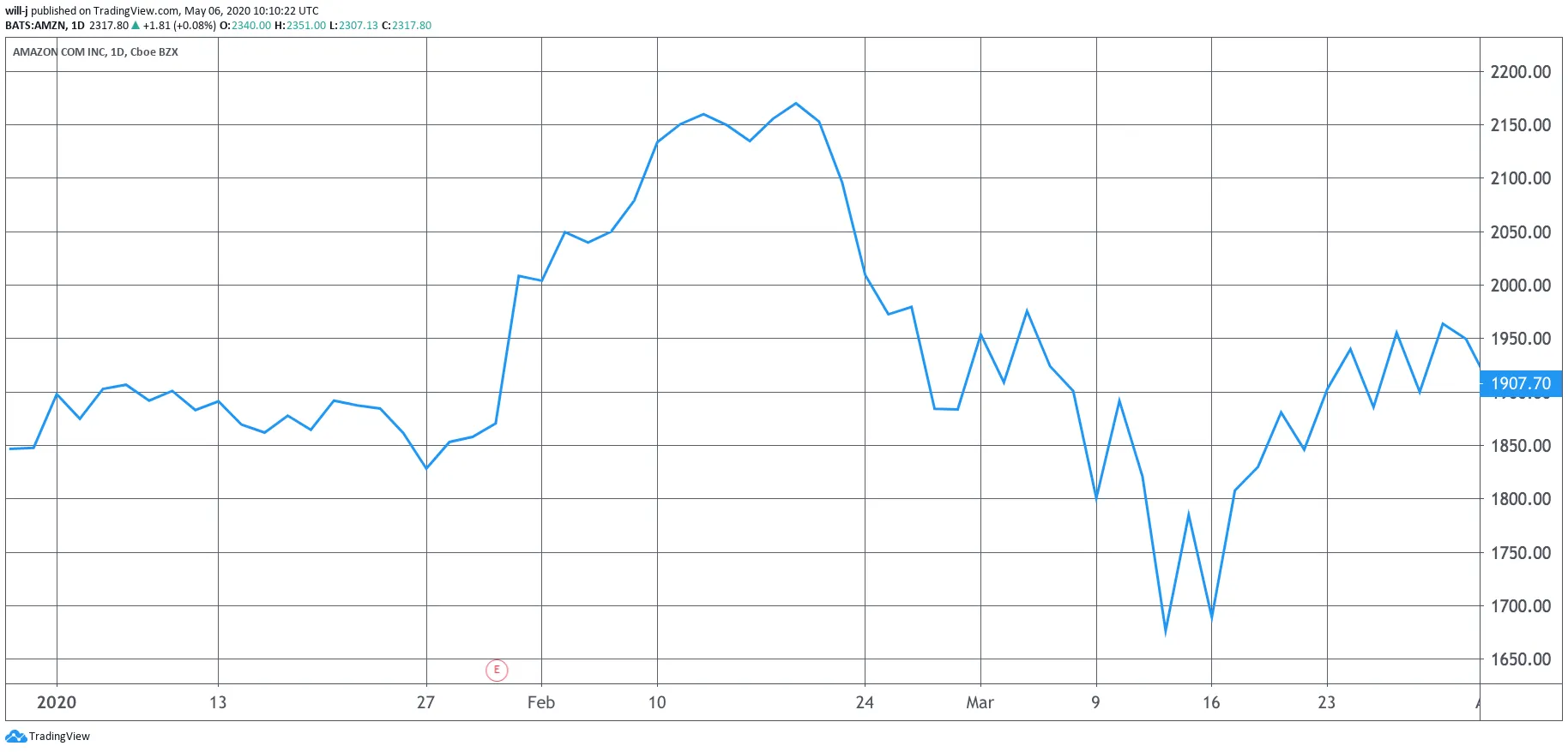

Amazon (AMZN): +0.3%

Apple (APPL): -15%

