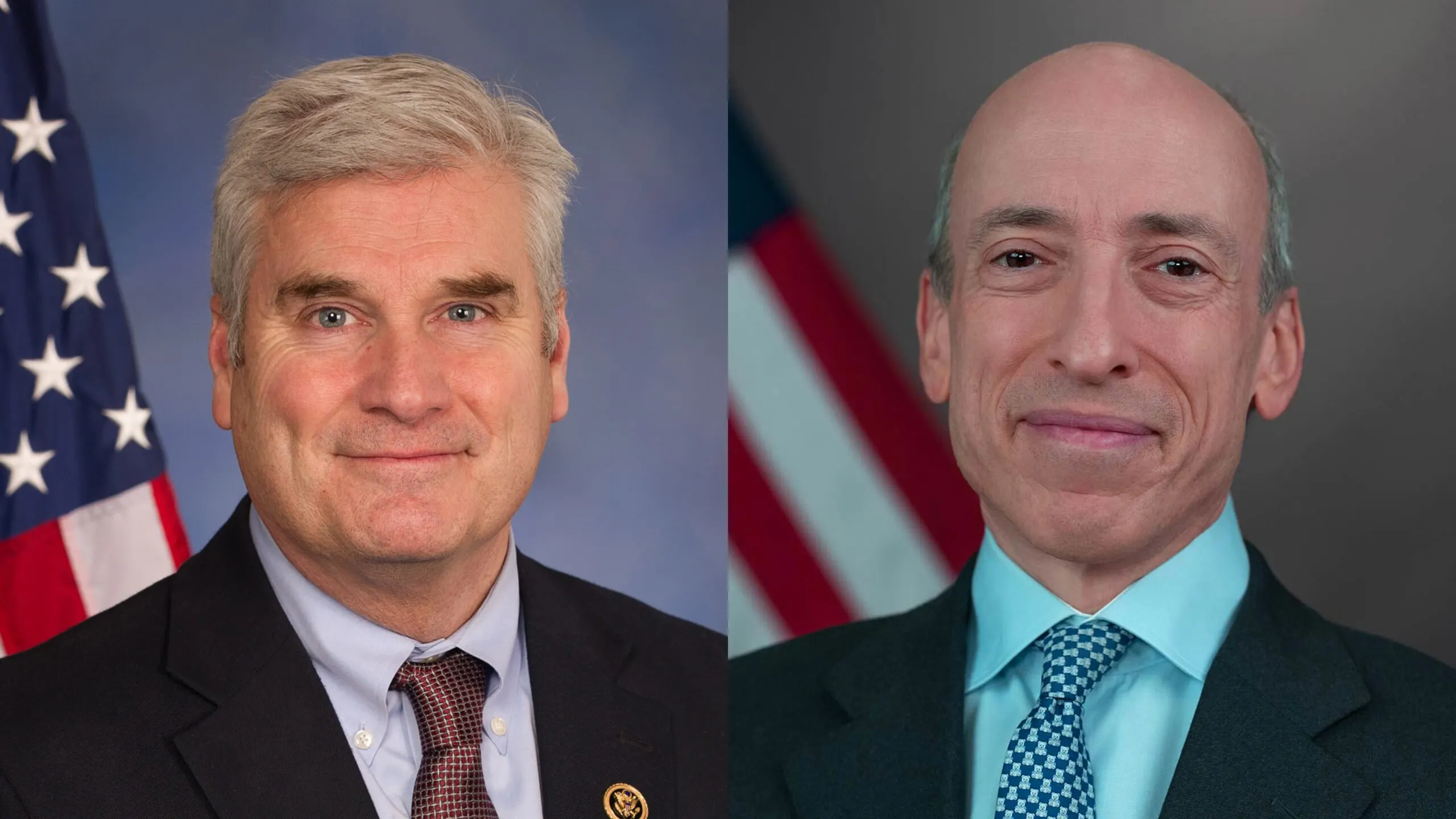

Minnesota Representative Tom Emmer again lashed out at the Biden Administration and SEC Chair Gary Gensler during a session of Congress as the U.S. House passed his appropriation amendment designed to "reign in SEC enforcement abuses against the digital asset industry."

