Though not predicting a meteoric, hockey-stick rise, crypto analysts say Bitcoin “could see increased appeal” in 2024.

CoinShares, a European asset manager, released its latest annual report this Tuesday about the state of the crypto industry and potential scenarios for 2024. The authors say they focused on macro signals and painted a positive outcome for crypto as the Federal Reserve eyes rate cuts and as investors feel safer pouring their money on digital assets.

"With the U.S. Federal Reserve likely to cut interest rates in the first half of 2024, Bitcoin, alongside gold, could see increased appeal," the report concludes, indicating a shift in investor focus towards fixed supply assets.

Others are not super bullish, either. Craig Erlam, a seasoned market analyst at the trading platform Oanda, takes a pragmatic view.

"It’s been a long time since we’ve been through a rate-cutting cycle, particularly one of this magnitude, so we’ll have to wait and see how it plays out," Erlam told Decrypt, "That said, monetary easing has been beneficial for risk assets over the years, and that this comes while the U.S. economy is performing well can’t hurt."

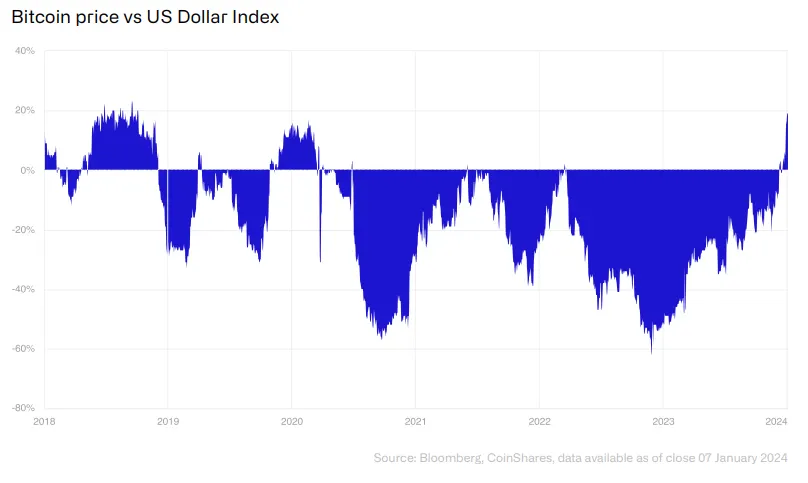

The Coinshares report also examines Bitcoin's correlation with the US Dollar and other assets. "Bitcoin typically exhibits a negative correlation with the U.S. dollar," the report states, and suggests a temporary increase in this correlation may exist amidst monetary policy shifts and market stress. The year thus far brought a dip in Bitcoin's price while the DXY, an index measuring the dollar against a basket of other currencies, spiked.

Meanwhile, the historical correlation between Bitcoin and gold, another crucial metric, stands at almost unprecedented levels, signifying a complex interplay between traditional and digital assets.

Erlam, however, is skeptical about Bitcoin's prospects as a fixed-supply asset. "I’m not convinced by bitcoin as digital gold or an inflation hedge to be honest, and I think the experience of the last couple of years probably backs that up,” he told Decrypt. He added that Bitcoin doesn’t need to exhibit such characteristics in order to perform well.

The importance of the US market in legitimizing Bitcoin ETFs is crucial for the global markets, according to Coinshares. While spot-based Bitcoin ETPs have found popularity in Europe, the US market is more influential.

"Although spot-based Bitcoin ETPs are already available in Europe... the US market, often at the forefront of technology investments, is seen as a more significant indicator of legitimacy," The report explains. The approval of Bitcoin ETFs triggered a bullish impulse in the markets, but it is still unclear if that will be enough to sustain a long-term bull run.

Erlam also weighed in on the broader implications of ETFs for Bitcoin.

"I think the benefit of an ETF has potentially been overplayed,” he said.” It’s an important step towards adoption but anyone expecting a flood of cash all buying bitcoin may be disappointed."

A notable observation from the report is the lack of attention for Ethereum by investors. Despite facing challenges, the authors point out, the Ethereum Foundation has adeptly managed transitions like Shanghai and The Merge.

"The Ethereum Foundation has demonstrated a growing proficiency in successfully rolling out major network upgrades,” Coinshares writes. “However, Ethereum seems to remain underappreciated by investors."

The report also flirted with the possibility of an Ethereum ETF to spice up the markets—speculation that seems more possible than ever if one takes into consideration recent statements by Cynthia Lummis promising not to repeat in Ethereum the mistakes committed by the SEC with Bitcoin ETFs in the past.

Edited by Ryan Ozawa.