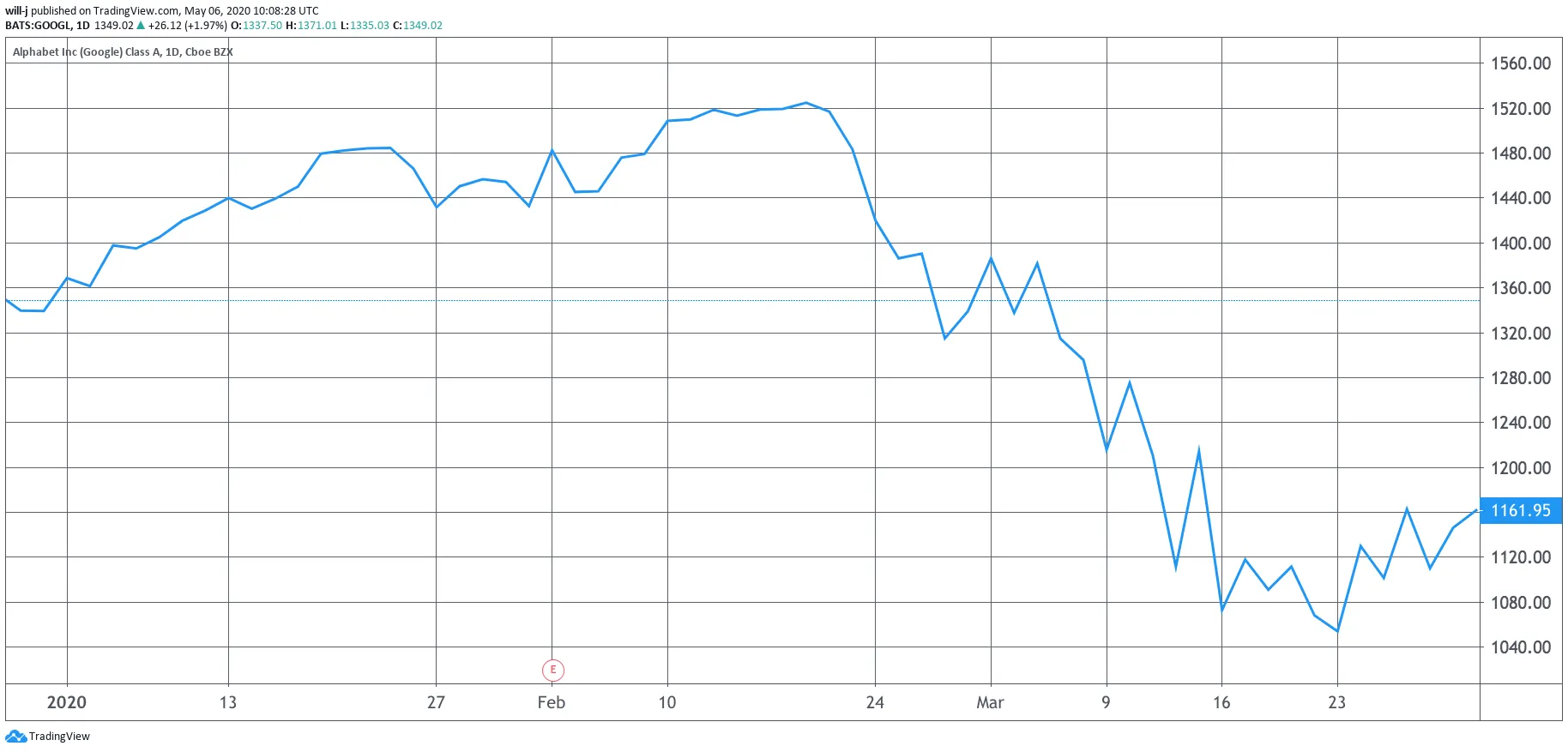

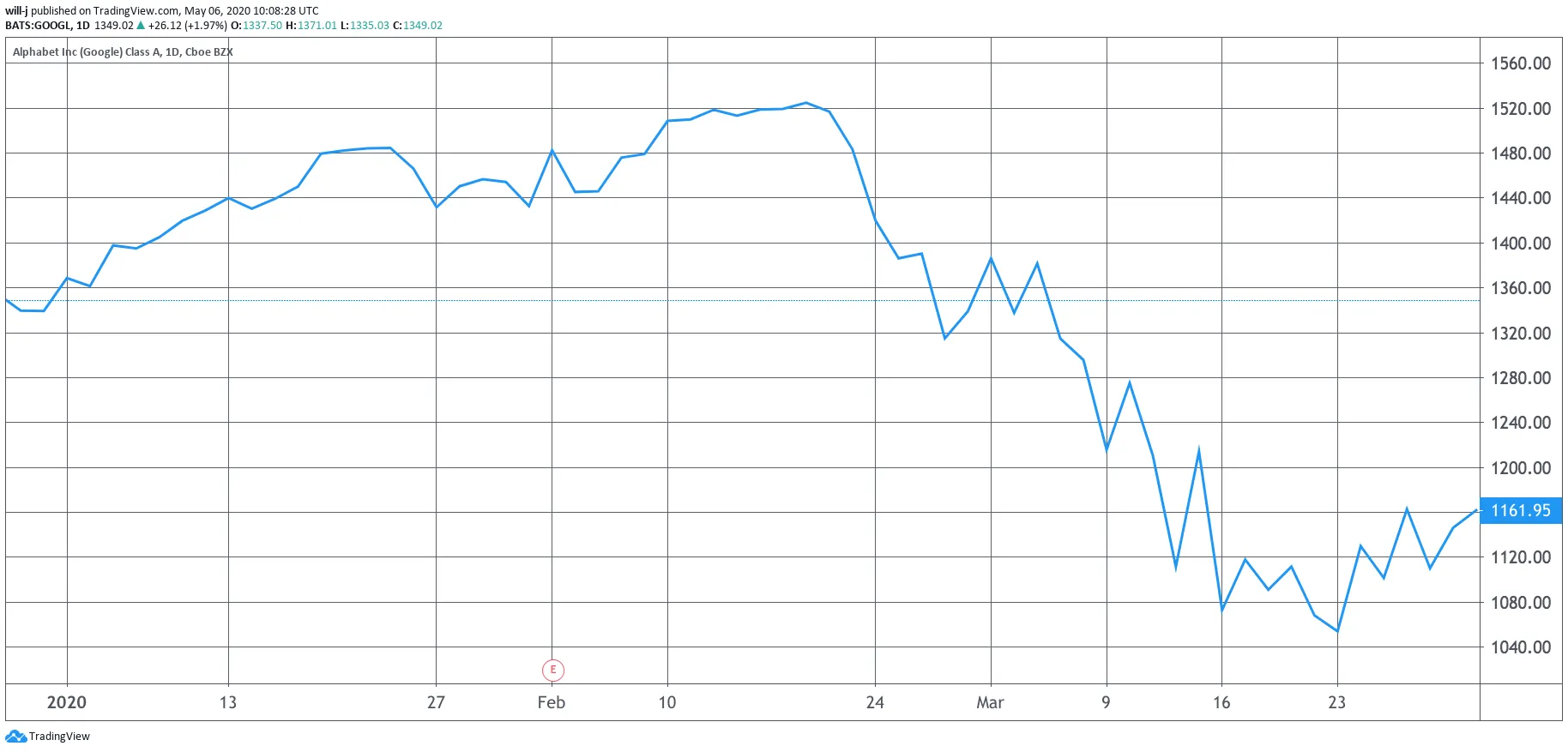