Emmer's attack came on the same day Gensler spoke at the annual DC Fintech Week conference, and told CNBC that whoever secured what remains of fallen crypto exchange FTX is welcome to revive the brand, provided they ”do it within the law.”

At the Capitol, Emmer railed against Gensler and the SEC in 700 words of prepared, critical comments.

“Regulation by enforcement is a practice all too common with this administration,” Emmer said. “This is particularly the case at the SEC and chair Gary Gensler, his approach towards our capital markets and financial services industry, but especially with our emerging digital assets community.”

.@GaryGensler is as ineffective as he is incompetent. Fortunately, my nonpartisan appropriations amendment to reign in SEC enforcement abuses against the digital asset industry passed the House today with no opposition.

Congress will hold unelected bureaucrats accountable. pic.twitter.com/TGaaW8I0Eu

— Tom Emmer (@GOPMajorityWhip) November 8, 2023

Emmer put forth an amendment to Congress that he says would end Gensler’s “pattern of regulatory abuse, a pattern that is crushing American innovation and capital formation.”

The amendment, Emmer said, prohibits the U.S. Securities and Exchange Commission from utilizing funds for enforcement activities concerning digital asset transactions until Congress enacts legislation that confers jurisdiction over this asset class to the SEC.

“Under Gensler’s leadership, the SEC has pursued dozens of enforcement actions against the digital asset industry despite never finalizing a single rule or regulation for the industry to follow,” Emmer said. “Chair Gensler refuses to provide the marketplace with clear criteria for digital assets that he would consider to be a security.”

Emmer said the SEC did not have jurisdiction from Congress over digital assets, adding that the SEC has shamelessly tried to expand their authority to “swallow and destroy” the digital assets industry through regulation by enforcement.

“At a time when clear guidance is desperately needed, Chair Gensler instead spends taxpayer resources praising himself for targeting celebrities like Kim Kardashian while Sam Bankman-Fried was running a Ponzi scheme right under his nose,” Emmer said.

Emmer said his amendment would send a message to every regulatory agency in the federal government that Congress will "hold unelected bureaucrats accountable."

"This will keep Chair Gensler – who has proven himself to be ineffective and incompetent – in check while Congress continues working to give this industry a chance to grow and develop right here in the United States," Emmer said.

As Emmer levied condemnation at Gensler, blocks away, the SEC chair was at a financial industry conference. During a "sideline" conversation with CNBC reporter MacKenzie Sigalos, Gensler acknowledged the possibility that FTX could be brought back to life under former New York Stock Exchange President Tom Farley.

Farley's crypto exchange Bullish is among three leading bidders seeking the remaining assets of FTX in a bankruptcy auction, the Washington Post reported today, along with Figure Technologies and Proof Group.

Gensler shared his advice for the next owners of the FTX brand.

“Build the trust of investors in what you’re doing and ensure that you’re doing the proper disclosures," he told Sigalos. "And also that you’re not commingling all these functions, trading against your customers, or using their crypto assets for your own purposes.”

In September, Gensler declared the cryptocurrency industry rife with non-compliance with securities laws.

“Given this industry’s wide-ranging non-compliance with the securities laws, it’s not surprising that we’ve seen many problems,” Gensler said in written remarks. “It’s reminiscent of what we had in the 1920s before the federal securities laws were put in place.”

However,after the collapse of FTX last year, Gensler was criticized for his soft-handed dealings with FTX and its founder, Sam Bankman-Fried.

In December, New York Representative Ritchie Torres accused Gensler of being responsible for failing to prevent FTX’s collapse and called for an independent investigation into the SEC’s dealing with FTX.

“If the SEC has the authority Mr. Gensler claims, why did he fail to uncover the largest crypto Ponzi scheme in U.S. history?” Torres wrote. “One cannot have it both ways, asserting authority while avoiding accountability.”

Gensler nor his SEC office responded to Decrypt's request for comment.

Edited by Ryan Ozawa.