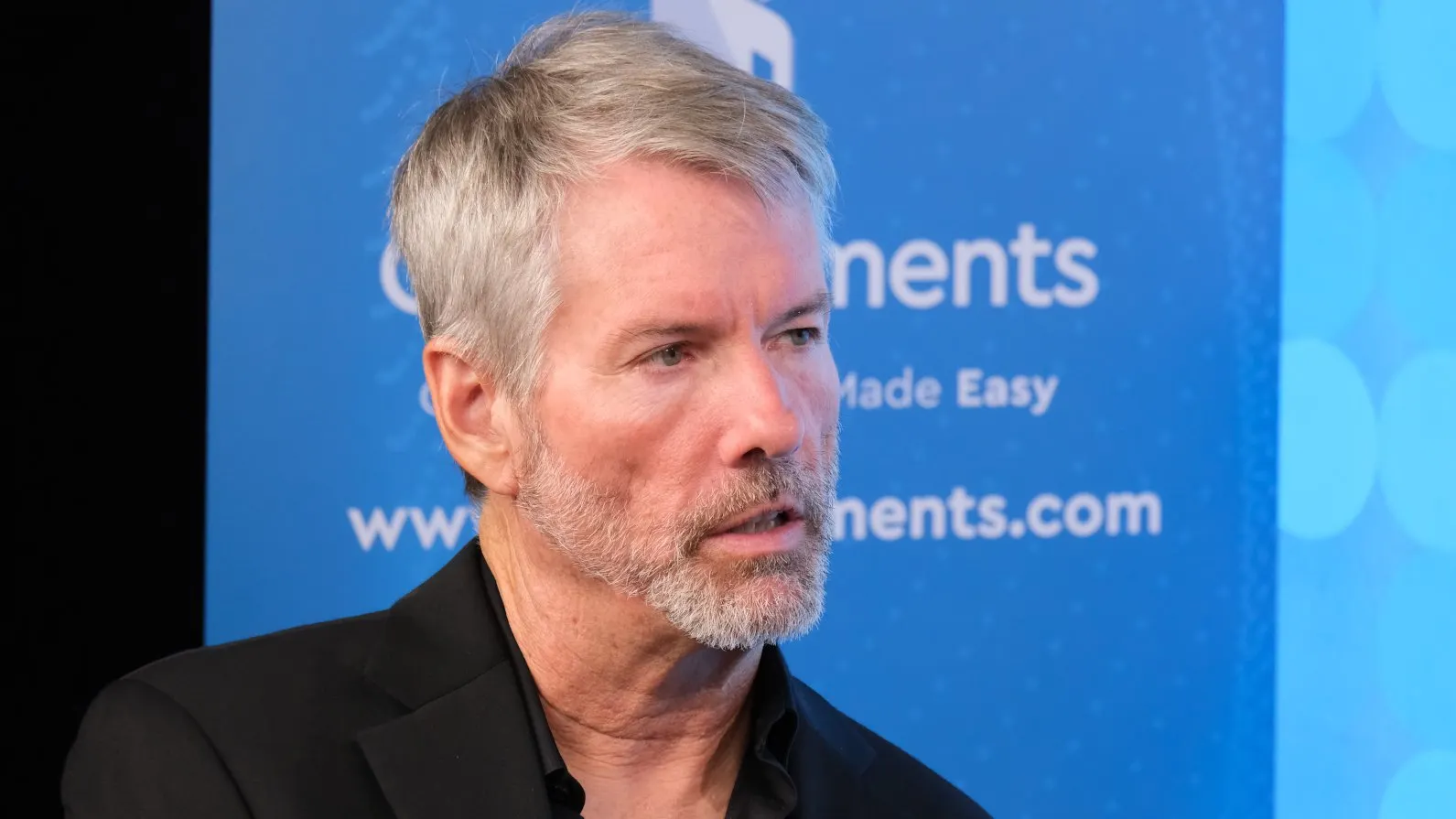

For years, MicroStrategy founder Michael Saylor refrained from acknowledging the existence of such a thing as the “crypto industry.” To him, there was Bitcoin—an asset he likened to the gold of our time—and then thousands of cheap imitators hardly worth mentioning.

“There is no second best,” the entrepreneur—who may personally own more than one billion dollars worth of BTC—was known to say.

That is, at least, until now.

It appears that the shocking, eleventh-hour approval of spot Ethereum ETFs two weeks ago has caused the Bitcoin maximalist to shift his stance on crypto—or at the very least, to adjust his political calculus.

“Bitcoin was going to be the only asset securitized and offered as a spot ETF by the Wall Street establishment—and it was going to spread as the one legitimate crypto asset,” Saylor said recently on the “What Bitcoin Did” podcast, summarizing his thinking prior to the U.S. Securities and Exchange Commission’s about-face approval of spot ETH ETFs.

For quite some time prior to that watershed moment, Saylor had loudly predicted that no other crypto asset besides Bitcoin would ever gain that crucial stamp of approval from traditional finance. He also claimed that Ethereum would be designated a security by the SEC.

Now, the Ethereum ETF approval—which some industry analysts suggest means that Ethereum cannot be considered a security—appears to have changed his views on the viability of crypto as an industry bigger than just Bitcoin.

“I think right now the best expectation is [that] the crypto asset class will be legitimized,” Saylor said.

In particular, the entrepreneur appeared impressed by industry-wide efforts that have resulted in a recent string of key political victories, including the spot Ethereum ETF approval.

“I think that we are politically much more powerful [when] supported by the entire crypto industry,” Saylor said. “They obviously have a lot of political power, a lot of users.”

Saylor’s MicroStrategy holds over 1% of all BTC in circulation—a sum currently worth more than $14 billion. He has long resisted calls to invest in any other crypto assets.

Edited by Andrew Hayward

Editor's note: This story was updated after publication to note that Saylor had previously claimed that Ethereum would be declared an unregistered security by the SEC.