Google (GOOGL): -19%

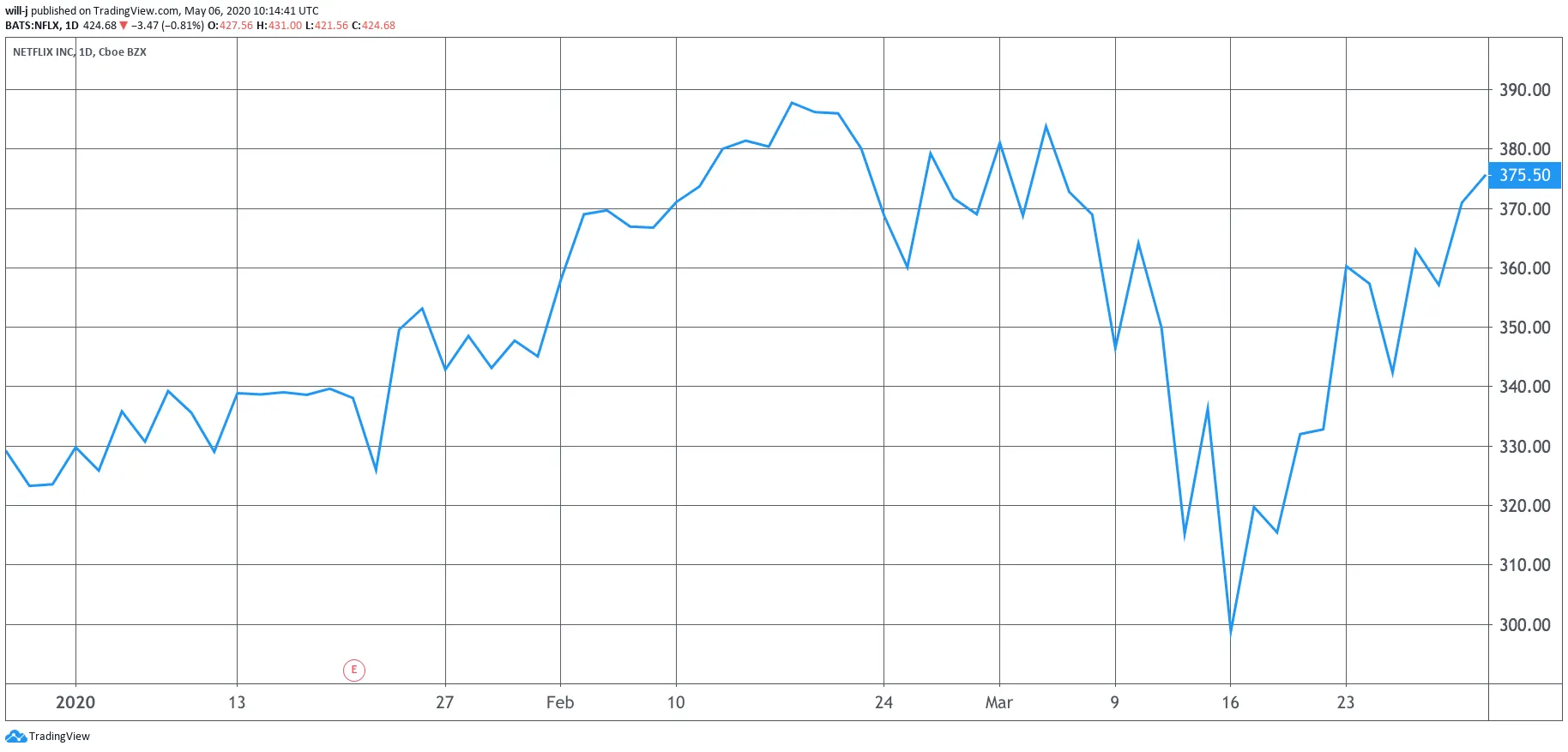

