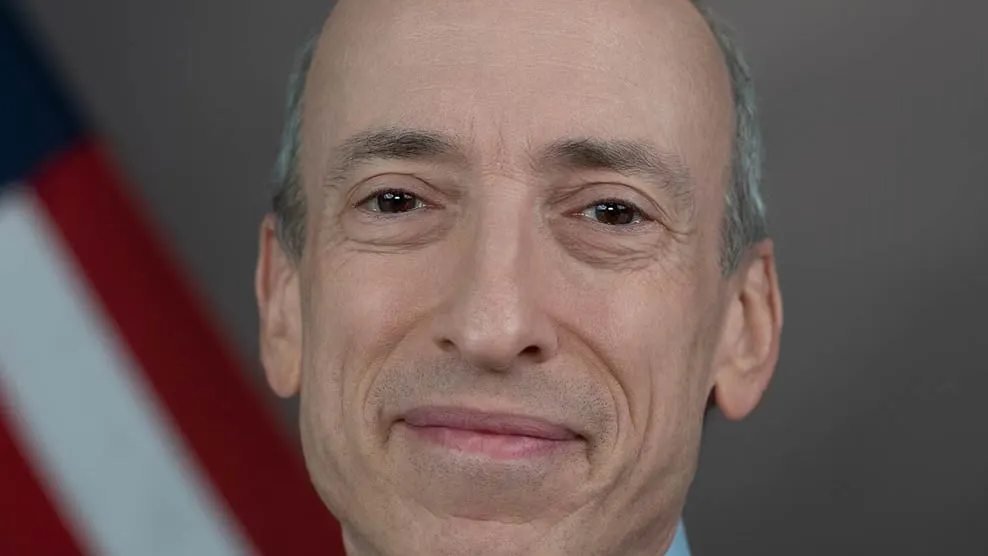

As Securities and Exchange Commission (SEC) Chair Gary Gensler prepares to testify on Capitol Hill, written remarks submitted ahead of Tuesday’s hearing on SEC oversight suggest his tough views on crypto—however broadly condemned—haven’t wavered.

“Given this industry’s wide-ranging non-compliance with the securities laws, it’s not surprising that we’ve seen many problems,” he wrote. “It’s reminiscent of what we had in the 1920s before the federal securities laws were put in place.”

Though Gensler is set to speak on various topics before members of the Senate Banking Committee, his comments on crypto will be closely watched among those in an industry that advocates say is largely held back by regulatory uncertainty in the U.S.

At the same time, Gensler’s position on crypto has been pretty consistent and clear. Securities laws in the U.S. don’t need to be touched to accommodate crypto because “the vast majority of crypto tokens likely meet the investment contract test,” he suggested.

Gensler’s reference to investment contacts invokes the Howey Test, the agency’s four-pronged approach for assessing whether an offering is a security based on a Supreme Court ruling in 1934 that dealt with orange groves.

Gensler has demurred in terms of how the Howey Test applies to coins like Ethereum—the crypto market’s second-largest token by market capitalization. Still, he suggested that “everything but Bitcoin” is a security in an interview with Intelligencer.

In Gensler’s appearance in April before a House Oversight Committee, he declined to say whether Ethereum should be considered a security or a commodity in a testy exchange with Rep. Patrick McHenry (R-NC).

The distinction is at the core of whether certain tokens and firms should be regulated under the SEC or Commodity Futures Trading Commission. In May, Rep. Stephen Lynch (D-MA) dismissed it as “industry-fueled narratives about a turf war between the two agencies.”

Crypto advocates contend that a regulatory regime established through enforcement actions does not help investors or issuers when it comes to crypto. And the sentiment has been echoed by both sides of the political aisle.

Republican lawmakers penned a letter in April that said a lack of clear rules and a nonexistent path for crypto trading firms to register with the SEC falls squarely on the regulator’s approach.

The sentiment was echoed by Ritchie Torres (D-NY) in July, who compared the agency to an “overzealous traffic cop” bent on ticketing drivers for speeding without ever telling them what the speed limit is at any point.

Asking Gensler whether he plans to “come to terms with the folly of the Commission’s crusade,” Torres referenced a partial courtroom victory Ripple Labs notched over the regulator in July as a reason to “reassess its reckless regulatory assault.”

A New York court found that certain sales of XRP did not constitute the sale of unregistered securities, counter to what the SEC alleged. The SEC was later dealt a loss in its lawsuit with Grayscale, where a court called the agency’s previous denial to convert Grayscale’s $15.6 billion Bitcoin trust into a spot Bitcoin ETF “capricious.”

Regardless, Gensler appears poised to stand by his regulatory gambit. He wrote, “There is nothing about the crypto asset securities markets that suggests that investors and issuers are less deserving of the protections of our securities laws.”