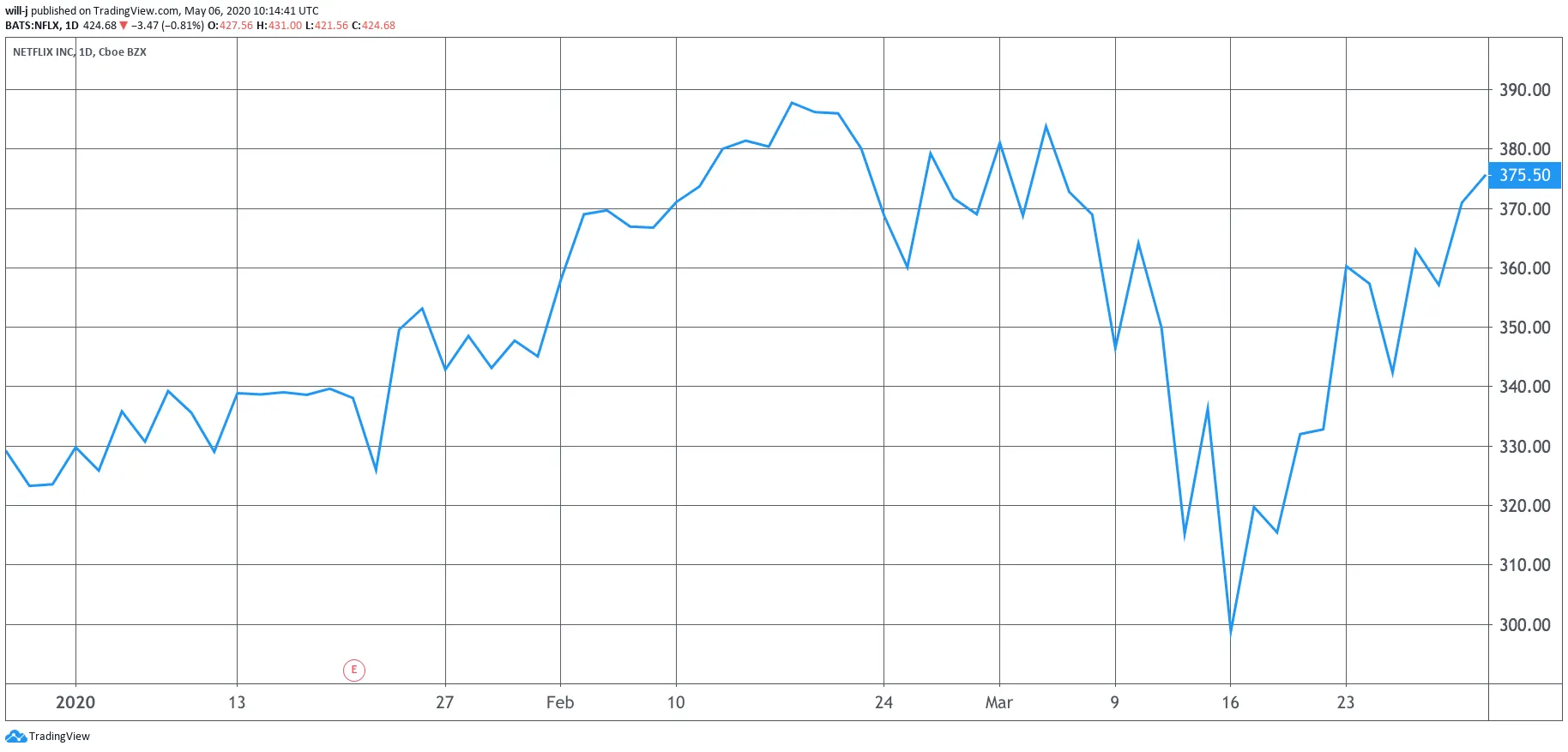

Netflix (NFLX): +13.6%

Tips

Have a news tip or inside information on a crypto, blockchain, or Web3 project? Email us at: tips@decrypt.co.

$91,353.00

2.04%$3,134.30

2.85%$2.08

1.38%$902.35

0.93%$0.9997

-0.00%$135.21

1.71%$3,132.96

2.82%$0.28655

0.08%$0.141467

0.95%$0.425667

2.34%$1.029

0.00%$61.16

0.86%$3,825.64

2.79%$601.61

1.90%$91,171.00

1.88%$3,398.62

2.79%$14.03

0.45%$0.999051

-0.05%$9.75

0.91%$0.999914

-0.00%$3,133.53

2.83%$30.24

-1.99%$3,393.11

2.80%$0.242192

0.45%$370.79

-4.08%$0.999321

-0.00%$91,337.00

2.01%$83.28

1.46%$1.62

2.32%$13.67

1.49%$356.49

3.48%$0.134941

-0.02%$0.00000845

-0.43%$1.077

-0.16%$0.150478

0.58%$1.00

0.03%$1.62

1.24%$0.104677

1.03%$0.999391

-0.05%$1.21

-0.00%$1.12

4.02%$5.62

0.27%$2.13

-0.87%$191.89

1.52%$294.05

4.24%$0.998828

-0.03%$3.58

1.14%$0.065911

5.42%$110.00

1.40%$1.74

1.11%$4,214.78

0.50%$0.997899

-0.21%$1.24

-2.10%$0.275188

5.13%$13.40

0.60%$1.00

0.00%$0.963371

-1.67%$0.00000462

1.73%$168.58

1.71%$3.51

0.38%$3,132.94

2.82%$0.22251

-0.95%$0.00309352

2.94%$0.00767728

1.93%$135.22

1.73%$4.70

1.17%$0.00000165

-0.52%$1.14

0.01%$0.02840377

2.40%$0.467153

0.05%$4,222.07

0.20%$0.052866

3.47%$0.582233

0.26%$0.999826

0.00%$10.43

2.10%$0.999197

-0.01%$3,603.48

2.84%$1.11

0.00%$0.123959

0.09%$1.11

-0.07%$89.01

-0.95%$0.999399

-0.00%$0.999701

0.01%$1.75

0.38%$0.054232

1.31%$902.10

0.93%$10.33

0.77%$0.1345

-0.09%$0.209954

-0.15%$146.91

1.78%$5.69

-0.42%$3,319.21

2.88%$1.50

-0.30%$2.24

0.23%$91,449.00

2.10%$0.01246947

-1.77%$0.01310682

0.34%$0.999132

-0.10%$3,353.38

2.64%$91,336.00

1.57%$91,572.00

2.07%$0.984607

0.28%$0.04960678

0.34%$10.91

0.00%$1.62

1.48%$0.131437

0.49%$0.997801

-0.03%$30.46

-1.79%$3,339.11

2.90%$0.00000936

-3.65%$113.54

0.00%$2.29

0.62%$1.016

0.00%$3,383.78

2.59%$91,299.00

2.06%$2.16

-2.57%$0.01138425

-0.69%$0.225384

-1.30%$91,147.00

3.36%$1.11

0.26%$0.999671

-0.00%$1.22

-1.14%$156.09

1.70%$0.999837

-0.02%$0.999943

0.02%$0.241708

3.15%$0.676888

6.78%$3,207.71

2.28%$0.679646

0.93%$3,133.18

2.82%$0.608473

2.70%$0.084992

-0.54%$0.315336

-1.06%$46.40

-1.58%$5.66

1.83%$0.39495

1.92%$0.860113

0.88%$91,130.00

1.85%$2.91

0.28%$5,510.89

7.56%$0.997811

-0.01%$0.300697

0.23%$0.112176

0.27%$0.999833

-0.03%$0.589144

0.98%$0.00550258

1.72%$3,133.25

2.80%$0.48242

0.52%$0.586332

0.15%$181.80

1.78%$0.813348

2.03%$0.997226

-0.05%$0.04635484

-0.69%$2,460.42

0.00%$1.002

0.54%$0.140007

9.06%$3,131.47

2.80%$0.00531395

-0.22%$3,369.35

2.82%$0.078683

-0.08%$1.22

0.09%$0.00004675

-0.76%$3,289.02

2.12%$0.999777

-0.08%$0.103677

-0.50%$11.30

0.63%$1.021

-0.03%$1.11

0.01%$3,438.89

3.24%$0.02148419

0.04%$0.00000042

1.13%$0.407971

3.85%$20.35

-0.61%$0.996443

0.40%$3,482.59

2.86%$2.42

0.36%$90,616.00

1.29%$0.069003

-1.08%$90,454.00

0.00%$0.259283

4.42%$0.03882851

-2.96%$0.382049

0.50%$91,324.00

2.12%$22.91

0.87%$0.072613

0.67%$0.141951

-1.29%$1.98

2.47%$0.348088

-2.69%$21.17

4.06%$0.00000037

2.02%$0.141406

0.95%$3,135.06

2.81%$0.095243

-0.66%$0.216412

-0.84%$16.85

1.54%$1.16

0.13%$0.340504

-0.48%$0.00727515

0.38%$128.41

2.55%$0.00682869

-1.44%$0.170527

-3.90%$3,388.03

2.83%$136.92

2.09%$0.999263

-0.04%$0.094341

3.39%$0.03139189

0.18%$1.004

0.31%$0.274166

-5.67%$30.29

-1.73%$1.15

0.95%$3,092.41

2.80%$0.30896

0.81%$3,379.88

2.55%$31.19

0.34%$0.0276749

2.52%$91,309.00

2.01%$0.00005429

-3.39%$1.088

0.00%$26.77

0.78%$3,130.69

2.68%$0.1525

-1.40%$0.181702

-0.32%$4.11

-0.87%$0.99976

-0.01%$955.40

0.85%$0.993876

0.02%$0.03285101

-0.49%$1.38

-1.76%$0.00279505

-1.29%$0.112978

-1.11%$1.00

0.00%$4.03

0.45%$3,129.57

2.63%$0.998395

-0.12%$13.66

1.43%$0.00000123

0.88%$0.275773

3.68%$0.00000126

-0.25%$0.252526

-5.23%$0.590477

-3.31%$3.30

2.42%$0.181146

-2.81%$0.161257

3.11%$0.080387

3.07%$2.35

0.87%$1.72

11.81%$0.293328

-0.52%$0.532977

2.36%

In the first quarter of 2020—despite a price crash and successive rebound towards the end—Bitcoin outperformed several of the biggest tech firms, including Google, Facebook, and Apple.

Last week, FAANG companies–the collective term for Facebook, Apple, Amazon, Netflix and Google–released their first-quarter earnings. Considering the economy and its agents have taken a veritable beating from the coronavirus pandemic and its subsequent lockdowns, most FAANG firms appear to be keeping their heads above water. However, their stock valuations tell a different story. Down approximately 15-20% across the board, the only FAANG stock doing well is, unsurprisingly, Netflix.

Meanwhile, although falling violently into the red in March, wiping out almost 50% of its total value, Bitcoin's Q1 performance cites a slightly less adverse reaction to some FAANG stock, reporting a comparatively tame 10% reduction.

Despite a stellar first-quarter performance, Facebook took the biggest hit on its stock price—plummeting 20% in Q1. According to its Q1 earning review, this may have been due to a significant decline in both advertising pricing and demand.

Still, it wasn't all bad news for FAANG stocks. Per its earnings call, Amazon's revenue from January 1 to March 31, is up 26%. Given the global scramble for household goods, PPE, and other coronavirus essentials, this isn't all too surprising.

As a result, Amazon's stock price has managed to tread water, increasing by +0.3% in the first quarter. While the returns don't represent its revenue performance, it's still in the green—just about.

The same can't be said for Apple. While its revenue is reportedly up by 1% despite the mass closure of stores due to global coronavirus lockdown, the firm cites a -15% downturn in its stock price throughout Q1.

Likewise, Google cites decent earnings over Q1, with revenue growing 13%. This is attributed to a surge in both search activity and Youtube viewership. However, Google's stock price tells a different story, citing a 19% decline over the first quarter of 2020.

Nevertheless, the reigning king of quarantine, Netflix, more than doubled its forecasted subscribers in Q1, adding around 15 million users globally—8 million more than it predicted. As a result, not only did the firm cite $5.77 billion in revenue, but its share value managed to surpass all other FAANG stocks—as well as Bitcoin—by a country mile, spiking 13.6%.

With mandatory lockdowns imposed across the world, there are no prizes for guessing how.

Tips

Have a news tip or inside information on a crypto, blockchain, or Web3 project? Email us at: tips@decrypt.co.